Table of Contents

What India’s Crypto Compliance Leaders, Regulators, and Policymakers Must Understand and Act On

For much of the past decade, India’s approach to crypto regulation was characterised by caution, ambiguity, and fragmented oversight. That phase is now decisively over.

FIU-India’s latest report on Virtual Digital Asset Service Providers (VDA SPs), released as part of its 19th Annual Report (FY 2024–25), marks a turning point. It is not merely a progress update. It is a supervisory playbook, an enforcement signal, and a policy roadmap rolled into one.

For compliance officers, regulatory leaders, and government officials, the message is unambiguous:

VDASPs are now fully embedded within India’s AML/CFT architecture, and regulatory expectations are no longer theoretical.

They are operational, enforceable, and increasingly unforgiving.

This article unpacks the report in depth and translating regulatory language into practical insight, connecting legal provisions with real enforcement outcomes, and drawing lessons from the typologies FIU-India is now seeing across India’s fast-growing crypto ecosystem.

Executive Summary: Key FIU-India VDASP Compliance Changes in FY 2024–25

- FIU-India, now single AML Authority For Crypto and VDA SPs Compliance, completed sectoral onboarding and supervisory ramp-up for VDA SPs after VDAs were brought under the PMLA reporting regime in 2023. FINnet 2.0, AI/ML risk models and ISO-certified IT processes now support registration, STR analysis and information sharing.

- As of 31 March 2025, 49 VDA SPs were registered as reporting entities (45 onshore, 4 offshore). FIU-India uses a central single-entry registration model (FINnet 2.0) and conducts in-person onboarding and live systems walkthroughs.

- Supervisory outcomes are material: penalties totalling ~₹28 Crore were levied on non-compliant VDA SPs in FY 2024-25; one offshore provider was fined ₹9.27 Crore following enforcement under Section 13 PMLA. FIU-India is also empowered to block URLs under IT Act Section 79(3)(b) for non-compliant offshore/unregistered operators.

Regulatory Shift

VDASPs formally embedded under PMLA

FIU-India = single AML authority for crypto

Scale of Supervision

49 registered VDASPs

45 onshore, 4 offshore

Enforcement Signal

₹28 crore penalties in FY 2024–25

₹9.27 crore fine on one offshore entity

Technology Backbone

FINnet 2.0 for registration & reporting

AI/ML STR analysis with ISO-certified IT systems

India’s Legal Framework Governing VDASPs: From Policy Intent to Enforceable Law

The inclusion of VDASPs under India’s AML regime is anchored in a clear statutory chain — not executive discretion.

Core Laws and Rules Applicable to VDASPs

FIU-India’s report makes clear that VDASPs are governed by the following legal instruments:

1. Prevention of Money Laundering Act, 2002 (PMLA)

VDASPs are treated as “Reporting Entities” under:

- Section 2(1)(wa) – Definition of Reporting Entity

- Section 12 – Obligations relating to record-keeping, identity verification, and furnishing of information

- Section 12AA – Power to call for information

- Section 13 – Power to impose monetary penalty and issue directions

These sections form the legal basis for registration, STR obligations, inspections, penalties, and remedial directions.

2. PMLA (Maintenance of Records) Rules, 2005

VDASPs are specifically captured through amendments that classify designated crypto activities as reporting obligations, including:

- Exchange between VDAs and fiat currencies

- Exchange between one or more forms of VDAs

- Transfer of VDAs

- Safekeeping or administration of VDAs or instruments enabling control over VDAs

The rules mandate customer due diligence (CDD), ongoing monitoring, record retention, and timely STR filing.

3. Information Technology Act, 2002 — Section 79(3)(b)

A critical escalation tool highlighted in the report is FIU-India’s designation as the authority empowered to issue directions for:

- Blocking URLs and digital access of non-compliant or unregistered offshore VDASPs operating in India

This has transformed FIU-India from a financial intelligence unit into a digital enforcement authority in the crypto space.

The Supervisory Landscape in FY 2024–25: Where India Stands Today

As of 31 March 2025:

- 49 VDASPs were registered with FIU-India

- 45 Indian entities

- 4 offshore entities offering services into India

Registration is conducted through FINnet 2.0, FIU-India’s centralised reporting and supervision platform. Importantly, the report clarifies that registration is activity-based, not domicile-based — a critical policy choice aimed at preventing jurisdictional arbitrage.

