Table of Contents

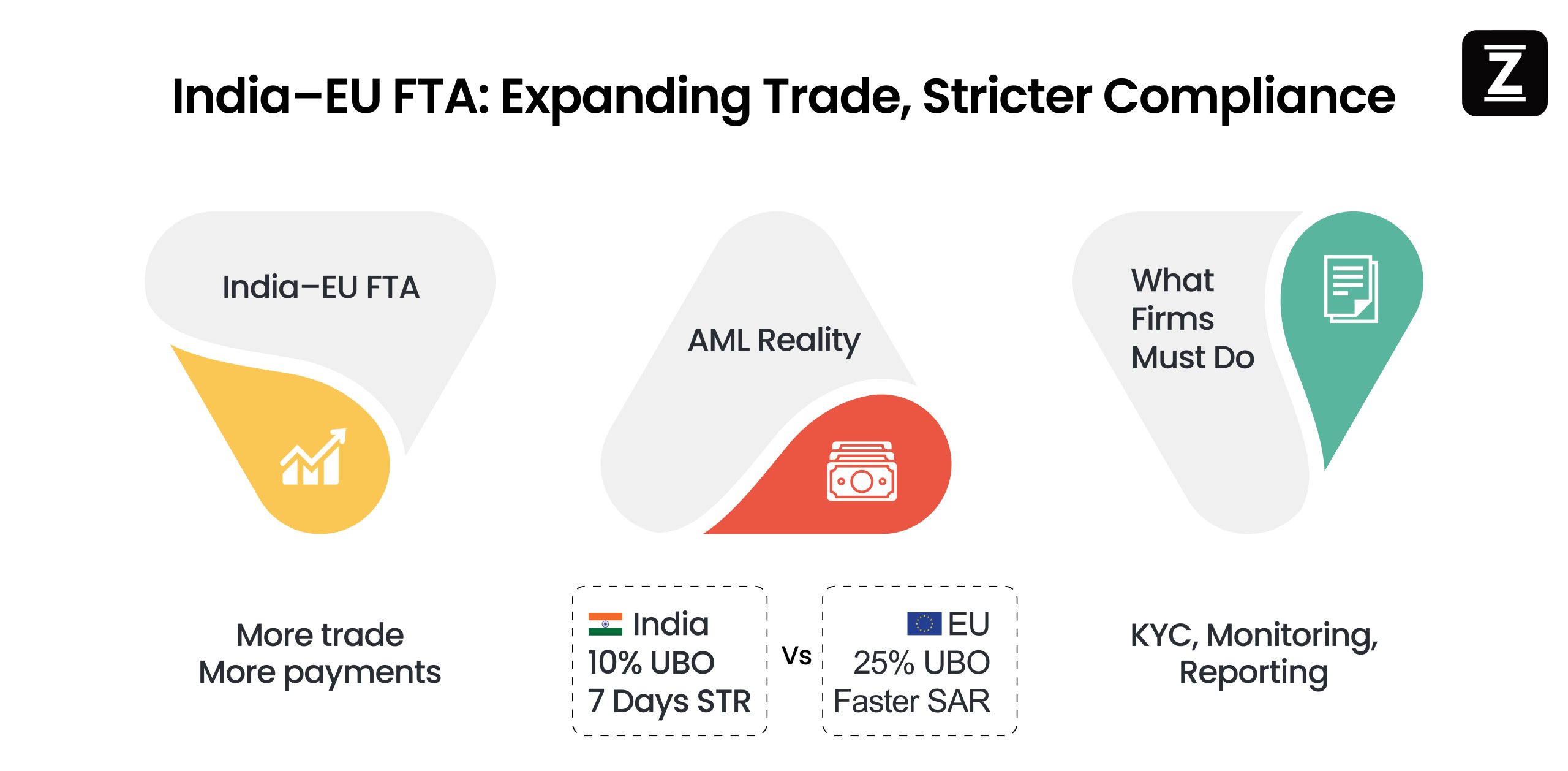

India-EU FTA AML compliance is becoming a key priority as the Free Trade Agreement (FTA), billed as the “mother of all deals”, will greatly expand trade and investment between the EU and India.

This landmark pact (announced Jan 2026) goes far beyond tariffs: it covers services (notably financial services), digital trade, mobility, and supply-chain security. In Indian Prime Minister Narendra Modi’s words, “This is not just a trade agreement. This is a new blueprint for shared prosperity”.

