Name Screening

Name Screening for AML Compliance: PreScreening.io

AML name screening to check against global sanctions, PEPs, and watchlists to identify potential risks.

PreScreening.io by ZIGRAM is an advanced AML name screening solution designed to help financial institutions, fintechs, and regulated businesses detect financial crime risks efficiently and remain compliant with global AML/CFT regulations.

What is Name Screening?

AML Name Screening is the process of comparing the names of individuals, entities, or counterparties against watchlists, sanctions lists, politically exposed persons (PEPs) lists, and adverse media databases to identify potential financial crime risks.

PreScreening.io automates this process using intelligent matching logic, configurable thresholds, and curated global watchlist libraries to deliver accurate and defensible screening outcomes.

Why is Name Screening Important?

- Stay compliant with AML/ CFT Regulatory obligations

- Identify high-risk entities

- Protect against reputational risks

- Prevent financial crimes

- Cross-border transactions

- Support in-depth investigation

- Avoid regulatory penalties/fines

- Contribute to the effort in combating terrorism

ZIGRAM enables this name screening capability through its PreScreening.io application to highlight customer and third party anti-money laundering, financial crime, emerging and other business risks.

When should Name Screening be performed?

- Onboarding new customers or entities

- Conduct periodic reviews or monitoring of existing customer base

- Processing transactions, especially cross-border or large transactions

- During change in customer information (e.g., name, address, beneficial ownership)

- Regulatory or internal risk policy that requires enhanced due diligence

- Employee hiring or reviewing third parties

PreScreening.io supports real-time, batch, and continuous monitoring workflows across all these screening scenarios.

Key Watchlist Libraries for Effective AML Name Screening

- Global Sanctions (UNSC, OFAC, EU, HMT, etc.)

- Politically Exposed Persons (PEP)

- Country Watchlists

- International Watchlists

- Shell Companies

- Restricted Entities

- Other risk intelligence sources

What are the Best Practices of AML Name Screening?

- Input for Name Screening : Critical Input Parameters to Enhance Match Accuracy

- Differential Threshold: Managing Risk Sensitivity through Threshold Tuning

- Name Screening List Selection: Compliance Through Accurate List Selection

- Name Matching Criteria: Enhancing Detection with Sophisticated Matching Logic

- Rules Engine: Automating Logic for Smarter Name Screening Decisions

- Investigation of Alerts: Verifying Alerts with Structured Review Protocols

- Workflow: Step-by-Step Screening Process for Compliance

- Reporting: Mandatory Reporting Requirements as per jurisdiction

- Audit Trail: Creating an End-to-End Record of Name Screening Activities

- Continuous Monitoring: Ongoing Surveillance for Risk Evolution

- User Management: Secure Role-Based Access and Governance

Core Features of ZIGRAM's AML Name Screening Application

PreScreening.io enables organisations to meet their Name Screening requirements with best-in-class practices and features built directly into the screening process.

- Quick scan - Real time and batch processing

- Ongoing Monitoring for onboarded, active or watchlist customers

- Differential thresholds to logically reduce false positives

- Composite case score for UBOs, Associations and multiple entities

- Case and entity specific reports – single and batch

- Customizable scoring, checks and thresholds

- Library feature for selection of 3330+ risk checks and watchlists

- Focus on multiple country, region and local lists

- Machine learning enabled adverse press coverage and news repository

- APIs for platform and workflow integration

- Disambiguation support – technology, data science and resourcing

- Rules engine for 50+ rules and logic for alert tuning

- Simulation projects for testing and tuning

- Best practices & standards

- Team workflows

Book A Demo

Fill out the form and our team will connect with you

FAQs for Name Screening

What is name screening in AML/KYC?

Name screening is the process of checking customer, vendor, or counterparty names against sanctions, PEP, and other watchlists as part of AML (Anti-Money Laundering) and KYC (Know Your Customer) requirements. It helps financial institutions prevent relationships with high-risk or prohibited entities.

Sanctions screening vs. name screening-what is the difference?

Sanctions screening focuses specifically on people or entities listed by governments and regulators for restrictions or prohibitions. Name screening is broader. It includes sanctions, PEPs, adverse media, law-enforcement lists, and other risk databases.

When should name screening be performed?

At onboarding, during transaction processing, on periodic reviews, whenever customer data changes, and whenever sanctions or PEP/adverse media lists are updated.

Does name screening include PEP and adverse media checks?

Yes. A complete solution, like PreScreening.io, covers PEPs, their relatives/associates, and negative news sources along with sanctions lists.

What lists are used for AML name screening?

