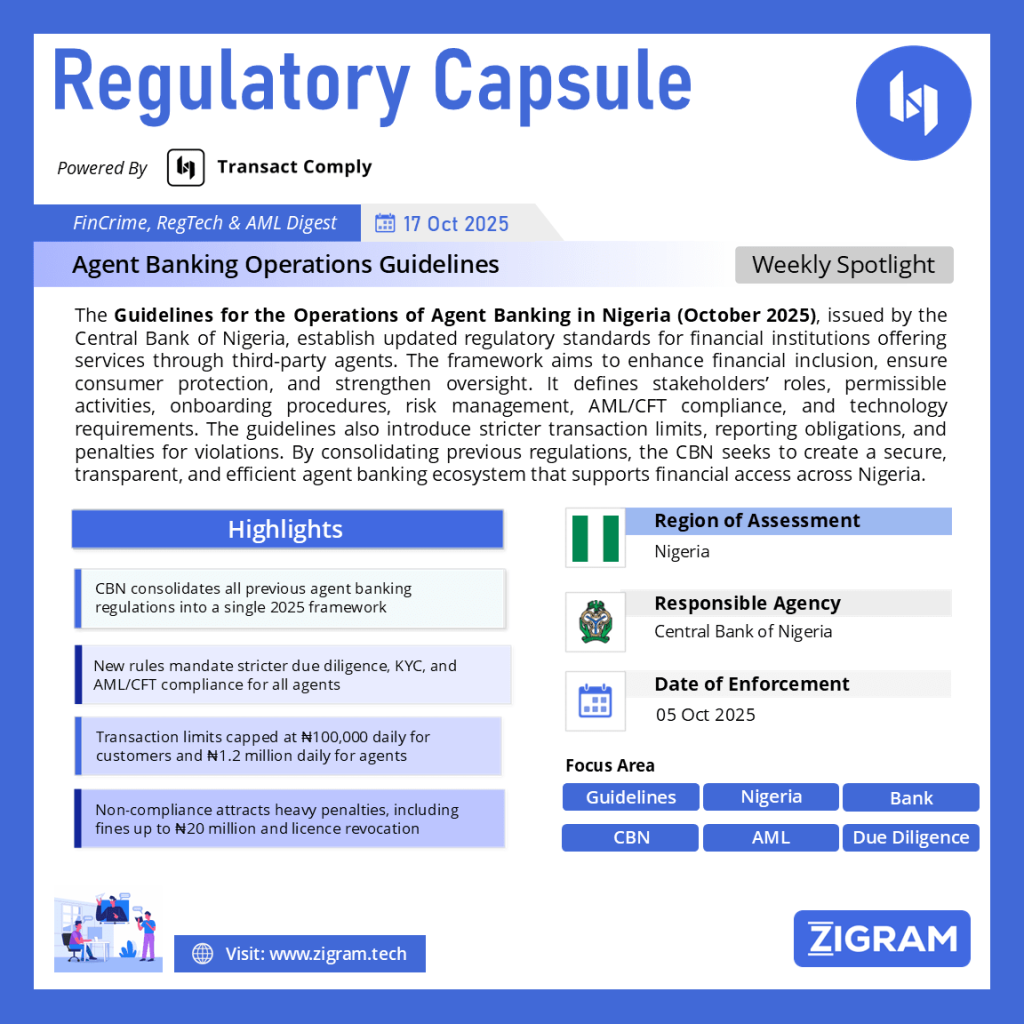

Regulation Name: Guidelines For The Operations Of Agent Banking In Nigeria

Date Of Release: 05 Oct 2025

Region: Nigeria

Agency: Central Bank of Nigeria

CBN Issues New Guidelines for Agent Banking Operations in Nigeria

In October 2025, the Central Bank of Nigeria (CBN) released the Guidelines for the Operations of Agent Banking in Nigeria, a comprehensive regulatory framework designed to strengthen financial inclusion, streamline agent banking operations, and ensure the safety, soundness, and stability of the Nigerian financial system. This new document consolidates all previous regulations on agent banking — including the 2013 guidelines and the 2015 framework for licensing super agents — into a single, updated rulebook aligned with modern technological and market realities.

A Renewed Push for Financial Inclusion

Agent banking, which allows licensed financial institutions to deliver financial services through third-party agents, has become a crucial tool for extending banking access to underserved and remote communities. With the rise of digital payments and mobile money, this model has expanded significantly. The 2025 Guidelines aim to ensure that this growth happens under robust governance and consumer protection standards.

