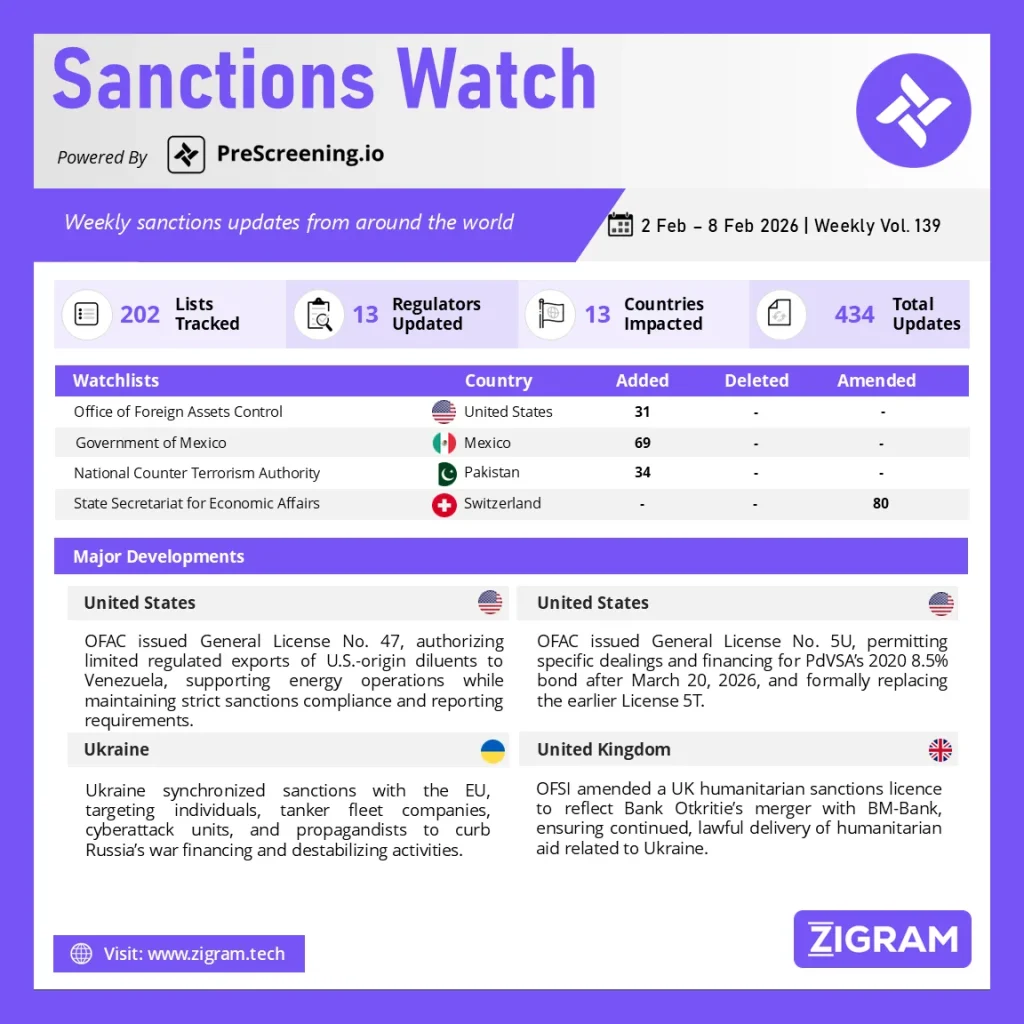

Sanctions Watch Vol 139

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

OFAC Issues General License No. 47, Enabling Lawful U.S. Diluents Trade with Venezuela

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has issued General License No. 47, providing targeted authorization for the sale and export of U.S.-origin diluents to Venezuela. The license allows transactions that are ordinarily incident and necessary for supplying diluents to Venezuela, including dealings with Petróleos de Venezuela, S.A. (PdVSA) and its majority-owned entities, under clearly defined legal and compliance conditions.

General License No. 47 reflects a balanced approach by enabling limited commercial activity while maintaining the broader framework of U.S. sanctions. The authorization supports energy infrastructure operations by allowing commercially reasonable transactions such as shipping, logistics, insurance, and port services, provided contracts are governed by U.S. law and disputes are resolved within the United States. Importantly, the license excludes high-risk activities, including transactions involving blocked vessels, digital currencies issued by the Venezuelan government, or parties linked to Iran, North Korea, or Cuba.

