Regulation Name: Finance Bill 2026

Date Of Issue: 01 Feb 2026

Region: India

Agency: Lok Sabha (India Parliament Lower House)

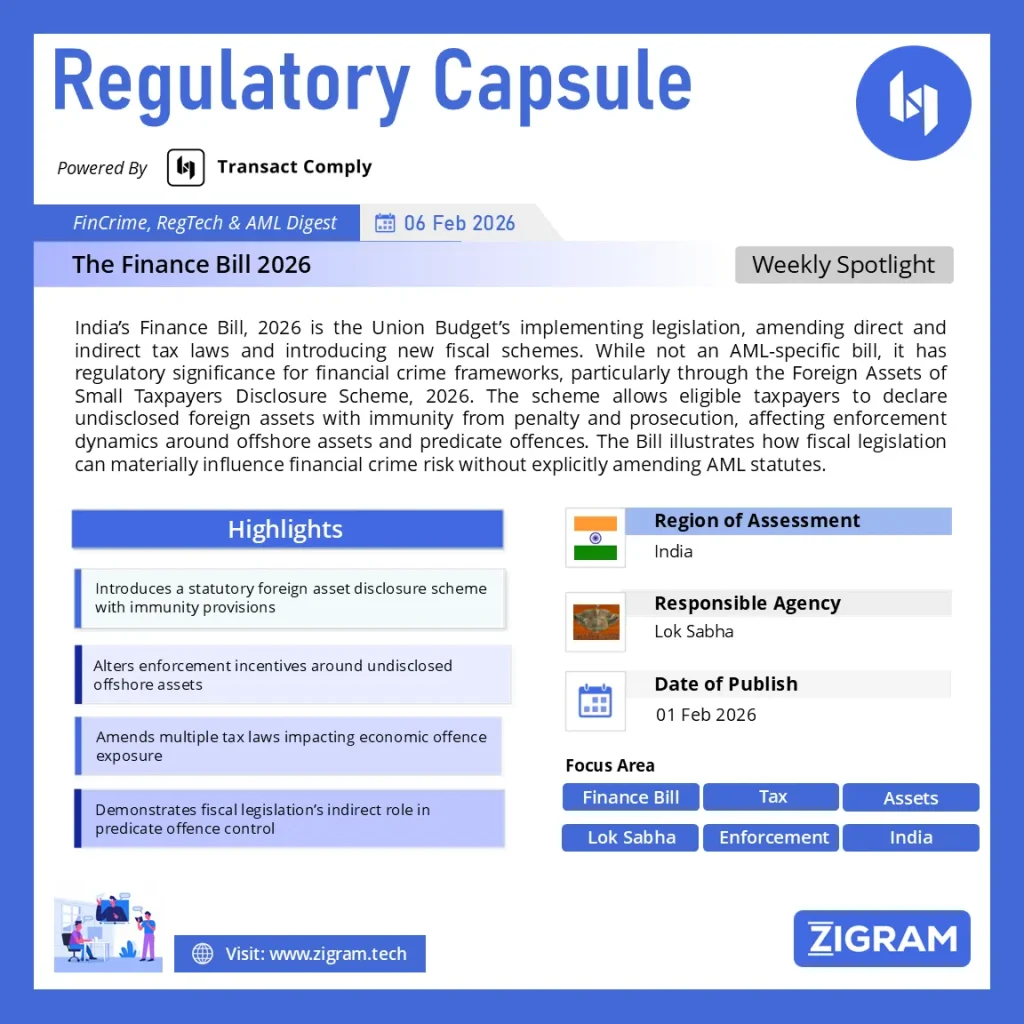

India’s Finance Bill, 2026: What the Budget Law Means for Compliance, Enforcement, and Financial Crime Risk

India’s Finance Bill, 2026, introduced as part of the Union Budget 2026–27, is the government’s primary legislative instrument for implementing fiscal policy. While traditionally viewed as a tax and revenue law, India’s Finance Bills have a broader regulatory footprint, often influencing economic offence enforcement, disclosure regimes, and compliance risk.

For compliance leaders and policymakers, the Finance Bill, 2026 is significant not because it amends anti-money laundering laws directly, but because it reshapes how financial misconduct—especially involving foreign assets—is detected, disclosed, and resolved.

Executive Summary — Finance Bill, 2026 (India)

What it is

- Annual omnibus fiscal legislation implementing the Union Budget 2026–27

- Amends multiple direct and indirect tax statutes through a single bill

Regulatory signal

- Fiscal reform with enforcement and compliance implications, not an AML statute

- Influences the economic offence and disclosure landscape relevant to financial crime risk

Key provisions

- Revises income tax rates, procedures, penalties, and assessment powers

- Introduces the Foreign Assets of Small Taxpayers Disclosure Scheme, 2026

- Provides conditional immunity from penalty and prosecution for eligible foreign asset disclosures

Why business leaders should care

- Offshore assets remain a core financial crime risk vector

- Disclosure schemes affect predicate offence exposure and enforcement incentives

- Signals government intent to prioritise fiscal transparency over retroactive enforcement

Action points

- Assess exposure to foreign asset disclosures across clients and entities

- Update country risk and enforcement narratives for India

- Monitor Parliamentary changes before final enactment

What Is the Finance Bill, 2026?