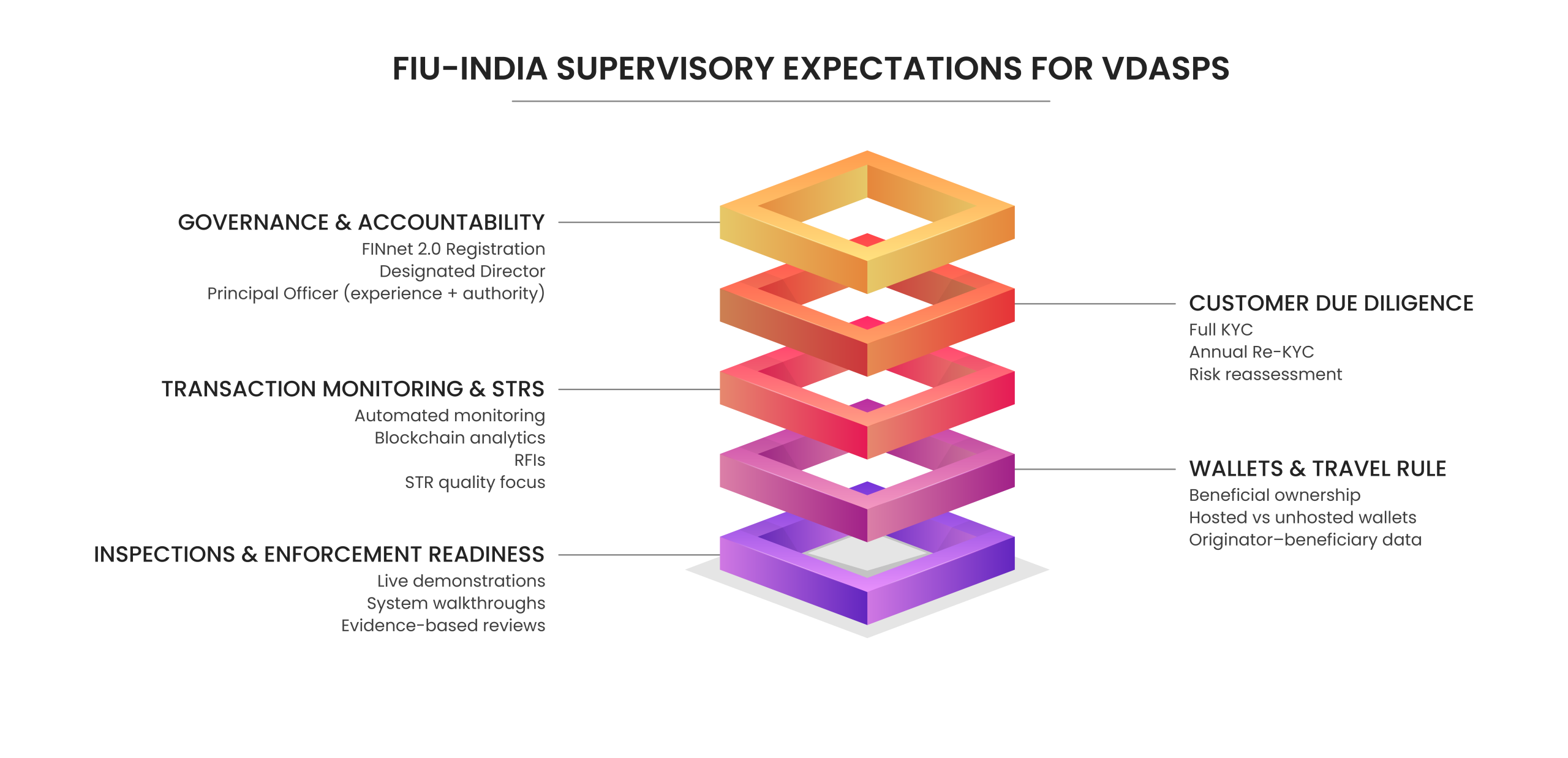

Key Obligations & Supervisory Expectations for VDASPs

FIU-India’s expectations go well beyond checkbox compliance. The report repeatedly emphasises demonstrable, live, and auditable controls.

1. Registration and Governance Controls

Every VDASP must:

- Register on FINnet 2.0

- Disclose all bank accounts and financial touchpoints

- Appoint:

- A Designated Director at board/senior management level

- A Principal Officer (PO) with:

- Minimum 3 years of AML/compliance experience

- Authority to access all transaction and customer data

- Direct reporting line to senior management

FIU-India explicitly expects the PO to be operationally involved and not just a symbolic appointment.

