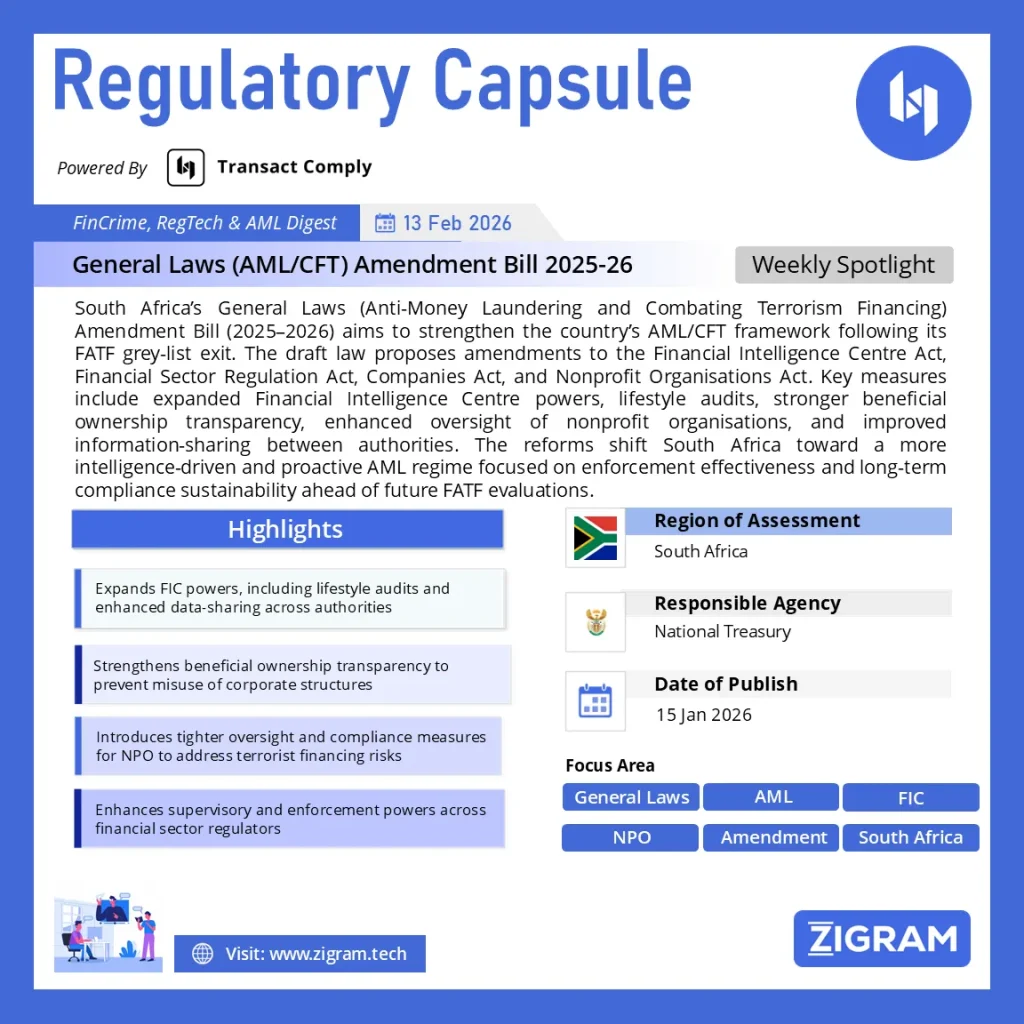

Regulation Name: General Laws (Anti-Money Laundering and Combating Terrorism Financing) Amendment Bill

Date Of Issue: 15 Jan2026

Region: South Africa

Agency: National Treasury of South Africa

South Africa’s AML/CFT Amendment Bill 2025: Why Compliance Leaders Must Rethink Enforcement, Intelligence and Risk Governance

South Africa’s General Laws (Anti-Money Laundering and Combating Terrorism Financing) Amendment Bill, 2025 is not just another regulatory update. It represents a structural redesign of how financial crime supervision will operate across banking, corporate governance, nonprofit oversight, and financial sector regulation.