The license also introduces strong transparency measures, requiring detailed reporting of parties, quantities, values, and transaction dates. Overall, General License No. 47 offers regulatory clarity, supports lawful trade, and demonstrates OFAC’s willingness to use targeted licensing to advance economic stability while safeguarding sanctions compliance and national security objectives.

OFAC Issues General License No. 5U, Providing Regulatory Clarity for PdVSA 2020 Bond Transactions

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has issued General License No. 5U, authorizing certain transactions related to the Petróleos de Venezuela, S.A. (PdVSA) 2020 8.5 Percent Bond on or after March 20, 2026. The license permits transactions, financing, and other dealings that would otherwise be restricted under Executive Order 13835, as incorporated into the Venezuela Sanctions Regulations.

General License No. 5U replaces and supersedes the earlier General License No. 5T, offering updated guidance and continuity for market participants engaging with this specific bond instrument. By clearly defining what activities are authorized, OFAC reduces legal ambiguity for investors, financial institutions, and compliance teams navigating complex sanctions requirements. Importantly, the license maintains safeguards by clarifying that it does not authorize transactions otherwise prohibited under the broader Venezuela Sanctions Regulations or other parts of U.S. sanctions law.

This targeted authorization reflects OFAC’s measured approach to sanctions implementation—allowing narrowly defined financial activity while preserving the overall integrity of the sanctions framework. The issuance of General License No. 5U is expected to support orderly financial processes, improve compliance transparency, and provide much-needed predictability for stakeholders dealing with legacy Venezuelan debt instruments, all while aligning with U.S. foreign policy and national security objectives.

Ukraine Expands Sanctions in Lockstep with EU, Targeting Russian Tanker Fleet, Cyber Units, and Propaganda Networks

Ukraine has taken another decisive step to counter Russian aggression by expanding its sanctions regime in full synchronization with the European Union. On 2 February 2026, President Volodymyr Zelenskyy signed a decree enforcing a decision of the National Security and Defense Council to impose restrictions on 10 individuals and six legal entities linked to Russia’s shadow tanker fleet, cyberattacks, sanctions evasion, and pro-Kremlin propaganda.

The new sanctions target foreign nationals and Russian citizens involved in exporting Russian oil through covert tanker operations, as well as Kremlin-aligned propagandists and members of Russia’s GRU-linked cyber units. Notably, individuals responsible for cyberattacks against Ukrainian state institutions and EU and NATO countries—aimed at stealing sensitive information and destabilizing political systems—are included.

Companies based in Russia, the United Arab Emirates, and Vietnam that own or operate tankers transporting Russian oil have also been sanctioned, further tightening pressure on Moscow’s energy revenue streams. In addition, Ukraine has sanctioned Russia’s 142nd Separate Electronic Warfare Battalion, which has been implicated in GPS interference across the Baltic region, disrupting civilian aviation.

In total, Ukraine has now synchronized 15 international sanctions packages introduced by its partners over the past year. This move underscores Kyiv’s commitment to strengthening coordinated global pressure on Russia, cutting off war financing, and countering destabilizing actions against Ukraine, the EU, and NATO allies.

UK Updates Humanitarian Sanctions Licence to Safeguard Aid Flows to Ukraine

The UK’s Office of Financial Sanctions Implementation (OFSI) has issued a positive and clarifying amendment to General Licence INT/2022/1947936, reinforcing the continuity of humanitarian assistance linked to the Ukraine conflict. On 5 February 2026, OFSI updated the licence to reflect the corporate merger of Bank Otkritie with BM-Bank, ensuring that technical changes in the banking sector do not disrupt the lawful delivery of aid.

Originally effective from 7 July 2022, the General Licence authorises a wide range of humanitarian actors—including UN agencies, the Red Cross movement, international NGOs, and UK-funded organisations—to carry out activities necessary for the timely delivery of humanitarian assistance and support for basic human needs in Ukraine and non-government controlled Ukrainian territories. It also permits relevant financial institutions to process payments required to support these activities, subject to strict safeguards.

The February 2026 amendment does not change the scope or intent of the licence; rather, it provides regulatory clarity by updating the list of designated financial institutions to reflect current corporate realities. This ensures legal certainty for banks and humanitarian organisations alike, reduces compliance ambiguity, and helps maintain uninterrupted humanitarian operations. Overall, the amendment underlines the UK’s continued commitment to enabling life-saving humanitarian assistance while maintaining the integrity of its Russia sanctions framework.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #OFAC

- #GeneralLicense47

- #GeneralLicense5U

- #VenezuelaSanctions

- #PdVSA

- #UkraineSanctions

- #EUSanctions

- #RussianOil

- #HumanitarianAid

- #OFSI