AAT’s 2024–25 Anti-Money Laundering Report: Strengthening Supervision and Upholding Standards

The Association of Accounting Technicians (AAT) has released its Anti-Money Laundering (AML) Annual Report 2024–25, highlighting its continued efforts to uphold integrity in the accountancy profession and ensure robust compliance with the UK’s Money Laundering Regulations. The Professional Regulation and Standards Compliance (PRSC) Board reaffirmed AAT’s commitment to maintaining public trust through effective oversight of firms and individuals under its supervision.

AAT, representing over 50,000 members and 80,000 students globally, remains a pivotal player in preventing financial crime. Its risk-based supervisory model aims to identify, assess, and mitigate the misuse of accountancy services for money laundering or terrorist financing.

Oversight and Supervision

As an AML supervisor, AAT monitors more than 6,900 firms that provide accounting and bookkeeping services in the UK. Around 42% of these are sole practitioners. The supervision framework ensures that members comply with the Money Laundering, Terrorist Financing and Transfer of Funds Regulations (2017).

AAT’s monitoring approach combines practice assurance reviews, risk assessments, and enforcement actions. In 2024, the Office for Professional Body AML Supervision (OPBAS) assessed AAT’s performance as “largely or partially effective” across all eight evaluation areas. Despite some disagreements with OPBAS findings, AAT continues to collaborate constructively to improve supervisory effectiveness.

Risk-Based Supervision

Central to AAT’s AML strategy is its risk-based approach, ensuring resources target firms with higher exposure to financial crime risks. The 2024–25 period saw updates to AAT’s risk methodology, expanding criteria to include cryptocurrency transactions, payroll services, and high-risk client profiles.

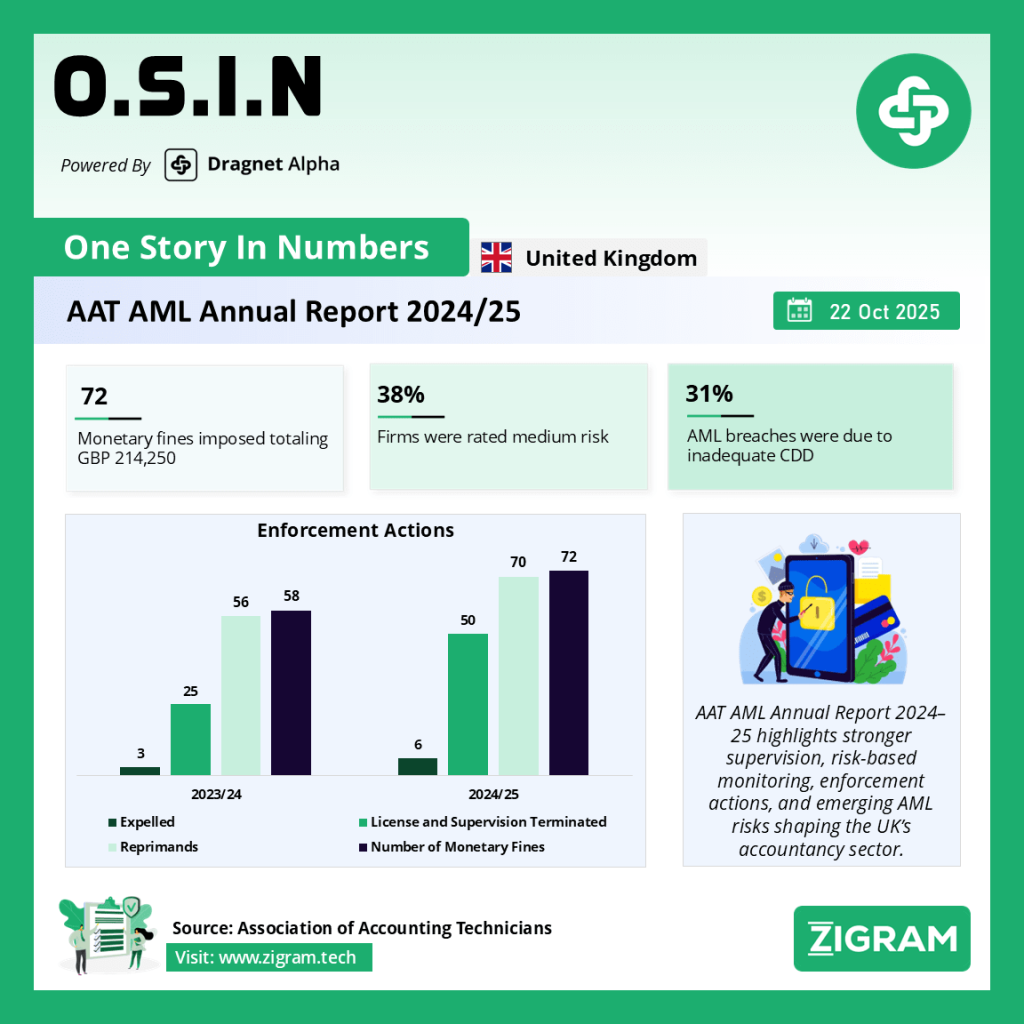

According to the AML firm return 2024, 4% of firms were classified as high-risk, 38% medium-risk, and 58% low-risk. AAT tailors its supervisory actions accordingly—high-risk firms undergo prioritized reviews, while low-risk firms are subject to random checks.

