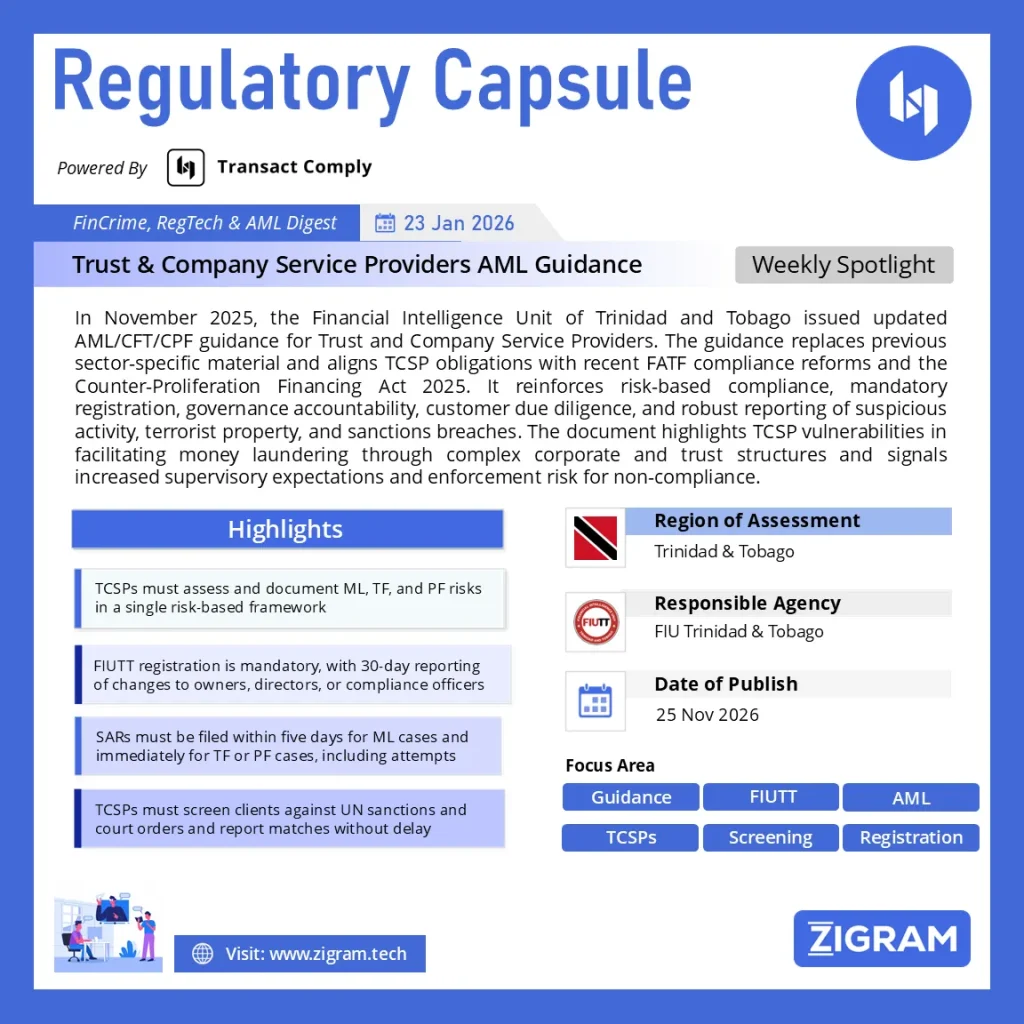

Regulation Name: AML/CFT/CPF guidance for Trust and Company Service Providers (TCSPs)

Date Of Issue: 25 Nov 2025

Region: Trinidad & Tobago

Agency: Financial Intelligence Unit of Trinidad and Tobago (FIUTT)

FIUTT Issue Updated AML Guidance for TCSPs

On 25 November 2025, the Financial Intelligence Unit of Trinidad and Tobago (FIUTT) issued Guidance Note GN/006/2025, providing comprehensive AML/CFT/CPF guidance for Trust and Company Service Providers (TCSPs). The guidance replaces all previous TCSP-specific guidance and reflects Trinidad and Tobago’s evolving legal framework following the enactment of the Counter-Proliferation Financing Act 2025 and FATF-related compliance reforms.

TCSPs are explicitly recognised as high-risk gatekeepers due to their role in company formation, trust administration, nominee arrangements, and the provision of registered offices. The guidance therefore seeks to tighten supervisory expectations across governance, risk assessment, customer due diligence, reporting, sanctions compliance, and record-keeping.

1. Scope and applicability clarified

The guidance applies to any individual or entity that, on behalf of clients, performs activities such as:

- Formation and incorporation of legal persons

- Acting as or arranging directors, secretaries, trustees, or partners

- Providing registered offices or correspondence addresses

- Acting as or arranging nominee shareholders

- Acting as trustees of express trusts

Employees of TCSPs also have internal reporting obligations, even though primary compliance responsibility rests with the entity.