While previous reforms focused on aligning legislation with global AML standards, this amendment moves decisively toward operational effectiveness — embedding intelligence-led enforcement, technology risk governance, and beneficial ownership accountability directly into law. For compliance leaders and policy officials, the message is clear: AML is no longer a siloed function; it is becoming a whole-of-system governance framework.

Key Highlights: Major Changes Introduced under South Africa’s AML/CFT Amendment Bill, 2025

- Lifestyle Audits Introduced: The Financial Intelligence Centre (FIC) gains authority to conduct lifestyle audits to assess whether an individual’s living standards align with legitimate income sources — signalling a shift toward proactive, intelligence-led AML supervision.

- Expanded FIC Information-Sharing Powers: Intelligence sharing now extends to authorities such as the Public Procurement Office and Border Management Authority, alongside broader access to public entity and municipal databases.

- Record Retention Extended: Accountable institutions must retain AML records for seven years, strengthening investigative timelines and regulatory scrutiny.

- Enhanced Sanctions and Terrorist Financing Controls: Institutions must report not only sanctioned property but also attempted transactions linked to designated persons or entities.

- Technology Risk Governance Embedded in Law: Institutions are required to assess ML/TF risks linked to new products, delivery mechanisms, and emerging technologies before market launch.

- Stronger Beneficial Ownership Enforcement: Companies risk deregistration and significant administrative fines for failing to maintain securities or beneficial interest registers, reinforcing corporate transparency obligations.

- Expanded Regulatory Powers under Financial Sector Regulation: Supervisors can license new financial services regardless of technology used, request information from beneficial owners, and initiate investigations proactively.

- Enhanced Oversight of Nonprofit Organisations: Directors can impose administrative sanctions, monitoring powers are expanded, and penalties for noncompliance are significantly strengthened.

- Broader Legal Protections for Reporting Entities: Institutions and individuals sharing AML intelligence in good faith receive expanded legal protection, encouraging collaboration across the compliance ecosystem.

- Integrated AML Governance Model: The amendments connect financial intelligence, procurement oversight, border controls, and corporate regulation into a unified supervisory framework focused on effectiveness rather than procedural compliance.

From Greylist Remediation to Effectiveness-Driven Regulation

The Memorandum on Objects explicitly states that the Bill is designed to address remaining FATF deficiencies and strengthen the AML/CFT system ahead of the next mutual evaluation cycle. But what distinguishes this reform is its emphasis on enforcement capability rather than procedural compliance.

Regulators are no longer asking whether institutions have policies — they are building mechanisms that allow authorities to actively interrogate wealth patterns, corporate structures, and technological risks. This transition signals a broader global shift: compliance is moving from “box-ticking” to intelligence-driven supervision.

The Rise of Intelligence-Led AML: Lifestyle Audits and Expanded FIC Powers

One of the most transformative aspects of the Bill is the introduction of lifestyle audits, enabling the Financial Intelligence Centre (FIC) to assess whether an individual’s lifestyle aligns with legitimate income sources.

This change fundamentally alters the compliance landscape. Instead of relying solely on suspicious transaction reports, regulators can now proactively analyse financial behaviour. Combined with expanded powers to access databases from public entities and municipalities, the FIC becomes a far more investigative body than a traditional financial intelligence unit.

For compliance executives, this signals the emergence of a regulatory model where financial intelligence, procurement oversight, and cross-border controls converge. Institutions must prepare for more intrusive information requests and deeper investigative collaboration between agencies.

Beneficial Ownership Enforcement Moves from Disclosure to Consequence

Corporate transparency has long been a cornerstone of AML reforms, but enforcement often lagged behind legislative intent. The amendment changes this dynamic significantly.

