Table of Contents

Financial Intelligence Unit (FIU) of Nepal (FIU-Nepal), operating under Nepal Rastra Bank, has released its Annual Report for FY 2024-25 (2081/82 B.S.) at a pivotal moment for the country’s AML/CFT regime.

The year marked record‑high digital reporting volumes, deepening use of the UNODC goAML platform, the formalization of new risk typologies (including virtual assets and hundi), and intensified international scrutiny following Nepal’s placement on the FATF “Jurisdictions under Increased Monitoring” list in February 2025.

For compliance professionals, regulators, financial institutions, fintechs, PSPs, DNFBPs, and policy leaders, the report provides a rare, data‑rich window into how financial crime risks are evolving in Nepal and how supervisory and intelligence expectations are rising accordingly.

This article distills the most operationally relevant insights from the report and translates them into concrete implications for regulated entities across banking, insurance, securities, remittance, payments, cooperatives, real estate, casinos, precious metals dealers, and emerging virtual asset businesses.

Key Insights from FIU-Nepal Annual Report 2024/25:

- Record-high digital reporting volumes: goAML connected 4,000+ institutions

- STR/SAR growth: 9,565 received; 41% led to intelligence dissemination

- Emerging typologies: trade-based laundering, hundi networks, and crypto activity

- FATF grey list implications: stricter supervision, on-site inspections, and enhanced STR expectations

- Intelligence-led compliance is now a regulatory expectation; technology and entity-level risk monitoring are critical

Role of the Financial Intelligence Unit (FIU) in Nepal’s AML Framework

FIU-Nepal functions as an administrative-type FIU under the Assets (Money) Laundering Prevention Act, 2008 (ALPA). Its statutory mandate is to:

- Receive Threshold Transaction Reports (TTRs), Suspicious Transaction Reports (STRs) and Suspicious Activity Reports (SARs)

- Analyse financial data and intelligence

- Disseminate actionable intelligence to law enforcement agencies (LEAs) and competent authorities

- Coordinate the national AML/CFT framework through the Coordination Committee

- Exchange intelligence internationally via the Egmont Group network

Importantly, FIU-Nepal does not investigate or prosecute; it only enables investigations through financial intelligence. This distinction shapes what regulators expect from reporting entities: quality data, contextualized suspicion, and timely reporting.

Organizationally, FIU-Nepal now operates specialized units for:

- Tactical, operational, and strategic analysis

- goAML system implementation and IT security

- Reporting entity integration and training

- Domestic and international cooperation

- Policy and planning

This multi‑layered structure signals a move away from basic compliance monitoring toward intelligence‑driven supervision.