Practice Assurance Reviews and Compliance Findings

During the reporting year, AAT conducted 327 practice assurance reviews, equivalent to 5% of its supervised members. Of these, 70% were desk-based and 30% were on-site. The results revealed that 12% of firms were fully compliant, 72% generally compliant, and 24% non-compliant.

The main causes of non-compliance included:

- Inadequate written AML policies and controls

- Poor client due diligence (CDD) documentation

- Lack of firm-wide risk assessments

- Insufficient training and criminality checks

AAT noted persistent misconceptions among members regarding ongoing CDD obligations. While firms often perform initial checks, they frequently fail to document updates when client circumstances change or new services are introduced.

Enforcement and Follow-Up Action

AAT enforces strict follow-up for non-compliant firms. In 2024–25, seven firms underwent follow-up reviews—one passed, two passed with actions, and four failed, leading to licence termination.

Across the year, 50 firms had their AML supervision terminated, 72 monetary fines were imposed totalling £214,250, and 70 reprimands or severe reprimands were issued. AAT also expelled three members for serious AML breaches. These penalties underline AAT’s zero-tolerance stance on non-compliance.

Case studies in the report illustrate AAT’s disciplinary rigor. In one instance, a member with extensive AML failings including absent CDD and ineffective training—was fined £3,000 and severely reprimanded for four years.

Trust and Company Service Providers (TCSPs)

AAT supervises around 2,816 firms and 905 sole practitioners offering trust or company services, such as forming companies or providing registered office addresses. It collaborates with HM Treasury to maintain the national TCSP register. Failure to register or secure authorisation constitutes a breach of Regulation 56 of the MLR 2017, an area where AAT continues to enhance scrutiny.

Promoting Best Practice and Sector Guidance

AAT continues to drive awareness and learning through its Knowledge Hub, CPD modules, and member communications. Key resources published during the year include guidance on:

- Sanctions compliance and high-risk jurisdictions

- Risks of cryptoassets and TCSP operations

- Reporting obligations for Suspicious Activity Reports (SARs)

Additionally, AAT published a series of AML Bitesize CPD modules and collaborated with the Accountancy AML Supervisors Group (AASG) to identify emerging risks across the sector.

Suspicious Activity Reporting and Helplines

AAT reinforced SAR obligations, reminding members that failure to report suspicions to the National Crime Agency (NCA) constitutes a criminal offence. In 2024–25, 191 supervised firms submitted 353 SARs, with 62% of firms submitting fewer than two reports.

The AAT operates two dedicated helplines—one for general AML queries and another for whistleblowing. During the year, 151 AML-related enquiries were handled, and confidential disclosures were encouraged to improve early detection of breaches.

Emerging Risks and Intelligence Sharing

AAT highlighted several emerging AML/CTF threats affecting accountants, including:

- Use of cryptoassets to obscure fund origins

- Sanctions evasion linked to Russian commodities

- Misuse of TCSPs for concealing beneficial ownership

- Artificial Intelligence misuse, including identity theft and automated financial fraud

To counter these threats, AAT strengthened collaboration through intelligence-sharing frameworks with HMRC, NCA, Companies House, and the FCA’s Shared Intelligence Service.

Looking Ahead

AAT’s upcoming priorities include implementing guidance from the UK Government’s consultation on the Money Laundering Regulations, supporting the Economic Crime Plan 2, and conducting AML webinars in partnership with the UK Financial Intelligence Unit.

The organisation also plans to refine its practice assurance selection model, improve SAR quality training, and ensure its AML website content remains current. Above all, AAT reiterated that AML compliance is not a “tick-box exercise,” reminding members that they serve as gatekeepers of the UK economy in the fight against financial crime.

Conclusion

The AAT’s 2024–25 Anti-Money Laundering Report underscores a maturing supervisory ecosystem—one increasingly data-driven, risk-sensitive, and enforcement-focused. By blending oversight, education, and intelligence-sharing, AAT continues to strengthen the resilience of the accountancy sector against money laundering and terrorist financing threats.

Click here to read the full report.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #AntiMoneyLaundering

- #AAT

- #EconomicCrime

- #AMLCompliance

- #Accountancy