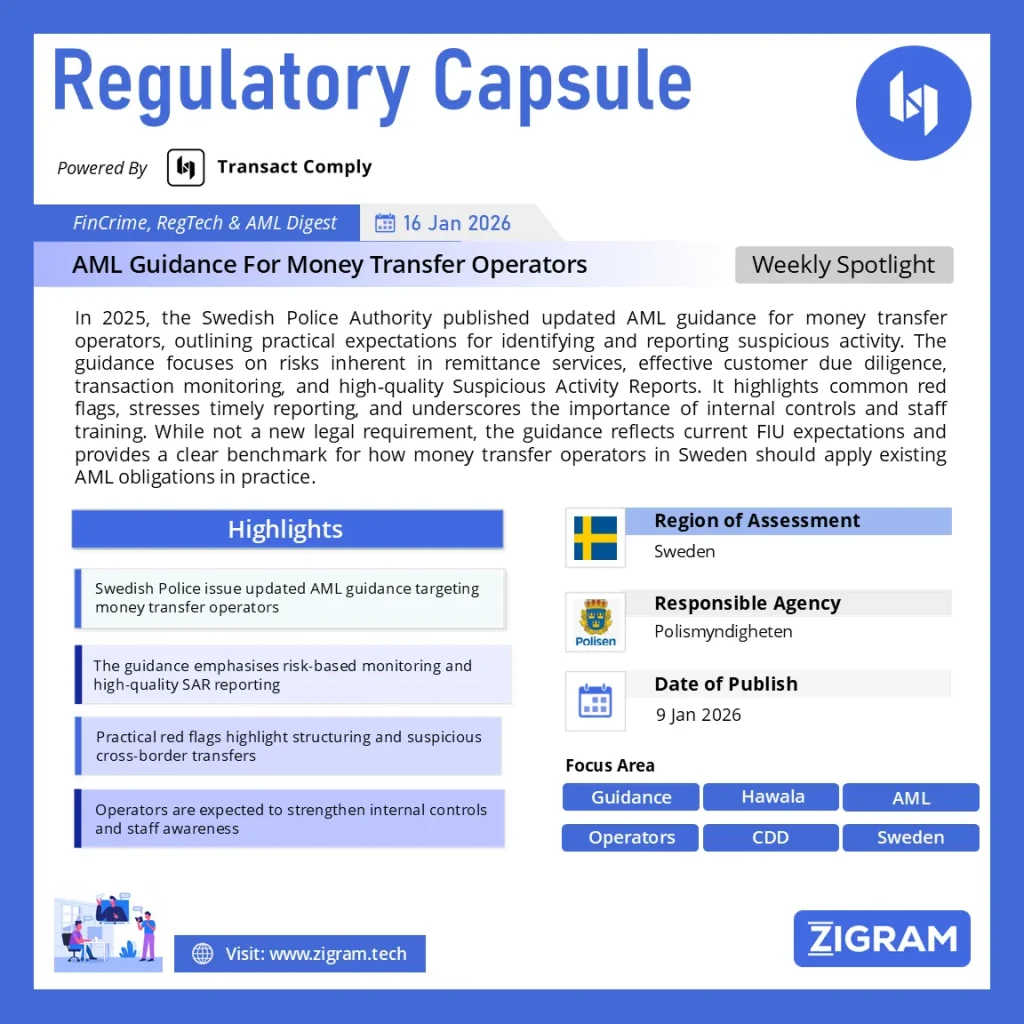

Regulation Name: Information on Money laundering and terrorist financing for providers of money transfer services

Date Of Issue: 9 Jan 2026

Region: Sweden

Agency: Polismyndigheten (Swedish Police Authority) – Financial Intelligence Unit

Swedish Police Issue Updated AML Guidance for Money Transfer Operators

In 2025, the Polismyndigheten (Swedish Police Authority), which hosts Sweden’s Financial Intelligence Unit (FIU), published updated anti-money laundering (AML) guidance for money transfer operators. The document, titled “Penningöverföraren”, provides practical instructions on identifying, preventing, and reporting money laundering risks associated with payment and remittance services.

While the guidance does not introduce new legislation, it clarifies how existing AML obligations should be applied in practice, particularly for businesses engaged in domestic and cross-border money transfers. It is intended to strengthen detection of illicit financial flows and improve the quality of Suspicious Activity Reports (SARs) submitted to the FIU.

Key focus areas of the guidance

Risk exposure in money transfer services

The Swedish Police highlight that money transfer services are inherently exposed to misuse for laundering criminal proceeds, financing organised crime, and facilitating cross-border illicit flows. Operators are expected to understand how their products, delivery channels, and customer base increase or mitigate these risks.

Customer due diligence and transaction monitoring

The guidance reiterates the importance of effective customer due diligence, including verifying customer identity and understanding transaction purpose. Operators must monitor transactions for unusual patterns such as frequent low-value transfers, rapid movement of funds, or transactions involving higher-risk jurisdictions.

Suspicious activity reporting expectations

A key objective of the document is to improve the timeliness and quality of SARs. Money transfer operators are reminded that reports should be filed as soon as suspicion arises, and narratives should clearly explain why a transaction or behaviour is considered suspicious.

Indicators of potential money laundering

The guidance outlines practical red flags, including:

- Structuring transactions to avoid reporting thresholds

- Use of third parties without clear economic purpose

- Transactions inconsistent with a customer’s known profile

- Repeated international transfers with no apparent legitimate reason

Internal controls and staff awareness

Operators are expected to maintain robust internal controls, ensure staff are trained to recognise suspicious behaviour, and document AML procedures. The Police stress that frontline employees play a critical role in detecting suspicious activity.

Why this matters

Although not a legislative change, this guidance reflects current FIU expectations and signals how the Swedish Police will assess AML compliance in practice. For money transfer operators, failure to align procedures with this guidance may result in increased scrutiny, supervisory attention, or enforcement referrals.

The document also reinforces Sweden’s broader efforts to combat financial crime by improving information flows between the private sector and law enforcement.

What money transfer operators should do now:

- Review AML risk assessments specific to money transfer services

- Update transaction monitoring rules and red-flag indicators

- Refresh staff training using the scenarios highlighted in the guidance

- Ensure SARs are filed promptly with clear, well-documented narratives

- Strengthen internal controls and documentation

Read about the guidance here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #AML

- #CFT

- #Sweden

- #MoneyTransfer

- #Remittances

- #FinancialCrime

- #SuspiciousActivity

- #SAR

- #FIU

- #Compliance

- #AMLGuidance

- #TransactionMonitoring