In today’s business landscape, responsible practices go beyond profitability. Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions, strategic approaches, and overall reputation. ESG due diligence, the process of identifying and mitigating risks associated with a company’s environmental impact, social responsibility, and governance practices, has become a vital tool for organizations of all sizes. This article explores the various applications, benefits, and best practices of ESG due diligence, empowering businesses to navigate this evolving landscape and contribute to a more sustainable future.

What Is ESG Due Diligence? Understanding Its Key Components and Importance

ESG due diligence is the process of conducting a comprehensive assessment of a company’s environmental, social, and governance (ESG) performance to identify potential risks, compliance gaps, and sustainability opportunities. This assessment helps organizations evaluate how responsibly and ethically a business operates, providing deeper insights into its long-term sustainability and risk management practices.

ESG due diligence involves a comprehensive assessment of a company’s sustainability practices and potential risks across three key areas:

Three Core Components of ESG Due Diligence: Environmental, Social & Governance

Environmental:

This includes evaluating the company's impact on the environment, such as carbon emissions, waste management, resource use, and pollution control.

Social:

This examines the company's relationships with its stakeholders, including employees, communities, and suppliers. Factors like labor practices, diversity and inclusion, human rights, and social impact initiatives are considered.

Governance:

This assesses the company's internal structures, policies, and procedures, focusing on transparency, accountability, board composition, and risk management practices.

By conducting thorough ESG due diligence, organizations can gain valuable insights into potential risks and opportunities, enabling them to make informed decisions and manage their operations responsibly.

Key Applications of ESG Due Diligence in Investment, M&A, and Supply Chain

Investment Decisions:

Investors increasingly consider ESG factors when evaluating a company's long-term viability and potential returns. ESG due diligence helps them assess the company's sustainability practices, identify potential risks, and make informed investment decisions.

Mergers and Acquisitions (M&A):

Failing to consider ESG factors during M&A activities can lead to reputational damage, regulatory issues, and financial losses. ESG due diligence helps identify potential risks associated with the target company and ensure alignment with the acquiring company's ESG values.

Supply Chain Management:

Ethical and sustainable practices throughout the supply chain are crucial for responsible businesses. ESG due diligence helps vet suppliers and ensure their practices align with the company's values and commitment to sustainability.

Why ESG Due Diligence Is Important and the Benefits of a Robust Process

ESG due diligence plays a vital role in promoting responsible business practices and ensuring long-term resilience. As organizations face increasing scrutiny from investors, regulators, and consumers, evaluating environmental, social, and governance risks has become essential for maintaining trust, profitability, and compliance.

Several factors contribute to the growing importance of ESG due diligence:

Key Importance of ESG Due Diligence for Sustainable Business Success

Meeting Investor and Customer Expectations

Investors increasingly prioritize companies with strong ESG performance and transparent reporting. Likewise, customers support brands that reflect their values on sustainability and social responsibility. Effective ESG due diligence helps build credibility and attract both investors and consumers seeking ethical partnerships.

Managing Risks and Ensuring Compliance

Through structured ESG due diligence, organizations can identify and mitigate environmental, social, and governance-related risks. Addressing compliance gaps in areas such as emissions, labor rights, or sourcing helps prevent fines, reputational harm, and operational disruptions.

Building a Positive and Trusted Reputation

Strong ESG practices enhance brand reputation, demonstrating accountability and integrity. Transparent reporting and ethical decision-making foster stakeholder confidence and distinguish organizations as responsible industry leaders.

Identifying Cost-Saving Opportunities

Implementing sustainable business practices — such as energy efficiency, waste reduction, and resource optimization — directly contributes to financial savings. ESG-aligned operations often lead to improved productivity and reduced long-term costs.

Driving Sustainable and Long-Term Growth

By integrating ESG principles into day-to-day operations, organizations create a foundation for resilient and responsible growth. This approach strengthens risk management, supports innovation, and prepares companies for evolving global standards.

Attracting Investors and Strengthening Market Position

A robust ESG due diligence process sets companies apart from competitors by demonstrating proactive governance, transparency, and sustainability. These qualities attract long-term investors and enhance market positioning.