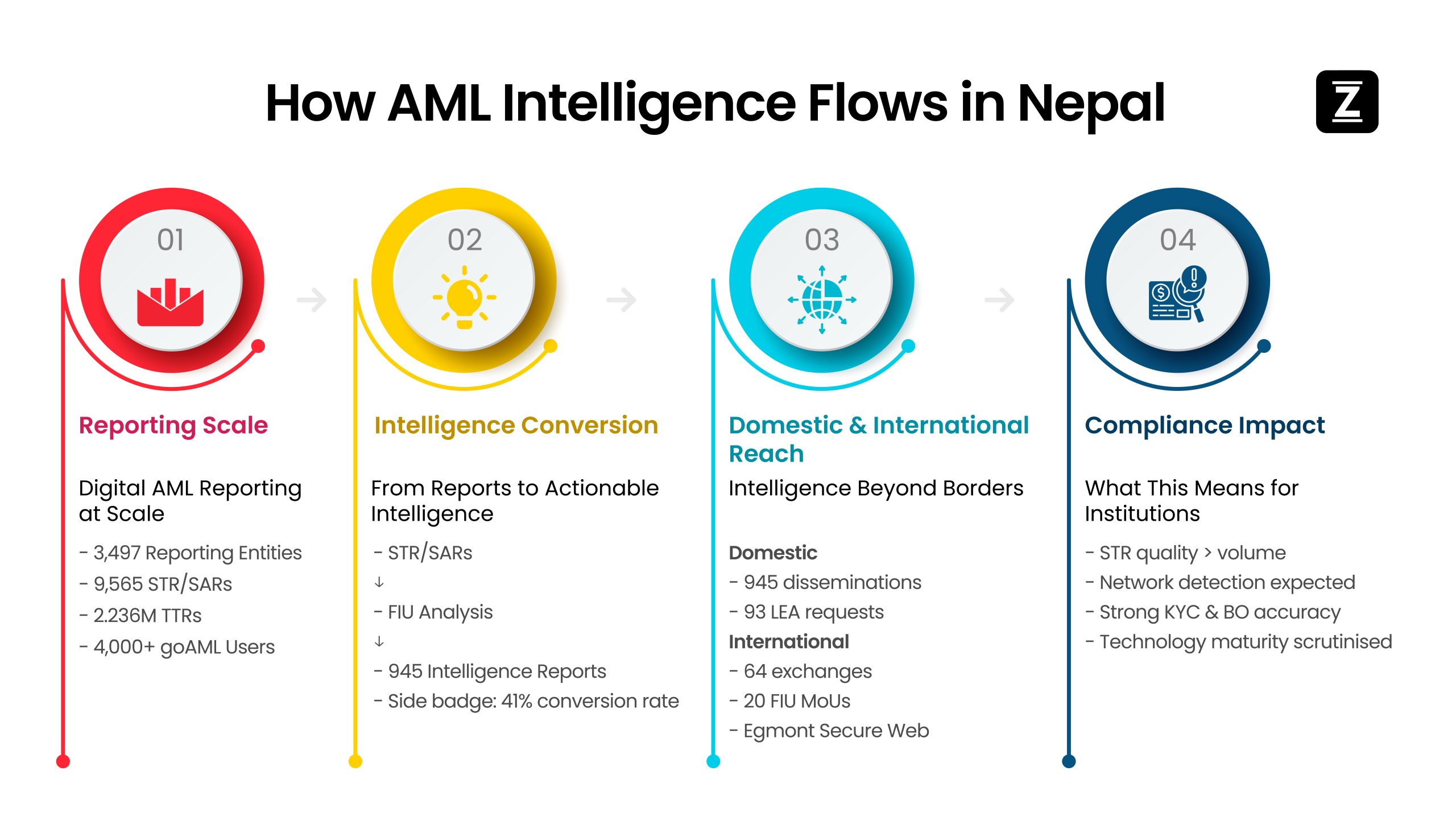

Digital Reporting Volumes and Intelligence Sharing in 2024-25: From goAML Adoption to Enforcement Outcomes

This reporting year marks a structural shift in Nepal’s AML ecosystem: digital reporting scale, analytical processing, and intelligence dissemination have become tightly interconnected parts of a single operating model. FIU-Nepal’s statistics demonstrate how transaction data now flows from reporting entities into investigative and prosecutorial pipelines.

Data published by the Financial Intelligence Unit (FIU) demonstrates how transaction reporting, intelligence analysis, and enforcement outcomes are now operationally linked within Nepal’s AML system.

goAML Integration in Nepal- Building the National AML Data Backbone

One of the most consequential developments in FY 2024-25 is the rapid expansion of the UNODC goAML platform from a banking‑centric reporting tool into a national AML infrastructure layer.

Key figures from the report:

- Registered reporting entities increased from 1,639 to 3,497 in one year (113.36% growth).

- Sectoral expansion was most pronounced in traditionally under‑supervised and high‑risk areas.

- Cooperatives: 1,010 → 1,766

- Dealers in precious metals & stones: 121 → 1,121

- Significant onboarding of PSPs/PSOs, microfinance institutions, merchant bankers, money changers, and public funds (EPF, CIT, SSF)

- By mid‑2025, 4,000+ institutions and authorities were connected to the platform.