Crucially, the FTA mandates tighter cooperation on regulatory issues, including financial controls and security. For financial institutions, fintechs and regulators, this means aligning two very different AML regimes (India’s PMLA-based rules and the EU’s AML directives/regulations) under one roof. The stakes are high as a flurry of cross-border transactions will expose gaps in anti-money-laundering (AML) compliance if the firms are unprepared.

This article explains the FTA’s context and details how AML requirements differ in India and the EU, what changes are coming, and how banks and fintechs on both sides must act now to avoid compliance pitfalls. We also highlight how advanced AML solutions (such as ZIGRAM’s Entity Hero, Transact Comply, PreScreening.io) can help bridge the gap and keep you ahead of regulators.

Key Takeaways:

- The India–EU FTA will significantly increase cross-border payments, investments, and trade finance activity.

- AML laws in India (PMLA) and the EU (AMLR) differ on beneficial ownership thresholds, PEP definitions, sanctions screening, and reporting timelines.

- Banks, fintechs, crypto firms, and regulated entities must comply with both regimes simultaneously.

- Applying the stricter standard (e.g. 10% UBO threshold) across operations is the safest approach.

- RegTech platforms like ZIGRAM help automate dual-jurisdiction AML compliance and reduce regulatory risk.

India–EU Free Trade Agreement (FTA): Scope and Compliance Impact

India and the EU finalized FTA negotiations in January 2026, calling it “the largest FTA India has ever signed”. It will cover:

- Over 90% of tariffs on goods will eventually be cut, and EU exporters are set to double shipments to India. Critically for compliance, the deal includes chapters on services and digital trade, plus a mobility agreement for skilled workers.

That means financial services, tech firms and cross-border professionals will face new opportunities and new AML obligations. For example, the EU won “privileged access” in Indian finance and maritime services.

But conversely, Indian companies will tap EU markets under EU rules. In short, every cross-border payment, investor or joint venture will need to meet both Indian AML rules and EU AML standards simultaneously. - The FTA also aims to “simplify customs procedures” and “strengthen risk management and controls at the EU border”, which implies tighter screening of goods and cash flows entering the EU. We should note the FTA is a “living agreement” with ongoing reviews, so AML requirements could tighten further.

Before businesses rush into new trade corridors, they must understand how and why AML rules differ between the two jurisdictions and what the FTA changes.

EU AML Framework Explained: AMLR, AMLA and Key Compliance Changes

European AML rules have historically been built on a series of Anti-Money Laundering Directives (AMLD) implemented by each member state (4th, 5th, and 6th AMLDs in 2015–2020). These directives require banks, payment providers and a growing list of “obliged entities” to do risk-based KYC, monitor transactions, and report Suspicious Activity Reports (SARs) to national Financial Intelligence Units (FIUs). The EU regime emphasizes customer due diligence, beneficial ownership transparency and cross-border FIU cooperation.

In 2024–25, the EU dramatically upgraded its AML rules. A new EU-wide AML Regulation (AMLR) and a European AML Authority (AMLA) were adopted to replace the old fragmented directives.

These reforms enter into force in steps: the regulations took effect on 9 July 2024, and most provisions apply by mid-2027. Under this package, one uniform “single rulebook” will govern AML in all EU states. AMLA (headquartered in Frankfurt) is now operational and will directly supervise the 40 largest cross-border banks (Jan 2028 onward). It also issues guidance to national supervisors and FIUs, greatly increasing harmonization.

Key changes under the new EU AML regime include:

Stricter Customer Due Diligence

Firms must precisely identify and continuously monitor beneficial owners (BO) of accounts and entities. They must submit Suspicious Transaction Reports (STRs) promptly (the EU sets a five-working-day max for FIU queries). Enhanced due diligence extends expressly to crypto-asset service providers under the AMLR.

Cash Payment Cap

EU-wide maximum cash transaction of €10,000 for businesses, with mandatory ID for cash payments above €3,000. The aim is to curb large anonymous cash flows. (Member states can set lower limits)

Expanded Scope of Obliged Entities

Many new sectors are pulled in. Under the AML Regulation, besides banks and insurers, crypto exchanges, crowdfunding platforms, football clubs/agents, art galleries, crowdfunding intermediaries, and dealers in high-value goods (gems, precious metals, luxury vehicles, etc.) must comply. (Previously only some of these fell under EU AMLD rules.) EU member states may exempt very low-risk actors, but overall the net is much wider.