Overcoming Challenges and Building an Effective ESG Due Diligence Process

Key Challenges in Implementing an Effective ESG Due Diligence Framework

Implementing effective ESG due diligence presents several key challenges. Data collection remains one of the most significant hurdles, with inconsistent reporting standards and limited transparency making it difficult to obtain accurate and comparable information.

Verification adds another layer of complexity, requiring time, expertise, and specialized tools to validate the authenticity of ESG metrics and disclosures.

Another ongoing issue is greenwashing - when organizations overstate or misrepresent their ESG performance. Distinguishing genuine sustainability efforts from superficial claims requires a structured, evidence-based approach and continuous monitoring.

By recognizing these challenges early, companies can design stronger ESG due diligence frameworks that enhance credibility, reliability, and trust..

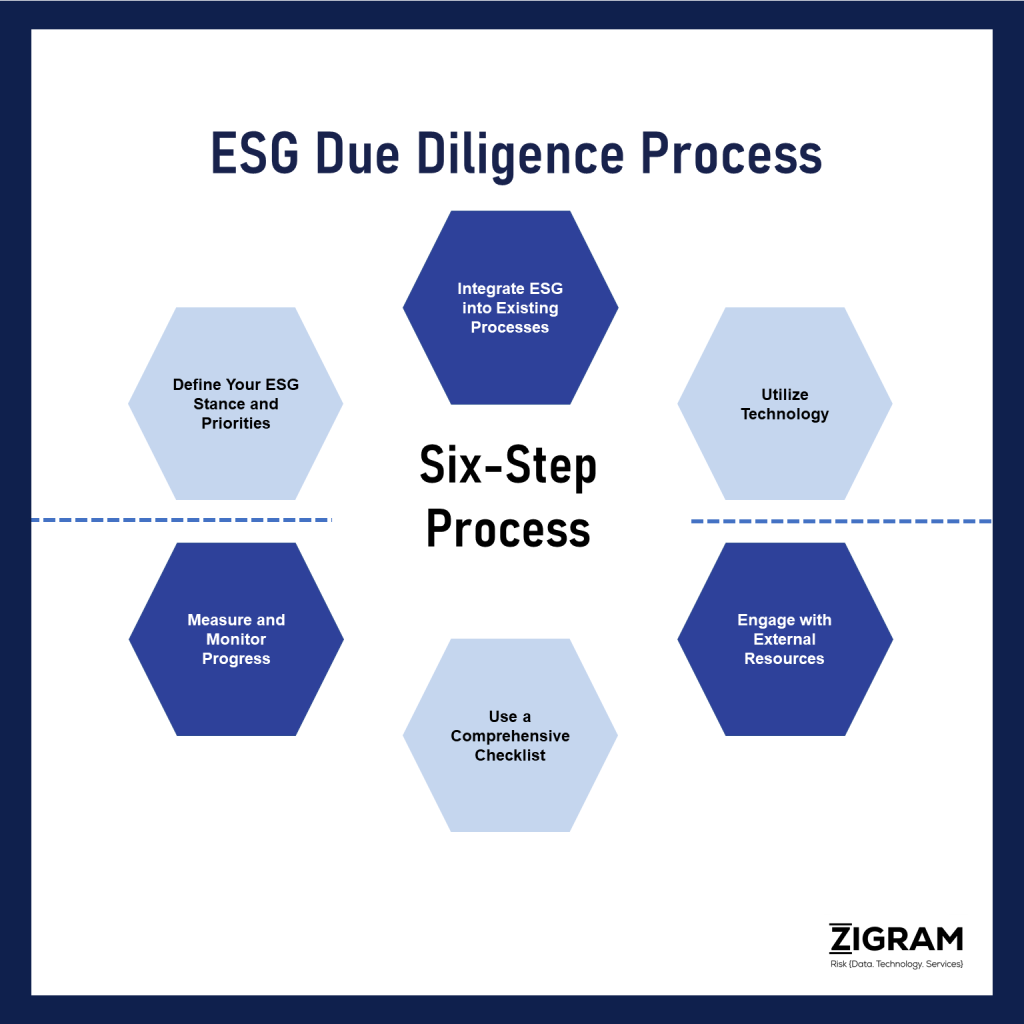

Step-by-Step Process for Building a Robust ESG Due Diligence Framework

Despite the challenges, a well-structured ESG due diligence process enables organizations to assess sustainability risks, improve transparency, and align with regulatory expectations. Below is a clear framework to establish an effective and repeatable process:

Define Your ESG Stance and Priorities:

- Identify the ESG elements most relevant to your organization and potential risks. Consider your industry, location, and stakeholder expectations.