International sanctions (UNSC, OFAC, EU, HMT, etc.), local/national lists, PEP databases, adverse-media feeds, regulatory watchlists, law-enforcement alerts, and beneficial-ownership registers.

How long does a name screening / AML check take?

Automated screening happens in seconds; only matches requiring analyst review take longer, depending on complexity.

How do name screening tools help reduce false positives?

Tools like PreScreening.io use smart algorithms, transliteration support, and contextual risk scoring to cut noise, automate low-risk matches, and give analysts clear dashboards for rapid decisions.

Can your name screening tools integrate with my current systems (via API)?

Yes, PreScreening.io offers secure API endpoints, batch upload options, and dashboards to integrate smoothly with KYC, onboarding, transaction monitoring, or core banking platforms.

FAQs for Name Screening

What is name screening in AML/KYC?

Name screening is the process of checking customer, vendor, or counterparty names against sanctions, PEP, and other watchlists as part of AML (Anti-Money Laundering) and KYC (Know Your Customer) requirements. It helps financial institutions prevent relationships with high-risk or prohibited entities.

Sanctions screening vs. name screening — what’s the difference?

Sanctions screening focuses specifically on people or entities listed by governments and regulators for restrictions or prohibitions. Name screening is broader — it includes sanctions, PEPs, adverse media, law-enforcement lists, and other risk databases.

When should name screening be performed?

At onboarding, during transaction processing, on periodic reviews, whenever customer data changes, and whenever sanctions or PEP/adverse media lists are updated.

Does name screening include PEP and adverse media checks?

Yes. A complete solution, like PreScreening.io, covers PEPs, their relatives/associates, and negative news sources along with sanctions lists.

What lists are used for AML name screening?

International sanctions (UNSC, OFAC, EU, HMT, etc.), local/national lists, PEP databases, adverse-media feeds, regulatory watchlists, law-enforcement alerts, and beneficial-ownership registers.

How long does a name screening / AML check take?

Automated screening happens in seconds; only matches requiring analyst review take longer, depending on complexity.

How do name screening tools help reduce false positives?

Tools like PreScreening.io use smart algorithms, transliteration support, and contextual risk scoring to cut noise, automate low-risk matches, and give analysts clear dashboards for rapid decisions.

Can your name screening tools integrate with my current systems (via API)?

Yes — PreScreening.io offers secure API endpoints, batch upload options, and dashboards to integrate smoothly with KYC, onboarding, transaction monitoring, or core banking platforms.