Beneficial Ownership Threshold

The EU has standardized BO thresholds at 25% ownership/control. (In high-risk sectors this can go down to 15%.) Crucially, EU law now requires transparent Ultimate Beneficial Owner (UBO) registers for companies, and credit intermediaries must verify identities.

In summary, the EU is moving toward a far more rigorous, unified AML regime. By 2027, EU regulations will override national rules: risk assessments, KYC, monitoring and reporting must meet these common EU standards. For any firm selling into Europe, that means no “country-by-country” shortcut: you must comply with the EU’s cross-border rules (and data privacy laws like GDPR) even while also observing Indian law.

India AML Framework Explained: PMLA, FIU-IND and Recent Updates

India’s AML framework rests on the Prevention of Money Laundering Act, 2002 (PMLA), with rules and notifications under it. The Act defines “reporting entities” and mandates Customer Due Diligence (CDD), record-keeping and reporting of specified transactions. Enforcement is carried out by the Enforcement Directorate (ED) (for investigations and prosecutions) and the Financial Intelligence Unit – India (FIU-IND) (for receiving/analyzing reports). FIU-IND sits under the Finance Ministry and maintains databases of Cash Transaction Reports (CTRs) and Suspicious Transaction Reports (STRs) filed by all reporting entities.

Who Must Comply (Reporting Entities)

The PMLA broadly covers banks and financial institutions, including cooperative banks, NBFCs, insurers, money changers and credit card companies. It also includes SEBI-registered intermediaries: stock brokers, mutual funds, depositories, forex dealers, portfolio managers, etc.. Designated non-financial businesses and professions (DNFBPs) in India include casinos, real estate brokers, jewelers, and registered money changers, all above certain thresholds.

In practice, any firm handling cash or finance in India (banks, fintech payment companies, remittance services, etc.) must register with FIU-IND and appoint a Principal Officer/Designated Director for AML compliance.

Core Obligations

Reporting entities must perform KYC/CDD at account opening and ongoing, identify beneficial owners and maintain detailed customer records. They must log specified transactions, including: any cash deposit over Rs.10 lakh (~€11k) or series over Rs.10 lakh in a month; non-profit receipts over Rs.10 lakh; cash transactions involving forged currency; any suspicious transaction (STR); cross-border wire transfers over Rs.5 lakh (~€5.5k); and high-value real estate dealings (≥Rs.50 lakh). Records of these are kept for 5 years.

Critically, STRs must be reported to FIU-IND within 7 working days of identifying a suspicious transaction. Other reports (CTRs, etc.) are filed monthly.

Beneficial Ownership

India requires companies to collect and file Ultimate Beneficial Owner (UBO) data. Under the Companies Act 2013 and Significant Beneficial Ownership (SBO) Rules (2018), any person with ≥10% beneficial interest must be disclosed to the ROC and RBI. Meanwhile, PMLA (2005 Rules) defines a Ultimate Beneficial Owner (UBO) as someone with ≥10% stake (15% for partnerships).

Thus an Indian bank or broker must identify natural persons behind accounts. Recently SEBI tightened this: large foreign portfolio investors (FPIs) must now “trace ownership to the natural person level” if aggregated stakes exceed thresholds. In short, India’s BO rules are strict (10% threshold) but filings are not fully public (SBO records with ROC and FIU).

PEPs and Sanctions

India’s AML law, Prevention of Money-Laundering (Maintenance of Records) Rules, 2005 (as amended in 2023), now defines Politically Exposed Persons (PEPs) as foreign public officials only. Though in practice, domestic PEPs (Indian politicians, civil servants) are also treated as high-risk entities and subject to KYC/CDD/EDD. This is a notable divergence: EU and FATF include domestic PEPs as high-risk. India does maintain extensive KYC lists for sanctions (UN, financial crime).

Recent Developments

India has been actively updating its AML rules, especially around fintech/crypto. In January 2026, FIU-IND released new AML/CFT guidelines for Virtual Digital Asset Service Providers (VDASPs). These require mandatory FIU registration, robust cyber-security, and very tight KYC – including capturing a live selfie with geo-tag at onboarding. Crypto entities must conduct “travel rule” checks and report STRs on crypto transfers.

Meanwhile, RBI and SEBI have been streamlining KYC: RBI’s master directions (2016, updated) govern banks’ AML programs, and in 2023 SEBI introduced stricter Ultimate Beneficial Owner (UBO) disclosure rules for FPIs. All this points to one thing: India is strengthening AML oversight, especially in cross-border and digital channels.

