Regulation Name: Law Art Market Integrity Act

Date Of Release: 23 July 2025

Region: United States

Agency: US Congress

The Art Market Integrity Act: Shedding Light on the U.S. Art Market

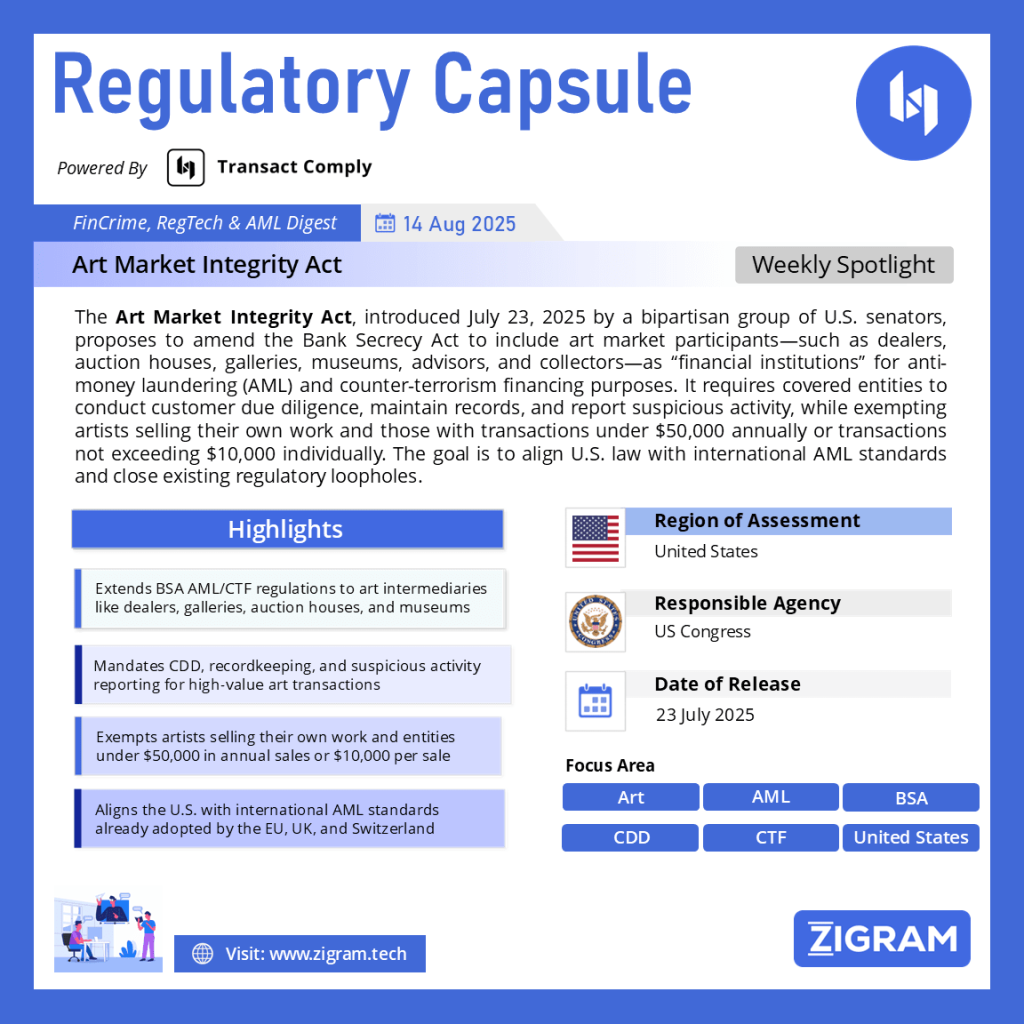

On July 23, 2025, a bipartisan coalition of U.S. Senators—including John Fetterman (D-PA), Chuck Grassley (R-IA), Sheldon Whitehouse (D-RI), Bill Cassidy (R-LA), Andy Kim (D-NJ), and David McCormick (R-PA)—introduced the Art Market Integrity Act, aiming to bring the U.S. art world under anti-money laundering (AML) and counter-terrorism financing (CTF) regulations existing under the Bank Secrecy Act (BSA). Until now, America’s art market—valued at approximately $25 billion, or roughly 43% of global sales—has remained largely unregulated, unlike other vulnerable industries such as real estate and precious metals.

This regulatory void has made the art market an appealing conduit for illicit activity. High-value transactions and the sector’s culture of anonymity have enabled criminals, kleptocrats, and sanctioned individuals to conceal their identities and launder money, with high-profile cases involving Russian oligarchs and Hezbollah financiers bringing the issue to light.

The Art Market Integrity Act would amend the BSA’s definition of “financial institution” to include intermediaries such as art dealers, galleries, auction houses, museums, advisors, custodians, and collectors. These covered parties would be required to conduct due diligence on clients, maintain transaction records, and report suspicious activity, akin to obligations imposed on banks and other regulated sectors.

Recognizing the need to avoid overburdening smaller actors, the legislation incorporates risk-based exemptions. Specifically, artists selling their own work are entirely exempt, as are individuals or businesses that have not exceeded $50,000 in total annual art-related transactions or engaged in any single transaction over $10,000 in the prior year.

Importantly, the Act brings the U.S. into alignment with international AML frameworks already in place in jurisdictions like the U.K., European Union, Switzerland, and China. Civil society groups, including Transparency International U.S., the Antiquities Coalition, and the FACT Coalition, have endorsed the bill, stating it brings much-needed oversight and transparency to a sector long considered opaque.

The Treasury Department and FinCEN would also play central roles. FinCEN would issue rulemaking guidelines in consultation with federal agencies to define exactly which entities qualify as covered intermediaries, geographic applicability, and the scope of due diligence requirements. Moreover, the Act would take effect on 360 days post-enactment or upon issuance of these rules—whichever comes first.

Supporters frame the Act as essential national security legislation, intended to protect the integrity of the U.S. art market while closing a glaring loophole that risks economic and reputational damage. Critics—particularly from smaller art businesses—caution that compliance costs and regulatory complexity may marginalize independent dealers and galleries if not accompanied by guidance and support.

As the Act enters committee reviews and legislative debate, one certainty emerges: if enacted, the Art Market Integrity Act would mark a transformative shift, introducing formal regulatory oversight to a previously opaque yet significant economic sector.

Read the full law here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #ArtMarketIntegrityAct

- #AMLinArt

- #CleanArtMarket

- #ArtTransparency