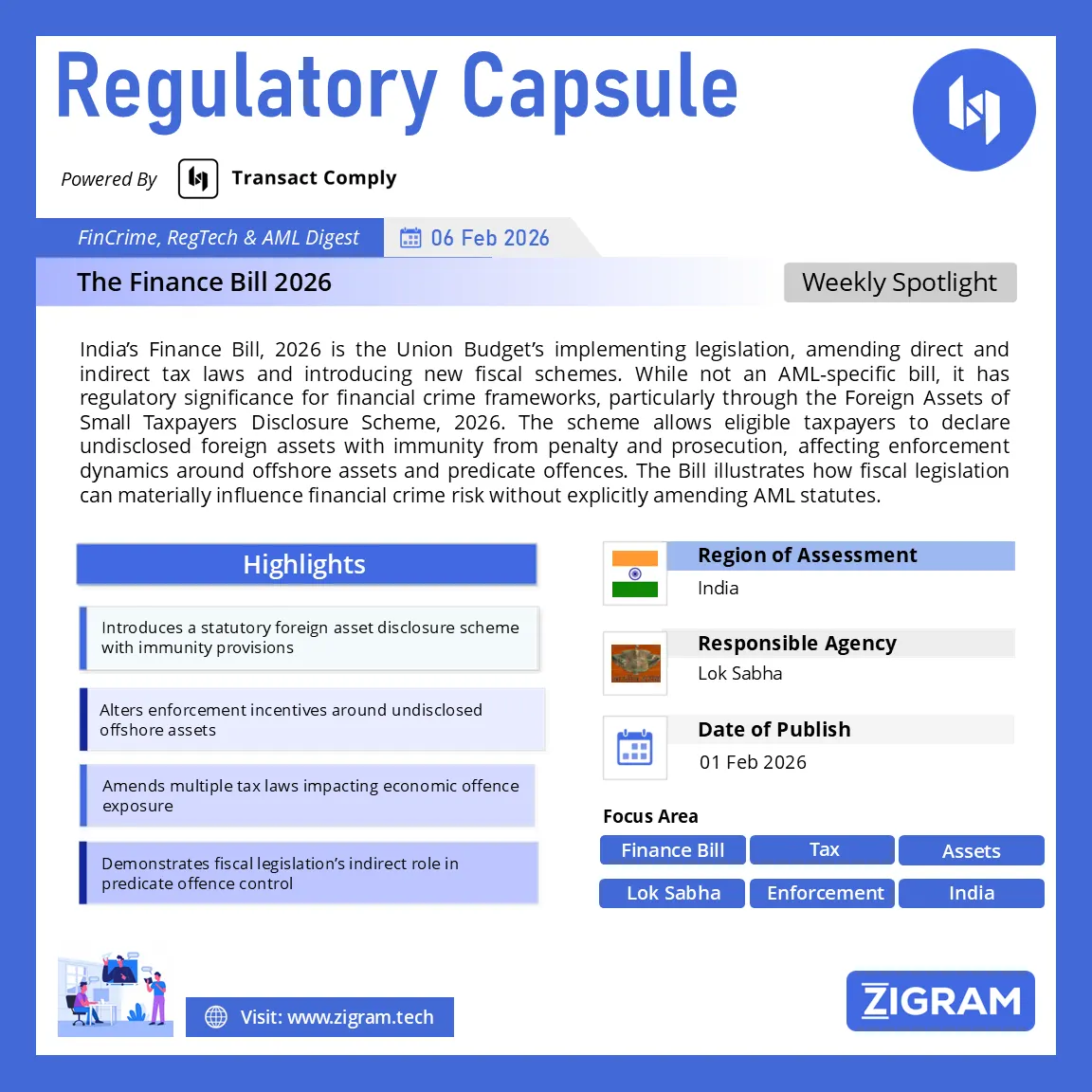

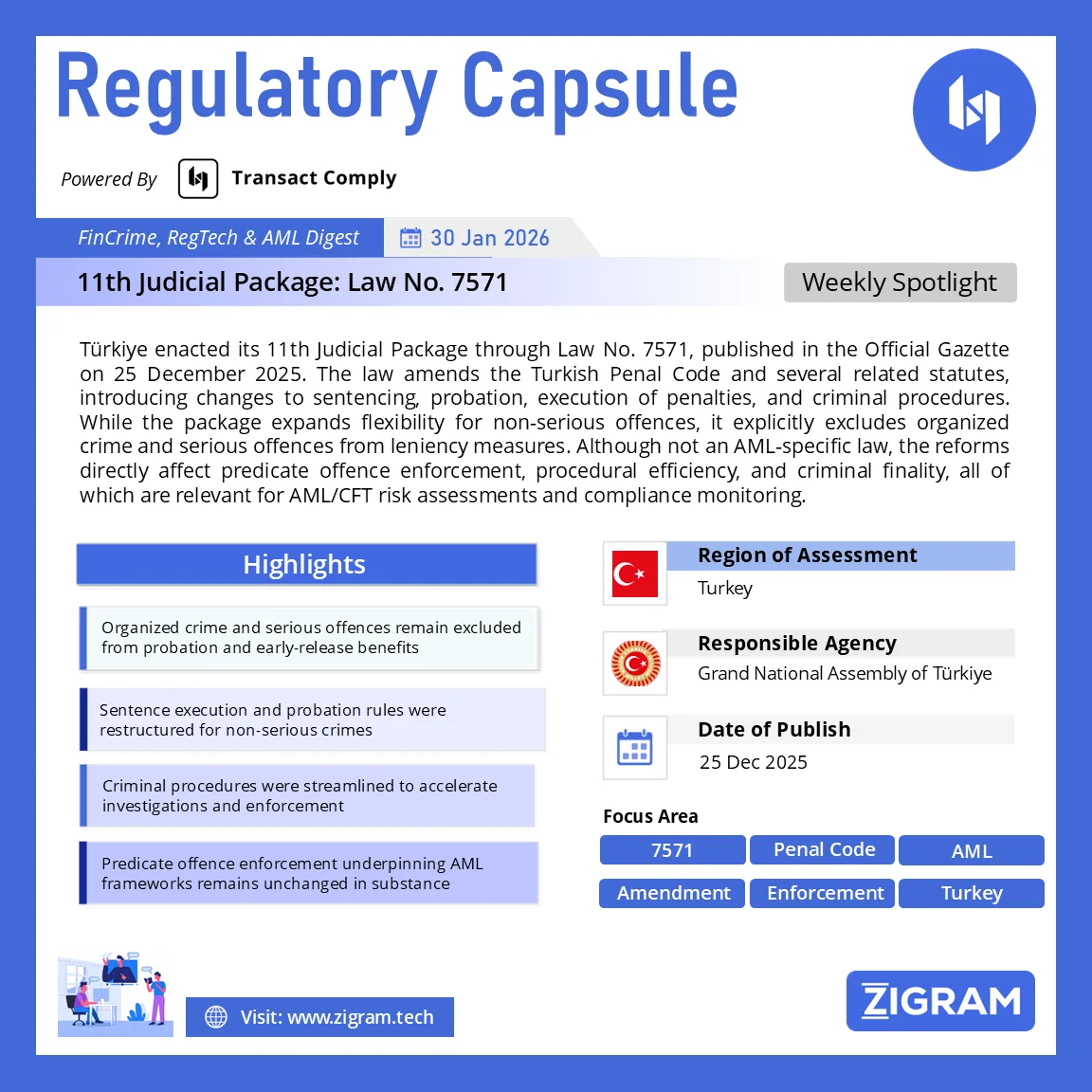

Articles

Explore insightful articles on cutting-edge topics like regulations, technological advancements, and critical insights into AML and financial crime risks