India vs EU AML Compliance: Key Regulatory Differences Compared

| Aspect | India AML Framework (PMLA + Regulators) | EU AML Framework (AMLR / 6AMLD / AMLA) |

|---|---|---|

| Primary Legislation | Prevention of Money Laundering Act (PMLA), 2002 – national statute governing AML obligations for reporting entities; enforced through FIU-IND and sector regulators (RBI, SEBI). | EU AML Regulation + AML Directives (AMLDs including 6AMLD) – harmonised across Member States; AMLR applies uniformly in all EU member states. |

| Regulatory Authorities | FIU-IND (central AML intelligence unit under Ministry of Finance) receives reports and shares info with ED for investigation. | European AML Authority (AMLA) – central EU-wide supervisor coordinating national FIUs and enforcing regulations. |

| Legal Structure | Fragmented: national law interpreted through multiple regulators (RBI, SEBI, IRDAI). | Unified rulebook: single AMLR + directives across Member States. |

| Scope of Regulated Entities | Banks, NBFCs, fintechs, insurers, brokers, real estate brokers, casinos, jewelers. | Banks, fintechs, VASPs, crypto exchanges, real estate professionals, luxury goods dealers. |

| Beneficial Ownership Threshold | ~10% beneficial ownership threshold. | Generally 25%; lower for high-risk sectors. |

| PEP Definition | Historically foreign PEP focused; expanding scope. | Domestic and foreign PEPs under FATF standards. |

| Transaction Monitoring & Reporting | STRs, CTRs, and wire transfer reports to FIU-IND. | Standardised SARs and travel-rule compliance. |

| Sanctions Screening | UN sanctions lists. | EU, UN, and national sanctions lists. |

| Crypto Regulation Alignment | Crypto VASPs under PMLA. | AMLR + MiCA compliance. |

| Cash Limits & Controls | CTRs above INR 10 lakhs. | Cash payment caps (~€10,000). |

| Enforcement & Penalties | FIU-IND and ED enforcement. | High administrative fines and AMLA supervision. |

| Supervision Style | Sector-specific national supervision. | Centralised AMLA-led supervision. |

| Regulatory Harmonisation | Lower harmonisation. | Single EU AML rulebook. |

| Beneficial Ownership Transparency | UBO registers not public. | Accessible EU-wide UBO registers. |

In summary, the AML frameworks diverge on scope, thresholds, authorities and execution. Firms must basically “double-team” compliance: meet India’s PMLA/RBI standards and EU’s AMLR/Member-State standards. Falling between the cracks could trigger penalties on either side – or both.

Preparing for India–EU FTA: AML Compliance Checklist for Banks and Fintechs

The FTA itself does not rewrite AML laws, but by accelerating trade and mobility it raises the stakes for compliance. Here’s what to expect and prepare for:

Surge in Cross-Border Transactions

Tariff cuts and service liberalization will boost remittances, cross-border loans, trade finance and payments. This ups the risk of trade-based money laundering (over-/under-invoicing, fictitious trades). Institutions must beef up transaction monitoring: automated systems should flag suspicious patterns, such as unusual payment routing or mismatches between declared value and volume of goods.

Enhanced KYC/Due Diligence Requirements

With more foreign counterparts, every bank and fintech must ID unfamiliar customers and their Ultimate Beneficial Owner (UBO)s. Expect regulators to demand proof that you’ve screened every new entity in both jurisdictions sanctioned and PEP lists.

For example, if an EU investor enters India, use our platforms to fetch their corporate hierarchy and Ultimate Beneficial Owner (UBO) for your FIU-IND KYC file, and to generate an EU-style Customer Due Diligence report for EU compliance. Simultaneously, validate EU AML requirements (e.g. verify if any EU-type PEP, per EU list) using the same data. In short, build one joint KYC process that satisfies both sides’ laws.

Tools like ZIGRAM’s Entity Hero (for risk management) can automate this.

Unified Beneficial Ownership Checks

A big headache is reconciling India’s 10% BO threshold with the EU’s 25%. Best practice: apply the stricter 10% rule globally. Keep detailed BO records for any Indian or EU counterparty. With the FTA encouraging joint ventures, due diligence on any target company’s ownership chain will be critical.

ZIGRAM’s Due Diliger, (which aggregates corporate data, due diligence, and ownership info) can maintain and update a multi-jurisdictional BO register so you never miss an indirect 10% holder in India or identify the key 25% owner in an EU firm.

