Anti Money Laundering News (15 Dec – 21 Dec 2025)

Welcome to this week’s edition of the Global AML News Weekly Digest. Here are the top stories making headlines around the world:

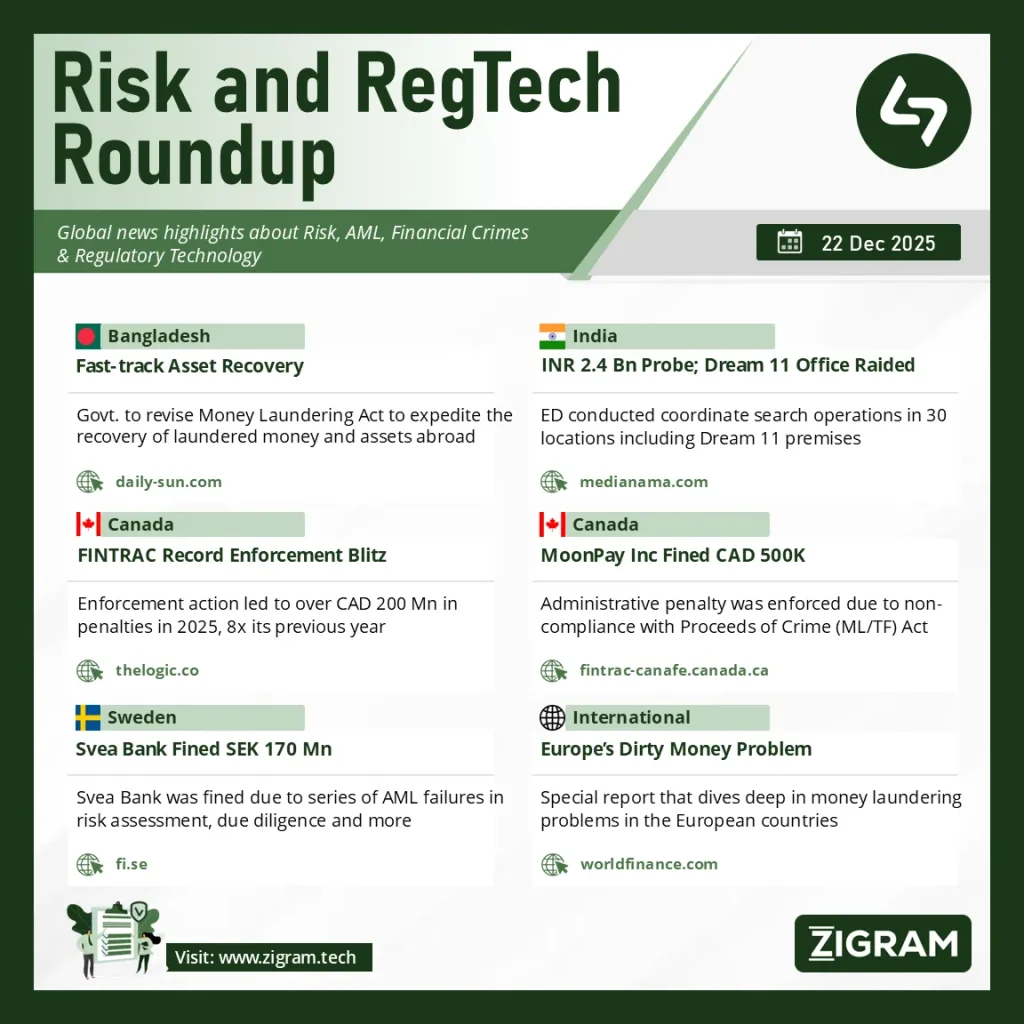

Bangladesh Government Moves to Amend Money Laundering Law to Speed Up Asset Recovery

The Bangladesh government has decided to revise key provisions of the Money Laundering Prevention Act 2012 to accelerate the recovery of laundered funds and assets held abroad. The decision was taken at a meeting of the National Coordination Committee on the Prevention of Money Laundering and Terrorist Financing, chaired by Finance Adviser Salehuddin Ahmed. Officials highlighted that 104 money-laundering cases are currently active, with assets worth over Tk66,000 crore—both domestic and overseas—frozen or attached. The amendments aim to ensure faster filing of charge sheets, quicker dispatch of Mutual Legal Assistance Requests (MLARs) to foreign jurisdictions, and speedy case resolutions ahead of the country’s fourth Mutual Evaluation by the Asia/Pacific Group on Money Laundering (APG) scheduled for 2027-28.