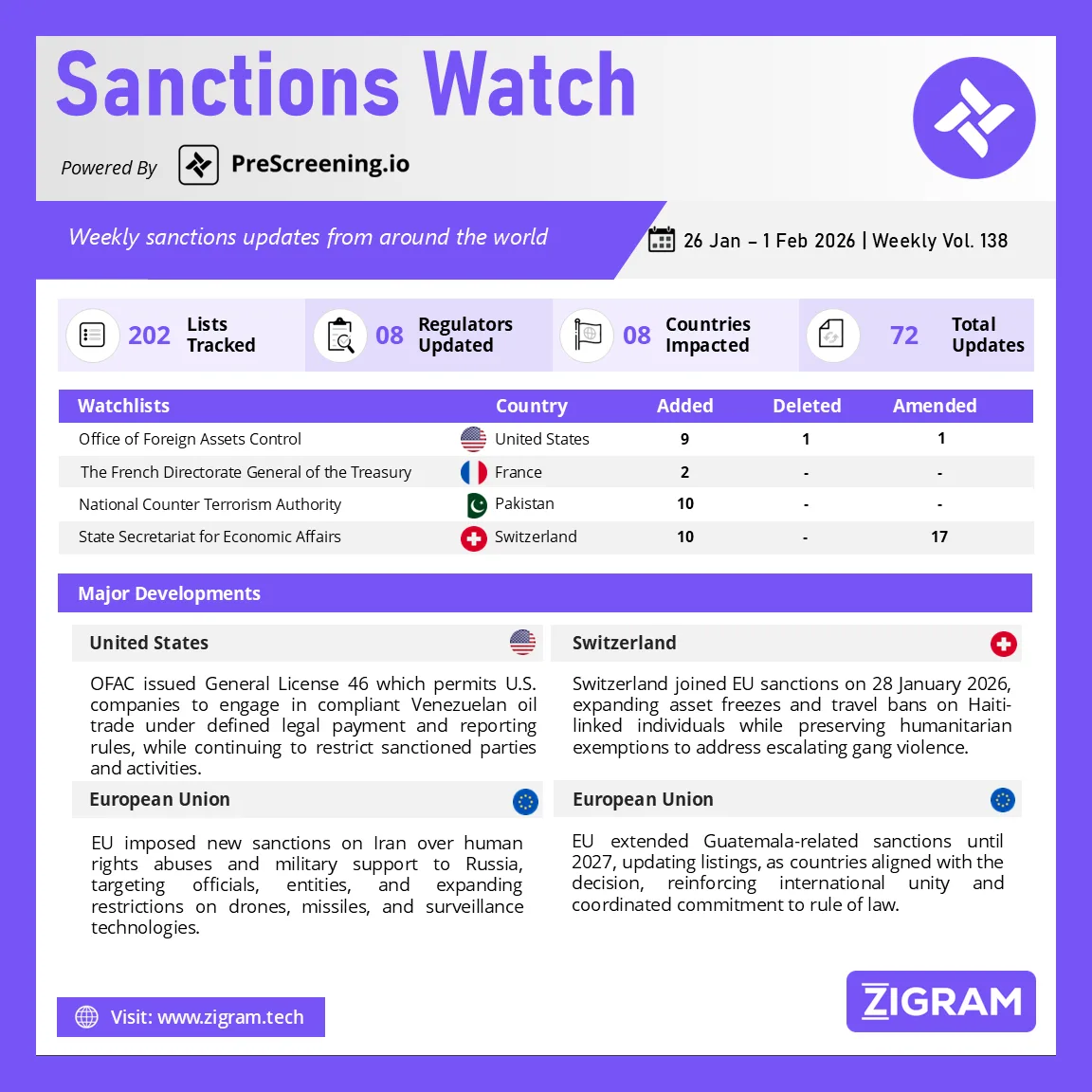

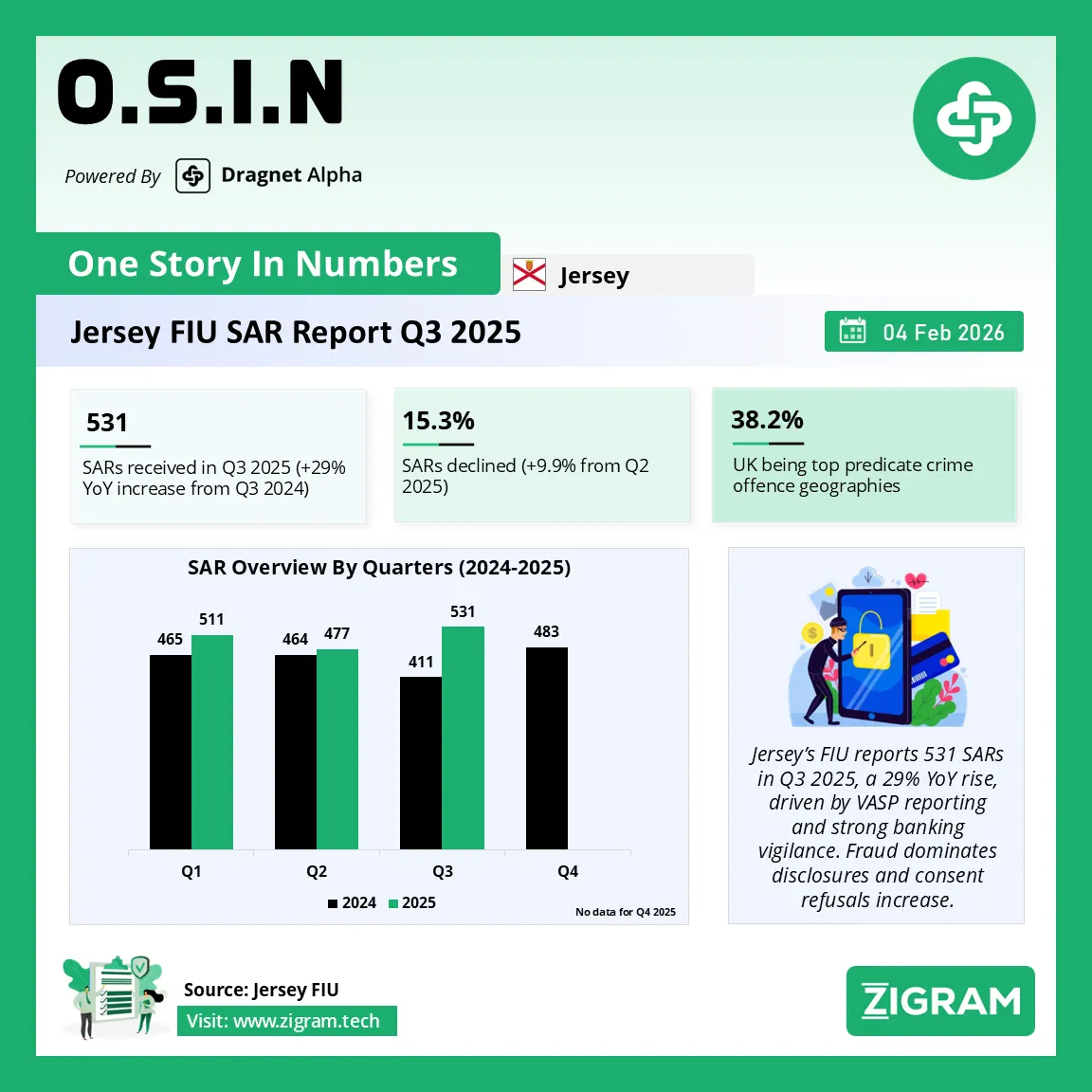

Resources

Our weekly dose of knowledge on the latest developments in anti-money laundering, financial crime, and other offenses, including news, regulations, and reports from around the world

LEARN MORE

Let's Find the Right Solution for You

Discover how our technology and data solutions can accelerate your compliance goals.

Explore Our Solutions

Explore Our Solutions Request Custom Pricing

Request Custom Pricing Schedule A Free Trial Or Demo

Schedule A Free Trial Or Demo