2. Customer Due Diligence and Re-KYC

FIU-India now mandates:

- Full KYC at onboarding

- Annual re-KYC for all customers, irrespective of risk rating

- Periodic customer risk reassessment

- Enhanced due diligence for higher-risk profiles

Failure to conduct timely re-KYC has already featured in supervisory findings.

3. Transaction Monitoring, Blockchain Analytics & STR Filing

- Automated transaction monitoring systems

- Monitor transactions on a risk-based basis

- Identify suspicious patterns using defined Red Flag Indicators (RFIs)

- Red-flag rules aligned to FIU-issued RFIs

- Blockchain analytics tools capable of:

- Tracing transaction lineage

- Identifying mixing, layering, and rapid movement

- Linking wallets to known typologies

- File Suspicious Transaction Reports (STRs) promptly

Low-quality or defensive STR reporting is explicitly criticised in the report.

4. Wallet Beneficial Ownership & Travel Rule Compliance

One of the most technically demanding expectations relates to:

- Identification of beneficial owners of hosted wallets

- Risk-based treatment of unhosted wallets

- Collection and transmission of originator and beneficiary information under the Travel Rule

5. Active Engagements With FIU-India Consultations and Working Groups

FIU-India encourages VDA SPs to participate in various consultations and consituted working groups to understand and analyse risks and jointly take mitigation measures.

Important Notice:

- Crucially, during inspections, FIU officers “demand live demonstrations”, including KYC verification, sanctions screening, transaction monitoring, blockchain analytics, and travel rule implementation, and not just static policy documents.

- FIU-India’s strategic analysis of VDASP STRs shows high volumes linked to Scam and Fraud, Gambling, P2P Scam and Child Sexual Abuse Material (CSAM), Terror Financing, Darknet services and proceeds of crime, highlighting severity of exploitation of VDAs for serious criminal activity.

STR Typologies & Operational Case Studies: What FIU-India Has Encounted In Crypto And VDA SPs

The most valuable part of the report lies in its real-world STR analysis, which reveals how VDAs are being misused in India today.

Spoofed Exchanges and Credential Theft

FIU-India documents cases where:

- Fraudsters created fake crypto exchange websites

- Users unknowingly shared login credentials

- Wallets were drained

- Stolen VDAs were liquidated through legitimate Indian exchanges

- Proceeds were converted into INR and withdrawn

This typology demonstrates how cyber fraud seamlessly converts into financial crime via VDASPs.

Large-Scale Hawala-Style Laundering via VDAs

One of the most serious findings involves:

- Multiple VDASP accounts

- Amounts approximately ~₹1,100 crore deposited and converted to Indian currency

- Use of crypto to bypass traditional banking scrutiny

- Links to unaccounted income and underground networks

This confirms that VDAs are increasingly used as modern substitutes for hawala channels.

P2P Scams, Online Gambling, and CSAM-Linked Proceeds

STRs revealed:

- P2P investment scams

- Illegal online gambling operations

- Wallets linked to child sexual abuse material (CSAM)

- Use of VDASPs for rapid cross-border movement

The report underscores the serious national security and human harm dimensions of crypto misuse.

Adult Content Platforms Paying Indian Creators via Crypto

In a notable case:

- An illegal adult content platform operated abroad

- Indian content creators were paid in cryptocurrency

- Funds originated from foreign VDASPs

- FIU traced flows amounting to ₹15.6 crore

This case illustrates how VDAs are being used to circumvent Indian payment regulations and content laws.

FIU-India Enforcement Actions Against VDASPs: Penalties and Sanctions

FIU-India’s supervisory posture is no longer advisory.

During FY 2024–25:

- ₹28 crore in penalties were imposed across VDASPs

- One offshore entity alone was fined ₹9.27 crore

- Notices were issued under Section 13 PMLA

- Blocking directions were issued under IT Act Section 79(3)(b)

The report makes it clear that non-registration and non-cooperation are now enforcement triggers, not procedural lapses.

What This Means for 2026 and Beyond

FIU-India’s VDASP chapter signals a structural shift:

- Crypto is no longer treated as an experimental sector

- Supervision is now systemic, technology-driven, and punitive where required

- Compliance failures carry reputational, financial, and operational risk

For VDASPs, the priority is no longer policy drafting, it is operational proof.

For regulators and policymakers, the challenge ahead lies in harmonising innovation with enforcement, while ensuring India’s framework remains globally interoperable.

The era of regulatory ambiguity has ended. The era of accountable crypto compliance in India has begun.