Operational implication for industry:

- Digital reporting via goAML is no longer a technical enhancement—it is the minimum supervisory baseline.

- Institutions still dependent on manual or semi‑manual reporting are increasingly visible as risk outliers during supervisory reviews.

STR and SAR Volumes- Measuring the System’s Analytical Load

FIU‑Nepal recorded the following volumes in FY 2024-25:

- STRs/SARs received: 9,565 (≈ 30% year‑on‑year increase)

- STRs subjected to detailed analysis: 2,282

- STRs postponed after preliminary screening: 1,337

Commercial banks continue to dominate reporting (~76%) and highest STRs/SARs value of NPR 38,880.51 Mn, but their relative share is declining as reporting matures across:

- Insurance companies

- Securities firms

- Payment service providers

- Cooperatives

- Remittance companies

The drivers behind this growth are structural:

- Mandatory digital reporting through goAML

- Increased supervisory scrutiny

- More sophisticated transaction monitoring deployments

- Cooperatives

- Rapid migration to digital payments (RTGS, connectIPS, mobile wallets)

However, FIU‑Nepal explicitly notes that volume without analytical usability has diminishing regulatory value. Report narratives, typology mapping, and entity context increasingly determine whether a case progresses beyond initial screening.

From Reports to Investigations- Domestic Intelligence Dissemination

FIU‑Nepal’s role is no longer limited to report reception. In FY 2024-25, the conversion of reports into investigative intelligence reached material scale:

Intelligence reports disseminated to domestic law‑enforcement agencies: 945

Recipients included:

- Nepal Police (Central Investigation Bureau)

- Department of Money Laundering Investigation (DMLI)

- Commission for the Investigation of Abuse of Authority (CIAA)

- Department of Revenue Investigation

- Other specialised supervisory and enforcement bodies

Each intelligence package typically contained:

- Transaction flow reconstruction

- Relationship and network mapping across accounts and entities

- Beneficial ownership indicators

- Cross‑border transaction trails (where relevant)

- Predicate‑offence risk classification

Effectiveness indicator: Approximately 41% of analysed STRs resulted in formal intelligence dissemination.

This fundamentally alters the compliance risk profile for reporting entities: poorly documented STRs no longer represent a paperwork failure—they can directly impair criminal investigations.

Two-Way Intelligence Flow- Information Requests from LEAs

FIU‑Nepal received 93 formal information requests from domestic law‑enforcement agencies during the year.

Common triggers included:

- Corruption and abuse‑of‑authority cases

- Large‑scale fraud schemes

- Tax evasion and customs manipulation

- Hundi and informal value transfer networks

- Trade‑based money laundering investigations

For compliance teams, this increases the likelihood of:

- Retrospective review of transaction‑monitoring decisions

- Requests for historical KYC/CDD files

- Scrutiny of earlier risk classifications

International Intelligence Exchange- Quantifying Nepal’s Cross‑Border Integration

Cross‑border cooperation also expanded materially:

- 64 international intelligence exchanges with foreign FIUs

- Exchanges conducted via the Egmont Secure Web

- New MoU signed with the Financial Intelligence National Center (Bahrain)

- Total bilateral FIU MoUs: 20

Cases supported included:

- Overseas remittance corridors

- Foreign shell‑company ownership chains

- Trade‑settlement discrepancies

- Crypto‑linked layering structures

- Politically exposed persons with multi‑jurisdictional exposure

Practical implication: Financial activity originating in Nepal is now routinely reconstructed using foreign banking and corporate‑registry data and foreign cases increasingly rely on Nepali reporting‑entity records.

This places higher expectations on:

- Beneficial‑ownership accuracy

- Consistency of KYC records across jurisdictions

- Sanctions and PEP screening depth

Solutions such as PreScreening.io and Entity Hero support this requirement by integrating sanctions, PEP data, adverse media, and entity‑network intelligence across jurisdictions.