ED Raids Dream11 Office and Co-Founder’s Premises in ₹2,434 Crore Money-Laundering Probe

India’s Enforcement Directorate (ED) has conducted coordinated raids at more than 30 locations nationwide, including the offices of fantasy gaming platform Dream11 and the personal premises of its co-founder Bhavit Sheth, as part of a money-laundering investigation linked to an alleged ₹2,434 crore financial fraud involving Jai Corp Limited. The action, carried out under the Prevention of Money Laundering Act (PMLA), stems from a Central Bureau of Investigation (CBI) First Information Report (FIR) and follows a Bombay High Court directive to form a special investigation team. Authorities are examining suspected financial ties between Jai Corp, Dream Sports (Dream11’s parent company), and related entities to determine whether misappropriated funds were layered through complex transactions. The probe is part of broader scrutiny of the online gaming sector after the ban on real-money gaming.

FINTRAC Unleashes Record Enforcement Blitz with Over $200 Million in Penalties

Canada’s financial intelligence unit, FINTRAC (Financial Transactions and Reports Analysis Centre of Canada), has dramatically stepped up its enforcement actions in 2025, issuing approximately $202 million in administrative penalties since April—more than eight times its previous annual high, signaling a new era of aggressive anti-money-laundering compliance oversight. The surge in fines spans a broad range of sectors and includes penalties for failures in transaction monitoring, reporting suspicious activities, and other breaches of AML/CTF obligations. While this marks a significant escalation in regulatory discipline, the agency faces ongoing court challenges from several fined entities, and questions remain about the overall effectiveness of penalties in compelling long-term compliance.

FINTRAC Imposes Penalty on MoonPay Subsidiary for AML Compliance Failures

Canada’s financial intelligence unit FINTRAC has announced an administrative monetary penalty of $536,853.35 against MP Technology Services Ltd., a Seychelles-incorporated subsidiary of MoonPay Inc., for multiple violations of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). The penalty, imposed on November 20, 2025, follows a compliance examination that found the entity failed to file required electronic funds transfer reports, lacked up-to-date written compliance policies and procedures, did not adequately assess money-laundering and terrorist financing risks, and neglected to submit suspicious transaction reports where reasonable grounds existed. FINTRAC emphasized that such enforcement actions are meant to encourage stronger compliance with Canada’s AML/ATF obligations and support the integrity of the financial system.

Swedish Regulator Fines Svea Bank SEK 170 Million for AML Compliance Failures

Sweden’s financial regulator, Finansinspektionen (FI), has issued a **remark and an administrative fine of SEK 170 million (approximately $18 million/€15 million) against Svea Bank AB for significant breaches of anti-money-laundering (AML) regulations. The supervisory review found that the bank failed to adequately assess money-laundering risks related to its products and services, did not implement sufficient customer due-diligence measures, and lacked robust transaction monitoring and suspicious activity reporting systems. FI’s enforcement underscores heightened regulatory scrutiny in Sweden’s financial sector to ensure stronger compliance with AML/CFT obligations and to protect the integrity of the financial system.

(fi.se)

Europe Struggles to Curb Massive Flows of Dirty Money Despite New AML Efforts

A special report from World Finance highlights the persistent and pervasive challenge of dirty money flowing through Europe’s financial system, with an estimated $750 billion of illicit cash passing through the region annually — roughly 2.3 % of Europe’s GDP. Experts point to structural weaknesses in oversight and enforcement, including fragmented regulatory bodies and uneven implementation of anti-money-laundering (AML) rules across member states. The recently established EU Anti-Money Laundering Authority (AMLA) aims to harmonize AML supervision, but its limited budget and delayed full operational status mean that substantial volumes of illicit funds are still likely to circulate unchecked. Despite regulatory ambition, Europe’s ability to stem dirty money flows ultimately depends on stronger cooperation, more resources, and industry commitment to compliance.

Stay informed with our weekly digest, bringing you the most impactful news from around the globe. Thank you for reading!

Subscribe to our weekly Newsletter – Click Here

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #AntiMoneyLaundering

- #AMLCompliance

- #FinancialCrime

- #RegulatoryEnforcement

- #GlobalAML

- #AssetRecovery

- #MoneyLaundering

- #PMLA

- #FINTRAC

- #CryptoCompliance

- #BankingRegulation

- #EUAMLA

- #FinancialRegulation