2. Legal framework consolidated under a single guidance

GN/006/2025 consolidates TCSP obligations under a wide range of statutes and regulations, including:

- Proceeds of Crime Act (POCA)

- Anti-Terrorism Act (ATA)

- Financial Obligations Regulations (FORs)

- FIUTT Act and Regulations

- Counter-Proliferation Financing Act (CPFA) and Regulations

- UN-based economic sanctions orders (Iran and DPRK)

A key development is the explicit integration of proliferation financing (PF) alongside money laundering and terrorist financing, requiring TCSPs to address ML/TF/PF as a single, interrelated risk set.

3. Mandatory registration and regulatory transparency

TCSPs must:

- Register with the FIUTT within prescribed statutory timelines

- Notify the FIUTT of changes to:

- – Directors

- – Beneficial owners

- – Legal owners

- – Partners

- – Compliance officers

- – Business address or activities

Failure to register or notify changes attracts significant criminal and administrative penalties, including daily fines. The guidance also details formal de-registration procedures, reinforcing regulatory lifecycle oversight.

4. Governance and accountability expectations raised

The guidance places strong emphasis on senior management responsibility, requiring:

- Appointment of a Compliance Officer and Alternate Compliance Officer

- FIUTT approval of these appointments

- Adequate training and competence at senior levels

Boards and senior management are expected to approve, resource, and oversee AML/CFT/CPF compliance programmes. Failures are treated not merely as technical breaches, but as governance failures.

5. Risk-based approach expanded and formalised

TCSPs must conduct and document a comprehensive ML/TF/PF risk assessment, considering:

- Geographic risk (including FATF high-risk and monitored jurisdictions)

- Client risk, including PEP exposure and complex ownership structures

- Transaction risk, particularly misuse of trusts, shell companies, shelf companies, pooled accounts, and virtual assets

The risk assessment must be:

- Documented

- Kept up to date

- Made available to the FIUTT upon request

This reinforces FATF’s expectation that TCSPs proactively identify vulnerabilities in company and trust misuse.

6. Compliance programme requirements detailed

TCSPs must maintain a written compliance programme that includes:

- Internal policies, procedures, and controls

- CDD and EDD measures proportionate to risk

- Transaction monitoring and escalation procedures

- Training programmes

- Independent audit arrangements

The programme must be approved by senior management and effectively implemented, not merely documented.

7. Customer Due Diligence and beneficial ownership focus

The guidance reinforces strict expectations around:

- Verification of customer identity

- Identification and verification of beneficial owners

- Understanding ownership and control structures

Special attention is given to complex, multi-jurisdictional structures, excessive use of nominees, and arrangements lacking clear economic purpose — all common typologies for laundering through TCSP services.

8. Reporting obligations sharpened

TCSPs are required to submit:

- STRs/SARs for ML, TF, and PF suspicions

- Terrorist Funds Reports

- Economic Sanctions Reports

Key points include:

- SARs for ML and predicate offences must be filed within five days

- TF and PF-related reports must be filed immediately

- Attempted transactions are reportable

- Failure to cease a suspicious relationship or transaction is a serious contravention

The guidance provides detailed explanation of “reasonable grounds to suspect”, helping TCSPs distinguish suspicion from mere intuition.

9. Sanctions and proliferation financing controls

A major enhancement is the explicit linkage between:

- UN sanctions lists

- Domestic court-ordered freezing measures

- Proliferation financing risks

TCSPs must:

- Screen clients at onboarding and on sanctions updates

- Immediately report matches to the FIUTT

- Implement controls to prevent sanctions evasion and PF activity

This reflects international concern over the misuse of corporate vehicles to bypass targeted financial sanctions.

10. Audits, training, and enforcement consequences

TCSPs must conduct:

- Independent AML/CFT/CPF audits at least every three years

- Ongoing staff and board-level training

Non-compliance can result in:

- Large fines

- Imprisonment

- Personal liability for directors and senior officers

The guidance makes clear that even a single serious failure can attract criminal consequences.

Why this guidance is significant

GN/006/2025 represents a material strengthening of supervisory expectations for TCSPs. It moves Trinidad and Tobago further toward FATF-aligned, risk-based supervision, with a particular focus on:

- Beneficial ownership transparency

- Corporate vehicle misuse

- Sanctions and proliferation financing risks

For TCSPs, the guidance is not optional best practice — it is the benchmark against which compliance will be assessed.

Read about the guidance here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #AML

- #CFT

- #CPF

- #TrinidadAndTobago

- #FIUTT

- #TCSP

- #BeneficialOwnership

- #SanctionsCompliance

- #FinancialCrime

- #RiskBasedApproach

- #FATF

- #RegulatoryUpdate