Companies that fail to submit securities or beneficial ownership registers for extended periods can now face deregistration, while administrative fines may reach substantial thresholds, including a percentage of turnover. This represents a decisive policy shift — beneficial ownership compliance is no longer an administrative obligation but a critical governance requirement.

For compliance leaders, this means beneficial ownership data must evolve from static registry filings into continuously monitored risk indicators integrated within onboarding, screening, and adverse media monitoring frameworks.

Technology Risk Governance Becomes a Legal Obligation

Perhaps the most forward-looking aspect of the amendment is its treatment of innovation risk. Accountable institutions are now explicitly required to identify and assess money laundering risks associated with new delivery mechanisms and emerging technologies before launching products or services.

This aligns South Africa with global AML trends that recognise digital onboarding, fintech ecosystems, and evolving payment models as significant risk vectors. Importantly, the Bill adopts a technology-neutral regulatory approach, ensuring that financial products cannot evade supervision simply because they operate on new technological frameworks.

For policy officials, this reflects a shift toward future-proof regulation. For compliance teams, it means embedding AML risk assessments directly into product development lifecycles — an area where RegTech solutions are increasingly essential.

Nonprofit Sector Oversight: Balancing Risk and Governance

The amendment also strengthens monitoring and enforcement powers over nonprofit organisations. Directors gain authority to impose administrative sanctions, and penalties for noncompliance are significantly enhanced.

While FATF has long highlighted vulnerabilities in the nonprofit sector, the challenge for policymakers lies in balancing oversight with operational independence. The Bill attempts to address this by introducing appeal mechanisms while simultaneously expanding supervisory authority.

Compliance leaders operating in philanthropic finance or NGO partnerships must reassess risk models, particularly around cross-border funding flows and governance transparency.

A More Assertive Supervisory Model under Financial Sector Regulation

Changes to the Financial Sector Regulation Act expand regulators’ ability to license institutions, request information from significant or beneficial owners, and initiate investigations where contraventions are suspected.

Perhaps most importantly, the amendment broadens the definition of financial products to include arrangements with similar outcomes, regardless of technology used. This closes regulatory gaps that previously allowed innovative structures to fall outside traditional oversight.

For policymakers, this is a clear signal that AML supervision is moving toward functional regulation — where outcomes matter more than legal form.

What This Means for Compliance Strategy

Taken together, the amendments reveal a consistent theme: regulators are building a more integrated and proactive AML ecosystem. Compliance leaders should anticipate several structural shifts:

- Increased regulatory access to institutional data and intelligence.

- Greater scrutiny of beneficial ownership and governance practices.

- Mandatory technology risk assessments embedded into innovation strategies.

- Stronger enforcement mechanisms across nonprofit and corporate sectors.

In practical terms, traditional compliance frameworks that rely on periodic checks and reactive reporting may no longer be sufficient. Institutions will need continuous monitoring capabilities, advanced analytics, and scalable risk intelligence platforms to meet evolving expectations.

The Bigger Picture: A Blueprint for the Next Generation of AML Supervision

South Africa’s AML/CFT Amendment Bill illustrates how jurisdictions are redefining financial crime governance. Rather than introducing isolated legislative fixes, policymakers are creating interconnected regulatory ecosystems that link financial intelligence, corporate oversight, and technological risk management.

For compliance leaders and regulators globally, the Bill offers a glimpse into the future of AML: a system where intelligence, enforcement, and innovation governance operate as a unified framework.

As jurisdictions worldwide move toward effectiveness-based FATF evaluations, the real question is no longer whether organisations comply with AML rules — but whether their systems generate actionable intelligence capable of preventing financial crime before it occurs.

Read about the amendment here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #SouthAfricaAML

- #AMLAmendment

- #FICAct

- #FinancialCrimeCompliance

- #AMLRegulation

- #BeneficialOwnership

- #FATF

- #RiskAndCompliance

- #RegTech

- #FinancialRegulation

- #PolicyAndCompliance

- #AntiMoneyLaundering