Intelligence Sharing as a FATF Performance Metric

FIU‑Nepal explicitly links intelligence dissemination volumes and international cooperation to its FATF remediation obligations:

Under FATF methodology, the effectiveness of a Financial Intelligence Unit (FIU) is measured not by reporting volume alone, but by the extent to which financial intelligence leads to investigations, prosecutions, and asset recovery.

- Demonstrating effective use of financial intelligence

- Increasing ML/TF investigation initiation rates

- Supporting asset‑freezing and confiscation proceedings

- Improving conviction outcomes

Intelligence sharing is therefore no longer a technical by‑product of reporting. It is now a core regulatory effectiveness indicator under FATF methodology.

Threshold Transaction Reports (TTRs): Non-Bank Sectors Now in Focus

Total TTRs received in FY 2024/25: 2.236 million

Key trends:

- BFIs contributed ~49.7% (down from previous years)

- Non‑bank sectors (securities companies, insurance, PSPs/PSOs, cooperatives, DNFBPs) now contribute ~50%

- Securities companies alone reported ~769,000 TTRs

- PSP/PSO reporting jumped to ~13,900

Another structural change: Cash‑based TTRs are declining, while cross‑border and non‑cash categories are rising which reflects Nepal’s fast shift to digital payments (RTGS, connectIPS, mobile banking).

Implication: Transaction monitoring models designed only for cash‑heavy banking environments are becoming obsolete. Institutions need multi‑channel, behaviour‑based detection logic.

This is where modern rule‑based and AI‑assisted transaction monitoring systems, such as ZIGRAM’s Transact Comply, become operationally critical for maintaining both detection accuracy and regulatory credibility.

What FIU-Nepal Is Actually Seeing: Emerging Typologies

Trade‑Based Money Laundering (TBML)

TBML reporting doubled year‑on‑year from 22 reports → 43 reports

Sub‑typologies include:

- Under‑ and over‑invoicing

- Phantom shipments

- Fake transport documents

- Dual‑use goods

- Shell companies

- Third‑party invoice settlement

Important Notice: Although TBML is not yet a separate offence under ALPA, FIU‑Nepal has created a dedicated reporting category for A‑class banks, signalling regulatory prioritisation.

New Predicate Offences Appearing in STRs

For the first time, reports explicitly included:

- Hundi networks

- Virtual currency / crypto‑related activity

- Undue transactions

These categories now sit alongside traditional risks such as tax offences, fraud, corporate misuse, gambling, and corruption.

Case Studies: From Theory to Practice

The report documents detailed operational cases, including:

- Hundi settlement using cryptocurrency via structured cash deposits and layered transfers across family-linked accounts

- Systematic misuse of PSP settlement accounts, involving:

- 428 STRs from 45 reporting entities

- 307 linked accounts

- NPR 11.8+ billion in suspicious flows

- Structured deposits by 290+ individuals

These examples illustrate FIU-Nepal’s analytical depth: link analysis, behavioural profiling, and cross‑institutional consolidation.

For compliance teams, the message is direct: “Regulators now expect institutions to detect networks, not just anomalous transactions.”

Entity‑centric intelligence platforms, such as ZIGRAM’s Entity Hero (for risk management of individuals and businesses) and PreScreening.io (for name screening against sanctions or PEP or adverse-media coverage) are becoming foundational rather than optional.

Analytical Maturity: Tactical → Operational → Strategic

FIU-Nepal formalised a three‑tier analysis model:

- Tactical analysis-data validation, database matching, enrichment

- Operational analysis-building actionable case intelligence, relationship mapping

- Strategic analysis-national risk trends, sectoral vulnerabilities, future threat modelling

Its latest strategic report focuses specifically on Virtual Assets and Virtual Asset Service Providers (VASPs), signalling that crypto businesses in Nepal are moving rapidly into the supervisory spotlight.