- Develop a customized checklist reflecting your values and long-term goals. Define clear expectations and desired outcomes for your ESG performance.

Integrate ESG into Existing Processes:

- Incorporate ESG considerations into existing due diligence procedures for transactions, supplier onboarding, and investment decisions.

- Train relevant personnel on identifying and assessing ESG risks and opportunities. Foster a culture of responsible decision-making within your organization.

Utilize Technology:

- Explore technology solutions like ESG governance software, data analysis tools, and satellite imagery to enhance data collection, analysis, and verification.

- Leverage AI and machine learning to identify trends, predict risks, and detect anomalies in ESG data.

Engage with External Resources:

- Stay informed about industry best practices, regulatory developments, and emerging standards. Partner with organizations like the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB).

- Collaborate with peers, regulators, and policymakers to ensure your approach aligns with evolving requirements. Seek expert guidance from ESG consultants when needed.

Use a Comprehensive Checklist:

- Utilize a checklist encompassing relevant factors like:

- Geographical information and potential environmental risks

- Sector-specific ESG considerations and industry benchmarks

- Company structure and governance practices

- Financial considerations and ESG-related investments

- Regulatory compliance and potential risks

- ESG rankings, ratings, and disclosures

- Reputation and media coverage of ESG performance

- Supply chain practices and labor standards

- Social impact initiatives and community engagement

- Technology utilization for sustainability goals

- Legal and regulatory requirements, both domestic and international

Measure and Monitor Progress:

- Establish key performance indicators (KPIs) aligned with your ESG goals and priorities. Track metrics like carbon emissions, waste reduction, employee engagement, and community investment.

- Regularly assess progress against these KPIs and industry benchmarks. Identify areas for improvement and adapt your approach based on results.

- Communicate results to stakeholders and continuously improve your ESG due diligence process to ensure long-term effectiveness.

The Role of Emerging Technologies in Strengthening ESG Due Diligence

Data Analytics: Enhancing ESG Data Collection and Risk Assessment

Data analytics tools play a crucial role in ESG due diligence by streamlining data collection, integration, and interpretation. They enable organizations to gather large volumes of ESG data efficiently, perform comprehensive assessments, and identify performance gaps and potential risks with greater accuracy.

Artificial Intelligence: Identifying Patterns and ESG Performance Trends

AI technology improves ESG due diligence by uncovering hidden patterns and trends across complex data sets. It helps organizations detect sustainability risks and opportunities that traditional manual analysis might miss, supporting more informed, data-driven decision-making.

Machine Learning: Ensuring Data Integrity and Detecting Greenwashing

Machine learning algorithms strengthen ESG due diligence by verifying data integrity and automatically detecting anomalies. These tools reduce the likelihood of greenwashing by flagging inconsistencies in ESG disclosures and ensuring that reported metrics accurately reflect real performance.

Blockchain: Building Transparency and Trust in ESG Reporting

Blockchain technology enhances ESG reporting through secure, transparent, and immutable data systems. It ensures the traceability of ESG information, helping stakeholders validate performance claims and increasing confidence in corporate sustainability disclosures.

Best Practices and Strategies for Effective ESG Due Diligence:

Implementing effective ESG due diligence best practices helps organizations enhance transparency, minimize risks, and align operations with global sustainability standards. A structured and adaptable ESG strategy ensures compliance, stakeholder trust, and long-term business resilience. The following best practices outline how companies can improve the quality and effectiveness of their ESG due diligence framework.

Tailor ESG Due Diligence to Sector and Geographic Context

There is no one-size-fits-all solution for ESG due diligence. Each industry faces unique risks, regulations, and sustainability challenges. Tailor your process to reflect sector-specific ESG priorities, local regulations, and stakeholder expectations to achieve meaningful, relevant results.

