Regulation Name: Law No. 25-10

Date Of Release: 24 July 2025

Region: Nigeria

Agency: Algeria Parliament

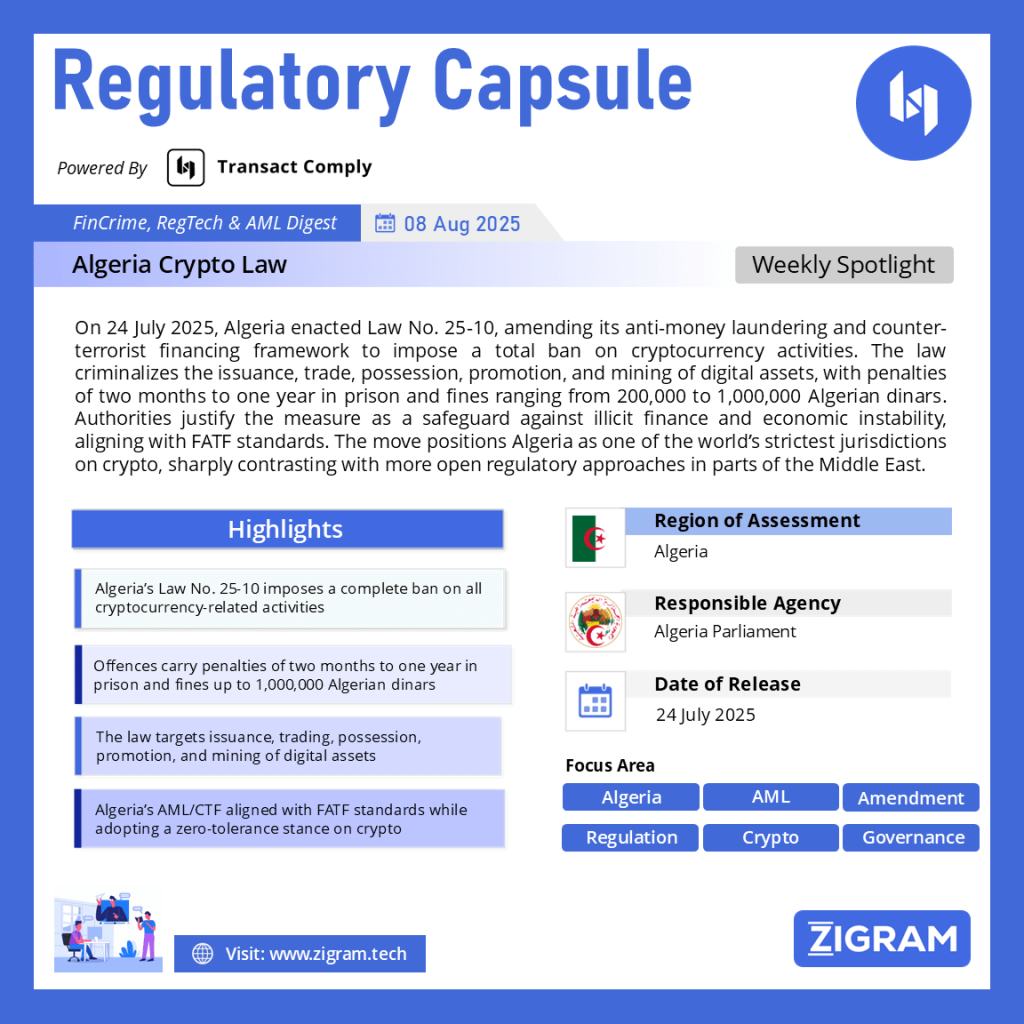

Algeria Passes Law No. 25-10: A Total Ban on Cryptocurrency Activities

On 24 July 2025, Algeria enacted Law No. 25-10, published in the Journal Officiel (Official Journal No. 48). This legislation amends the country’s anti-money laundering and counter-terrorist financing (AML/CTF) framework to impose a complete ban on cryptocurrency-related activities. The move establishes Algeria as one of the most restrictive jurisdictions in the world when it comes to digital assets, closing any legal avenue for their use, promotion, or development.

Scope of the Prohibition

Law No. 25-10 leaves no ambiguity in its treatment of cryptocurrencies. It makes it a criminal offence to issue, purchase, sell, possess, or use digital assets for any purpose, whether as payment, investment, or speculation. The law also prohibits the promotion and advertising of crypto products, the operation of trading platforms and wallets, and the provision of any intermediary services. Even cryptocurrency mining—whether carried out by commercial operators or individual hobbyists—is now banned. These measures collectively eliminate all possible forms of lawful crypto activity in Algeria.

Penalties and Enforcement

The legislation prescribes severe penalties for violations. Individuals found guilty face prison terms ranging from two months to one year, along with fines between 200,000 and 1,000,000 Algerian dinars (approximately USD 1,540 to USD 7,700). In cases where offences are connected to organized crime, money laundering, or terrorist financing, the penalties can be substantially higher. This strict enforcement mechanism reflects Algeria’s commitment to aligning with international AML/CTF standards set by the Financial Action Task Force (FATF).

Rationale Behind the Law

Government officials have justified the ban as a safeguard for national financial stability and a means to protect citizens from the risks inherent in highly volatile digital assets. They argue that cryptocurrencies can facilitate illicit transactions, capital flight, and speculative losses, which could undermine the economy. The adoption of Law No. 25-10 is consistent with Algeria’s historically cautious stance towards digital finance and its preference for tightly controlled monetary systems.

Regional and Global Context

Algeria’s decision stands in sharp contrast to regulatory trends in other parts of the Middle East and North Africa. While regional financial hubs such as the UAE and Bahrain are establishing regulated frameworks to integrate digital assets into their economies, Algeria has opted for outright prohibition. This divergence could limit the country’s participation in global fintech developments and isolate it from technological innovation in the financial sector.

Implications and Outlook

The sweeping ban is likely to have far-reaching consequences. With no legal channels for crypto engagement, some activities may shift underground, potentially making them harder for authorities to monitor and regulate. Critics warn that this could stifle innovation, discourage investment in blockchain technologies, and prompt skilled professionals to seek opportunities abroad. Supporters, however, contend that the measure is necessary to shield Algeria’s economy from the destabilizing effects of speculative and illicit digital asset transactions.

Law No. 25-10 marks a decisive moment in Algeria’s financial regulation. By imposing a total ban on cryptocurrencies, the government has reinforced its conservative approach to financial oversight, prioritizing stability and compliance with global AML/CTF norms over innovation and market liberalization. Whether this strategy will deliver long-term economic benefits or create unintended challenges remains a question that only time and enforcement outcomes will answer.

Read the full law here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #Algeria

- #Law25_10

- #CryptoBan

- #AML

- #CTF

- #FinancialRegulation

- #DigitalAssets

- #CryptoRegulation

- #FATF

- #Blockchain