Entities operating exchanges, wallets, payment gateways, or crypto brokerage services should expect:

- Formal licensing expansion

- Mandatory STR typology alignment

- Enhanced customer due diligence and beneficial ownership scrutiny

ZIGRAM’s DueDiliger platform is increasingly relevant here, enabling:

- AI/ML-integrated due diligence reports

- Automated corporate registry analysis

- UBO identification

Post-Mutual Evaluation Reality: Nepal on the FATF Grey List

Following the APG mutual evaluation (2022-23) and the subsequent observation period, Nepal was placed under FATF Increased Monitoring in February 2025.

Key deficiencies cited include:

- Low national understanding of ML/TF risk

- Weak supervision of high‑risk sectors

- Limited action against illegal money transfer services and hundi networks

- Weak investigation and prosecution outcomes

- Technical gaps in targeted financial sanctions

Nepal has committed to a two‑year action plan, supported by:

- Amendments to ALPA and ALPR (April 2024)

- New National AML/CFT Strategy (2024-25-2028-29)

- Re‑ratings of several FATF recommendations (CDD, DNFBPs, new technologies, higher‑risk countries, etc.)

For regulated businesses, this translates into: A sustained period of stricter supervision, more on‑site inspections, and deeper scrutiny of transaction monitoring effectiveness.

Designated Director (DD)

The Designated Director is a board‑level officer responsible for overall compliance with PMLA and PMLR. Core responsibilities include:

- Ensuring internal systems exist for CDD, monitoring, reporting, and record keeping,

- Approving ML/TF/PF risk assessments,

- Ensuring timely submission of reports to FIU‑IND,

- Allocating adequate resources and staffing to compliance,

- Overseeing employee adherence to AML obligations.

Principal Officer (PO)

The Principal Officer is the operational head of AML/CFT compliance. The role must be:

- Full‑time,

- Senior enough to access all business data,

- Independent from revenue and growth functions,

- Experienced in AML, financial crime, and regulatory reporting.

The PO must be formally notified to FIU‑IND and updated via FINgate whenever details change.

Responsibilities of the Principal Officer

The guidelines prescribe extensive duties, including:

- Reviewing and deciding on all STR filings,

- Maintaining internal escalation mechanisms,

- Preserving records of investigations and decisions for at least five years,

- Liaising with FIU‑IND and law‑enforcement agencies,

- Periodic review of transaction monitoring rules and typologies,

- Submitting quarterly AML effectiveness reports to the Board covering:

- Programme effectiveness,

- Identified vulnerabilities,

- STR statistics and trends,

- Red‑flag indicators issued by FIU‑IND,

- Proposed policy or system changes.

Conflicts of interest are explicitly prohibited.

Technology Roadmap: Where Supervision Is Heading

FIU-Nepal’s forward strategy is built on three pillars:

The Financial Intelligence Unit (FIU) is increasingly relying on advanced analytics, automation, and network-based intelligence to identify complex financial crime patterns at scale.

- Risk‑based prioritisation

- Advanced technology & analytics

- Deepened coordination & capacity building

Planned upgrades include:

- AI/ML‑based triaging of high‑risk STRs

- Network detection for hidden relationships

- Large‑scale dataset analysis for emerging typologies

- Modernised IT infrastructure and cybersecurity

This is a clear signal to industry: regulators will increasingly benchmark institutional AML systems against similar technological standards.

8. What This Means for Nepal’s Regulated Entities

Financial Institutions & PSPs

- Upgrade transaction monitoring beyond threshold rules

- Integrate behavioural and network‑based detection

- Improve STR narrative quality

DNFBPs (Casinos, Real Estate, Precious Metals, Auditors, Lawyers)

- Expect tighter onboarding and goAML enforcement

- Prepare for sector‑specific typology guidance

- Document source‑of‑funds rigorously

Virtual Asset Businesses

- Align early with FATF Travel Rule principles

- Build crypto‑specific AML frameworks

- Maintain robust entity and wallet‑level risk analysis

Regulators & Policymakers

- Use FIU data to calibrate proportional supervision

- Prioritise outcomes (convictions, asset recovery), not just compliance volumes

The ZIGRAM Perspective: From Compliance to Intelligence

The Financial Intelligence Unit (FIU)-Nepal 2024-25 report makes one point unmistakably clear:

Nepal’s AML/CFT regime is shifting from compliance reporting to intelligence‑led risk management.