Real-Time Sanctions Screening

The EU and India may have different sanction lists (EU’s autonomous sanctions vs India’s mandatory UN sanctions). Any cross-border payment needs to be checked against all relevant lists. The FTA means many more international payees to check – automation is essential to avoid human error or delays. For instance, any EU company paying an Indian supplier should be screened not only against EU/UN lists but also check Indian RBI/UN mandates, and vice versa.

PreScreening.io can screen payments and customer lists against EU, UN, OFAC and Indian (UN-based) sanction lists and real-time adverse media screening.

Adhering to Cash/Threshold Rules

EU entities must implement the new €10,000 cash cap by late 2025. Indian entities already hit the ~€11,000 mark and report all above that. Merchants and service providers in Europe should prepare for lower cash usage or end-of-day reporting mechanisms. In India, accountants should remember that any rupee 10 lakh cash deal triggers a CTR. The FTA itself won’t change these domestic rules, but companies engaging in cross-border trade should adapt billing and payment practices so as not to inadvertently breach either regime. For example, a European exporter receiving a large cash advance (rare in EU now) must report or reject it according to EU limits, while an Indian exporter receiving rupee cash overseas must still file reports to FIU-IND.

ZIGRAM’s Transact Comply can help by applying both RBI/FIU and EU FATF travel-rule checks to each wire or crypto transfer and transaction monitoring rules for both regions.

Reporting and Audits

Companies should refresh AML policies to include dual reporting. In India, maintain your FINNet filings (STRs/CTRs) as usual. In the EU, prepare for stricter audits: member states are likely to institute mandatory AML/CTF internal audits or officer certifications (already common in the UK and Netherlands).

The new EU AML regulation will require firms to demonstrate full compliance documentation on request. Firms should proactively request joint compliance reviews covering both jurisdictions.

Employee Training and Governance

The FTA’s digital chapter suggests focus on “trusted digital ecosystems”. Compliance staff should be trained on both sets of rules: know both the EU’s 5-6 AMLD/AMLR requirements and India’s PMLA standards. Indian firms adding EU operations may need to appoint an EU compliance officer or work with AML specialists.

Fintechs should audit their technology for compliance gaps: are transaction monitoring rules parameterized to catch both EUR and INR ranges? Are KYC questionnaires updated for EU vs Indian PEP screening? Preparing now avoids rushed fixes once the deal lifts trade volumes.

Industry Impacts Across the Board

While financial institutions and fintechs are front-line in AML, the FTA’s ripple effects touch many sectors:

Exporters and Importers

Manufacturing and IT firms will see easier access to each other’s markets. In turn, trade finance banks will handle more LCs, cross-border collections and foreign investments. Each such flow must pass AML filters. Expect scrutiny on value discrepancies or “middleman” entities. Non-financial firms should coordinate with their bankers: ensure banks have the firm’s updated business profiles and source-of-funds descriptions.

ZIGRAM’s solutions can help by providing Entity Hero data on any trading partner (like an EU customer in India) in advance.

Fintech and Crypto

Fintech companies facilitating cross-border digital payments or crypto transfers must update AML workflows for both markets. India’s RBI-IFSC Sandbox rules and forthcoming payment interoperability frameworks will interact with EU PSD2 and crypto rules. With EU’s Travel Rule regulations and India’s VDASP guidelines (Jan 2026), fintechs must implement transaction traceability.

Automated monitoring (Transact Comply) with scenarios for cross-border crypto remittances, combined with on-the-fly sanctions and name screening (PreScreening.io), will become the norm.

Asset Managers & Investors

Fund managers expanding into the new markets must tighten Ultimate Beneficial Owner (UBO) due diligence. EU fund houses investing in India should KYC Indian portfolio firms down to 10% owners. Conversely, Indian asset managers raising EU capital must file stringent disclosures to SEBI and may soon face EU-style transparency rules if accessing EU investors.

Real Estate and Infrastructure

The FTA will spur infrastructure investment projects. Real estate developers from each region should note that both Indian and EU regulators will ask “Who is the ultimate owner?” on any cross-border deal.

Since EU agents are now obliged entities, European developers will themselves be covered by AML rules when buying property in India. Meanwhile, Indian real-estate firms should collect foreign buyer IDs as if the deal happened in a “non-financial” sector, because EU compliance extends to real estate professionals.