According to the CBN, the key objectives of the guidelines are to:

- -Establish minimum standards for regulating and operating agent banking.

- -Enhance financial inclusion by expanding service delivery through agents.

- -Promote responsible market conduct and better service quality.

The new rules apply to all CBN-licensed financial institutions authorized to engage in agent banking, including commercial banks, microfinance banks, mobile money operators, and payment service banks.

Stakeholders and Roles Defined

The CBN identifies five main players in the agent banking ecosystem:

- -Principals: Deposit-taking institutions licensed to carry out agent banking.

- -Super Agents: CBN-licensed aggregators that recruit, manage, and oversee multiple agents.

- -Agents: Individuals or businesses contracted to provide financial services on behalf of a principal.

- -Payment Terminal Service Aggregators (PTSAs): Entities that manage PoS terminal deployment and ensure connectivity.

- -The CBN: The regulator, supervisor, and enforcer of the framework.

Agents may be individuals or non-individuals such as retail shops, petrol stations, or supermarkets. However, each agent can work exclusively for only one principal at a time to prevent conflicts and reduce operational risks.

Permitted and Prohibited Activities

The guidelines clearly list permissible services agents may offer, including cash deposits and withdrawals, bill payments, fund transfers (in naira only), balance inquiries, mini statements, and account opening facilitation.

Activities not permitted under the framework include:

- -Super agents conducting direct agent banking.

- -Agents performing banking services such as account opening, lending, or forex trading.

- -Use of automated machines as agents.

- -Delegating agency roles to third parties.

Each principal must determine which services an agent may perform based on risk assessment and regulatory compliance.

Onboarding and Due Diligence

The guidelines impose strict requirements for appointing agents, ensuring that only qualified and trustworthy individuals or entities are approved. Key conditions include:

- -No record of loan default, bankruptcy, or financial crime.

- -Submission of valid identification, tax, and registration documents.

- -Completion of background and credit checks.

- -Compliance with AML/CFT/CPF and KYC standards.

The CBN also mandates a “Know Your Agent” (KYA) process — including BVN, NIN, and GPS-linked registration — to prevent fraud and ensure traceability. Agents must undergo training before onboarding and attend refresher sessions at least twice a year.

Operational Standards and Risk Controls

The 2025 Guidelines set clear operational and technological requirements to safeguard transactions and protect customers. Key highlights include:

- -Dedicated Agent Accounts: All transactions must be routed through a specific account linked to the principal. Any operations outside it are deemed violations.

- -Real-Time Transactions: Technology must enable instant settlements and reversals.

- -ICT and Security: Institutions must ensure data encryption, two-factor authentication (2FA), and secure transmission of information.

- -Consumer Protection: Principals must provide receipts for all transactions, set up complaint redress systems, and resolve grievances within seven working days.

- -Branding Rules: Agents may not use misleading terms like “bank” or “finance” in their signage. All agent premises must display authorization letters, service lists, and official contacts of the principal.

Transaction Limits and Reporting

To minimise risks, the CBN caps customer transactions as follows:

- -Cash-in and Cash-out: ₦100,000 per day or ₦500,000 per week.

- -Bill Payments: ₦100,000 per day.

Additionally, each agent’s cumulative daily cash-out limit cannot exceed ₦1.2 million.

Principals must submit detailed monthly reports to the CBN by the 10th of each month, covering transaction volumes, fraud incidents, complaints, agent lists, and compliance records. Late submission attracts penalties.

Enforcement, Sanctions, and Consumer Protection

CBN has enhanced its enforcement framework to ensure compliance. Infractions attract heavy penalties — for example, ₦10 million for operating without a license, ₦5 million for engaging in prohibited activities, and ₦20 million for ownership changes without approval.

In cases of persistent violations, the CBN may suspend an institution from agent banking, revoke its license, or blacklist responsible officers.

These sanctions reflect the regulator’s intent to preserve system integrity, protect consumers, and deter misconduct within the agent banking network.

Conclusion

The 2025 Guidelines for the Operations of Agent Banking in Nigeria mark a major step toward tightening oversight and improving trust in the country’s rapidly expanding financial inclusion ecosystem. By setting clearer roles, accountability mechanisms, and digital compliance requirements, the CBN aims to make agent banking safer, more transparent, and accessible to millions of Nigerians — particularly those in underserved and rural areas.

Read about the circular here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #CBN

- #AgentBanking

- #FinancialInclusion

- #NigeriaBanking

- #Fintech

- #CBNGuidelines

- #DigitalFinance