To operate sustainably in this environment, institutions require:

- Entity-level risk intelligence → Entity Hero

- Real-time transaction monitoring → Transact Comply

- Global sanctions, PEP & adverse‑media screening → PreScreening.io

- Automated due diligence & beneficial ownership mapping → DueDiliger

Together, these capabilities allow organisations to:

- Detect structured laundering early

- Reduce false positives

- Improve STR quality

- Demonstrate regulatory maturity during audits and inspections

Strategic Priorities and Future Outlook: Where Nepal’s AML Regime Is Headed

The Financial Intelligence Unit (FIU)-Nepal’s report frames intelligence sharing, technology modernisation, and risk‑based supervision as mutually reinforcing pillars of its forward strategy.

The institution’s officially articulated strategic priorities include:

Institutionalization of Risk‑Based Supervision

FIU‑Nepal plans to further align supervisory expectations with sector‑specific risk profiles by:

- Prioritising high‑risk sectors (PSPs, cooperatives, remittance firms, casinos, dealers in precious metals and stones, and emerging VASPs)

- Allocating analytical resources dynamically based on STR typologies and geographic exposure

- Integrating national and sectoral risk assessment outputs directly into reporting‑entity supervision

Technology‑Driven Financial Intelligence

The future operating model is explicitly technology‑centric:

- Advanced analytics modules embedded within goAML

- AI/ML‑based prioritisation of high‑risk transaction clusters

- Automated detection of hidden ownership and transaction networks

- Secure large‑scale data sharing across agencies

- Strengthened cybersecurity controls

For regulated institutions, this implies that manual compliance workflows will become structurally inadequate.

Transaction monitoring systems such as Transact Comply, combined with automated entity due‑diligence platforms like DueDiliger, are increasingly aligned with the supervisory direction FIU‑Nepal itself is pursuing.

Deepening Domestic and International Cooperation

FIU‑Nepal intends to:

- Expand the scope of intelligence‑sharing MoUs

- Formalise information‑exchange protocols with sector regulators

- Increase joint training with LEAs and reporting entities

- Standardise STR quality benchmarks across sectors

Human Capital and Analytical Capability Building

The report also prioritises:

- Specialised training in trade‑based money laundering analysis

- Cryptocurrency and blockchain transaction tracing

- Network analytics and typology development

- Legal and evidentiary documentation standards

Conclusion: Compliance in Nepal Is Becoming Intelligence-Centric

The Financial Intelligence Unit (FIU) Nepal’s Annual Report 2024-25 makes one institutional message unmistakably clear:

Nepal’s AML/CFT framework is transitioning from rule-based compliance toward intelligence-led financial crime control.

The rapid expansion of intelligence sharing both domestically (945 disseminations, 93 LEA requests) and internationally (64 cross‑border exchanges, 20 MoUs), demonstrates that regulatory compliance is now directly linked to investigative effectiveness.

For financial institutions and DNFBPs, this means:

- STR quality will matter more than STR quantity

- Entity-level risk understanding will outweigh isolated transaction alerts

- Technology capability will become a supervisory differentiator

- Cross-border transparency will be unavoidable

Institutions that align early with this trajectory by strengthening transaction monitoring, entity intelligence, sanctions screening, and automated due diligence will not only reduce regulatory exposure but also position themselves as credible partners in Nepal’s effort to exit the FATF grey list.

All data and statistics referenced are derived from FIU-Nepal’s officially published Annual Report for FY 2024-25.