The Finance Bill, 2026 is an omnibus legislative proposal introduced by the Government of India through the Ministry of Finance. It gives statutory effect to the Union Budget by amending multiple laws governing:

- Direct taxation

- Indirect taxation

- Enforcement procedures

- Disclosure and compliance schemes

Once enacted, it becomes the Finance Act, 2026.

Structure of the Finance Bill, 2026

The Bill is organised into multiple chapters, each serving a distinct policy purpose:

- Preliminary Provisions

This section establishes the short title, commencement, and applicability of the law. It confirms that the amendments apply from the assessment year 2026–27 onward unless otherwise specified.

- Income Tax Rates and Fiscal Measures

The Bill implements proposed tax rates, surcharges, and cess adjustments. These provisions focus on revenue mobilisation and taxpayer relief and do not directly affect financial crime enforcement.

- Amendments to the Income-tax Act

A substantial portion of the Bill amends the Income-tax Act to refine:

- Assessment and reassessment procedures

- Reporting and compliance timelines

- Penalty structures

- Administrative powers of tax authorities

While largely procedural, these amendments enhance information gathering and enforcement efficiency, which indirectly supports economic offence detection.

The Key Regulatory Signal: Foreign Assets of Small Taxpayers Disclosure Scheme, 2026

The most compliance-relevant element of the Finance Bill, 2026 is the introduction of the Foreign Assets of Small Taxpayers Disclosure Scheme, 2026.

What the Scheme Does

The scheme allows eligible persons to:

- Declare previously undisclosed foreign assets or overseas income

- Pay a prescribed tax

- Receive immunity from penalty and prosecution under specified laws, subject to conditions

Why This Matters for Financial Crime and Compliance

Foreign assets are a high-risk vector for:

- Tax evasion

- Illicit financial flows

- Proceeds of crime concealment

By creating a statutory disclosure window, the Bill:

- Temporarily alters enforcement dynamics

- Encourages voluntary compliance

- Improves visibility into offshore asset holdings

While the scheme does not amend the Prevention of Money Laundering Act, it affects the predicate offence landscape, particularly where tax offences intersect with broader financial crime risks.

Indirect Tax and Customs Amendments

The Finance Bill, 2026 also amends customs duties and GST-related provisions. These changes impact trade and supply chains but remain primarily fiscal in nature, with limited direct relevance to AML or predicate offence frameworks.

What the Finance Bill, 2026 Does Not Do

For clarity, the Bill:

- Does not amend the Prevention of Money Laundering Act

- Does not expand AML reporting entity definitions

- Does not modify FIU-IND powers

- Does not change beneficial ownership reporting rules

Its relevance lies in economic enforcement and disclosure, not AML rulemaking.

Who Should Pay Attention

- Compliance officers managing cross-border risk

- Banks and financial institutions monitoring tax-linked financial crime exposure

- Policy teams tracking enforcement incentives

- Advisors and auditors dealing with foreign asset disclosures

Why the Finance Bill, 2026 Matters Strategically

India’s Finance Bills routinely influence financial crime risk without using AML terminology. The 2026 Bill continues this pattern by:

- Introducing a controlled disclosure mechanism for offshore assets

- Adjusting enforcement incentives for economic offences

- Reinforcing fiscal transparency through legislative means

For compliance leaders, the Bill signals policy intent rather than regulatory relaxation.

What Compliance Teams Should Do Next

- Review eligibility and scope of the foreign asset disclosure scheme

- Assess implications for client risk profiling and disclosures

- Monitor Parliamentary amendments before enactment

- Align internal narratives on India’s evolving enforcement posture

Conclusion

The Finance Bill, 2026 is more than a budget law. While firmly fiscal in character, it carries meaningful implications for economic offence enforcement, offshore asset transparency, and compliance risk management. Its foreign asset disclosure scheme, in particular, underscores how fiscal legislation can shape financial crime outcomes without explicitly amending AML statutes.

Frequently Asked Questions (AEO Optimised)

Is the Finance Bill, 2026 an AML law?

No. It is a fiscal law, but it has indirect implications for financial crime enforcement.

Does it affect foreign assets?

Yes. It introduces a disclosure scheme for undisclosed foreign assets.

Why should compliance teams care?

Because it alters enforcement incentives and improves visibility into offshore asset holdings.

Read about the guidance here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #AML

- #CFT

- #PredicateOffences

- #FinancialCrime

- #OrganizedCrime

- #Türkiye

- #JudicialReform

- #Compliance

- #RiskManagement

- #RiskBasedApproach

- #FATF

- #RegulatoryUpdate