Start ESG Due Diligence Early for Proactive Risk Management

Integrate ESG analysis at the earliest stage of due diligence activities. Early adoption allows organizations to conduct deeper assessments, identify potential ESG risks, and address issues before they escalate into financial, reputational, or compliance challenges.

Prioritize Material ESG Factors with the Greatest Impact

Focus on the ESG factors most critical to your organization’s operations and long-term goals. Evaluate materiality based on impact, stakeholder relevance, and regulatory importance to allocate resources effectively and maximize sustainability outcomes.

Engage Stakeholders to Strengthen ESG Alignment

Involving internal and external stakeholders — including employees, board members, and investors — enhances transparency and buy-in for ESG initiatives. Conduct interviews, on-site reviews, and collaborative assessments to ensure ESG goals align with broader corporate strategy.

Stay Informed on Emerging ESG Regulations and Standards

The ESG landscape evolves constantly with new reporting frameworks and global compliance requirements. Stay updated on industry best practices, emerging trends, and evolving regulatory standards through engagement with peers, policymakers, and sustainability networks.

Measure ESG Performance and Collaborate with Experts

Define measurable ESG KPIs to track progress over time and benchmark against industry standards. Partnering with ESG consultants and external specialists can enhance data verification, improve reporting accuracy, and ensure alignment with international frameworks.

The Future and Global Impact of ESG Due Diligence

The Potential Impact of ESG Due Diligence on Developing Countries

While ESG due diligence holds significant promise for advancing responsible and ethical business practices, its effects on developing countries require careful consideration. Stringent ESG requirements may unintentionally create barriers for smaller organizations, limiting their access to global investments and markets.

To ensure equitable participation, ESG frameworks must be adapted to reflect the economic realities and regulatory capacities of developing regions. This approach fosters inclusive growth, enabling emerging economies to adopt sustainable practices without compromising development or competitiveness.

The Future of ESG Due Diligence: Trends Shaping Responsible Business

ESG due diligence continues to evolve rapidly as technology, regulation, and stakeholder expectations transform how businesses measure and manage sustainability. Several emerging trends are redefining its future:

Mandatory Reporting Standards

Global regulators are implementing mandatory ESG disclosure requirements, leading to more standardized, transparent, and comparable sustainability reporting.

ESG-Linked Performance Metrics

Companies are increasingly tying executive compensation and bonuses to measurable ESG outcomes, reinforcing accountability and aligning leadership incentives with sustainability goals.

Evolving Regulatory Landscapes

The ESG regulatory environment is in constant flux. Continuous monitoring and adaptive due diligence frameworks are essential to stay compliant and competitive in global markets.

Data Collection and Technology Advancements

Innovations such as AI, machine learning, and satellite imagery are revolutionizing ESG data analysis. These tools enhance data accuracy, detect risks early, and uncover deeper sustainability insights.

Global and Societal Considerations

As concerns about climate change, human rights, and social equity intensify, ESG due diligence is expanding beyond company-level practices to address global environmental and social impacts.

Building a Sustainable and Inclusive ESG Future

ESG due diligence has become a core pillar of responsible business strategy. By embedding ESG principles into daily operations, organizations can attract investors, build stakeholder trust, mitigate risks, and ensure long-term resilience.

The future of ESG lies in innovation, inclusivity, and continuous improvement — adapting to evolving regulations, leveraging advanced technologies, and maintaining a global, culturally sensitive perspective. Companies that embrace these shifts will be better positioned to lead the next generation of sustainable, transparent, and ethical enterprises.

Empower Your ESG and Compliance Journey with ZIGRAM

ZIGRAM is your one-stop solution for all compliance and due diligence needs. Experience powerful, data-driven tools that enhance AML, KYC, and ESG due diligence workflows.

Try our FREE AML DEMO today to see how ZIGRAM can help you simplify compliance and strengthen sustainable business operations.

Implementing a robust ESG due diligence process offers several benefits for organizations, including:

ESG due diligence is still evolving, with several key trends shaping the future:

- #ESG

- #Environment

- #Social

- #Governance

- #DueDiligence