Luxury and High-Value Goods

EU is expanding AML oversight of art, jewelry, precious metals and luxury cars. Indian exporters of gems or textiles will increasingly find European buyers (or insurers) running compliance checks on their transactions. Indian compliance teams should likewise monitor their own customers in the luxury goods sector to prevent misuse of the new trade corridor.

Professional Services

Accountants, lawyers and company-service providers advising on cross-border transactions will face scrutiny from both sets of regulators. EU law already requires lawyers to perform AML in property/finance deals; in India, lawyers recently became reportable only if they “promote” or manage client funds. The FTA may encourage sharing best practices – firms should be ready to treat any “regulated professional” similarly in both markets.

A Year-Round Guide Sprint for Complete AML Compliance

This is the operational heart of how to be compliant in this new India-EU FTA deal: a short, no-nonsense playbook with measurable deliverables. Integrate these into your 90/180/365 day sprints.

Sprint 0-90 days: Triage & Governance

- Board memo & corridor declaration: designate “India-EU corridor” as a top 3 enterprise risk.

- Quick hit: Counterparty heat map-top 100 counterparties, exposure limits, product lines.

- Assign dual-jurisdiction compliance leads and legal counsel escalation path.

Sprint 30-180 days: Detection & Data

- Correlate customs → payments: link invoice/shipping manifests to payments for invoice-matching and unit-price checks (TBML detection).

- Ultimate Beneficial Owner (UBO) automation: deploy automated Ultimate Beneficial Owner (UBO) resolution that pulls EU registries, Indian SBO filings, adverse media, sanctions and PEP lists. Entity Hero is built for this exact task-automated entity trees, source-of-truth consolidation, and Ultimate Beneficial Owner (UBO) heuristics reduce manual chase time by orders of magnitude.

- Trade-finance typologies: implement targeted rules (circular trade, improbable unit prices, repeated advance payments). Integrate these into monitoring-Transact Comply can encode these typologies and output audit-grade alerts tied to trade docs.

Sprint 90-365 days: Controls & Resilience

- Dual-rule engine: map AMLR/AMLA EDD triggers and PMLA triggers into one decision engine with jurisdictional provenance (so you can show regulators which rule fired and why). PreScreening.io can generate compliance-grade evidence packets for any KYC/EDD decision.

- Correspondent re-engineering: re-score nested banks and tighten onboarding thresholds; demand transaction-level visibility for nested flows.

- Fintech & VASP hardening: require source-of-fund proofs, chain analytics, and enhanced CDD for cross-border rails.

Ongoing Audit & Regulatory Readiness

- Audit trails per jurisdiction: store the provenance of checks (which registry, timestamp, rule version) for at least the longest of EU/India retention rules.

- Run scenario stress-tests: TBML surge, simultaneous STR requests from FIU-IND and an EU national FIU, and nested bank failure.

Conclusion: Act Now for Seamless Compliance

The India-EU FTA opens vast new markets, but it also raises the bar for AML compliance. Firms cannot afford to apply a “one-size-fits-none” approach. Preparation is urgent: as trade ramps up, both regulators will expect ironclad controls. Financial institutions and fintechs should immediately review their AML programs against both PMLA and EU standards.

Key steps include mapping out legal requirements in each jurisdiction, updating policies, training staff, and critically deploying cross-border AML technology.

By proactively harmonizing KYC, transaction monitoring and reporting, firms can leverage the FTA’s opportunities while avoiding fines and reputational damage. ZIGRAM’s Complete AML System offers a ready path: real-time name screening and comprehensive watchlist checks via PreScreening.io, advanced monitoring with Transact Comply, and entity risk management with Entity Hero. Together these tools help meet India’s and Europe’s toughest AML rules with 100% compliance.

Don’t wait, the FTA is set to reshape India–EU commerce, and full compliance will be a prerequisite for doing business. Contact us for a demo for ZIGRAM’s solutions today, and ensure your organization stays ahead of the curve under the new regime.

This analysis is based on current AML regulations under India’s PMLA, EU AMLR/AMLA framework, FATF guidance, and regulatory updates as of 2026.

Sources:

India-EU FTA finalised: Top 15 frequently asked questions on trade deal answered – CAalley.com

What is the 6th EU Anti-Money Laundering (AML) Directive? – MemberCheck

Anti Money Laundering Laws and Regulations Report 2025-2026 India

Beneficial Ownership Disclosure: Navigating Compliance Challenges in India – Lexology

India strengthens anti-money laundering (AML) regulation for cryptocurrency sector – Lexology