Transaction Monitoring

Transaction Monitoring for AML Compliance: Transact Comply

Monitoring transactions to generate AML, Fraud and Compliance alerts real time or end of term.

Transact Comply by ZIGRAM is Transaction Monitoring solution for real-time and batch monitoring, helping regulated institutions detect suspicious activity and meet AML/CFT compliance requirements.

What is Transaction Monitoring?

Transaction Monitoring is the process of reviewing and analyzing customer transactions in real time or at scheduled intervals to detect suspicious, unusual, or high-risk activity.

By tracking patterns, behavioral changes, spending trends, and cross-border movements, transaction monitoring identifies red flags such as money laundering, fraud attempts, sanctions exposure, and terrorist financing risks.

Transact Comply delivers this capability through an AI/ML-driven transaction monitoring platform designed for banks, fintechs, MSBs, and regulated institutions.

Why does Transaction Monitoring Matter?

- Prevent money laundering, fraud, and terrorist financing.

- FATF, local regulators, and sectoral AML guidelines compliance.

- Protects customers, platforms, and financial ecosystems.

- Reduces operational and reputational risks.

- Timely alerts, data-driven insights, and investigative workflows.

- Strengthens internal controls and audit readiness.

ZIGRAM’s transaction monitoring application and an AI/ML-powered system, Transact Comply, enables safer customer transactions and helps in payment screening, by detecting suspicious activities using configurable rules.

What are the Use Cases of Transaction monitoring?

- Suspicious Transaction Detection: Flag large, rapid, or unusual cash movements.

- Sanctions & PEP Screening: Identify transactions involving high-risk entities or jurisdictions.

- Structuring / Smurfing Alerts: Detect fragmented patterns designed to avoid reporting limits.

- Fraud Detection: Identify anomalous payment behavior, rapid transfers, or account takeovers.

- Geographical Risk Monitoring: Alert on activity routed through high-risk countries.

- Customer Behavior Monitoring: Compare activity patterns against historical behavior.

- Channel-Specific Monitoring: ATM, online banking, cards, wallets, forex, crypto and more.

- Trade-Based AML: Monitor invoice, pricing and quantity anomalies in trade transactions.

- Regulatory Reporting: Support STR/SAR filing with enriched data and case summaries.

How does Transaction Monitoring Work?

- Data Collection: Ingest transaction data from banking systems, payment channels, and external sources.

- Customer Risk Profiling: Assign risk scores based on geography, behavior, products, and history.

- Rule Engine & Analytics: Apply AML typologies, thresholds, scenarios, and ML-based models within Transact Comply

- Alert Generation: Automatically flag unusual patterns using Transact Comply’s real-time analytics

- Case Management: Investigators review alerts inside Transact Comply’s integrated case management module

- Regulatory Reporting: Generate STR/SAR reports and maintain full audit trails.

- Continuous Optimization: Update rules and models based on evolving risks.

What is a Transaction Monitoring System?

A Transaction Monitoring System is a specialized AML compliance tool that automatically analyses customer transactions to identify risky or suspicious activity. It integrates with core banking, payment gateways, wallets, and fintech platforms to run pre-configured rules, machine learning models, and behavioral analytics.

A strong transaction monitoring system (like Transact Comply) supports real-time detection, investigator workflows, escalations, dashboards, and regulatory reporting. It helps institutions reduce manual effort, improve decision-making, enhance fraud and AML prevention, and stay fully compliant with global and local regulations.

Transact Comply is ZIGRAM’s AI-powered transaction monitoring system designed to help regulated institutions detect suspicious activity, reduce false positives, and meet AML/CFT obligations.

Why Choose Transact Comply for AML Transaction Monitoring?

- Real-time Transaction Monitoring, Efficient Alert Generation & Review – Instant visibility into all transactions, triage and investigation

- Behaviour-Based & Ongoing Alerts – Detect anomalies and suspicious patterns

- Configurable Rules Engine – Create and update monitoring rules easily

- Risk-Based Thresholds & Scoring – Apply dynamic risk scoring to transactions

- Cross-Channel Data Integration – Combine data from banking, payments, cards, and wallets

- Scalable Cloud Infrastructure – High performance and secure cloud deployment

- Intuitive UI with Visual Analytics – Clear dashboards and visual insights

- Scenario Testing & Simulation – Test rules before live deployment

- Audit Trail & Logging – Full traceability for compliance

- Alert Prioritization & Categorization – Focus on high-risk alerts first

- Iterative Simulation for Configurations – Optimize rules through repeated testing

- API Integration & Data Export – Seamless connectivity with internal systems

- Regulatory Report Generation – Auto-generate STR/SAR/TTR reports

- Cross-Border Monitoring & Geolocation – Track global and jurisdictional risks

Book A Demo

Fill out the form and our team will connect with you

FAQs for Transaction Monitoring

Is Transaction Monitoring mandatory for regulated institutions?

Yes, regulators across jurisdictions require banks, fintechs, casinos, MSBs, and other regulated entities to implement transaction monitoring as part of their AML and CFT compliance obligations.

What types of transactions can be monitored?

Transaction monitoring can cover payments, transfers, cards, wallets, cash deposits, withdrawals, forex, trade transactions, crypto transactions and cross-border activity across multiple channels.

How does transaction monitoring reduce false positives?

Modern transaction monitoring uses risk-based thresholds, behavioral profiling, alert prioritization, and scenario testing to reduce unnecessary alerts and focus on high-risk activity.

What is real-time vs batch transaction monitoring?

Real-time monitoring flags suspicious transactions instantly, while batch monitoring reviews transactions at scheduled intervals, such as daily or end-of-day processing.

How does ZIGRAM’s transaction monitoring support regulatory reporting?

ZIGRAM’s transaction monitoring platform, Transact Comply, automates alert investigations, maintains audit trails, and generates STR/SAR-ready reports aligned with regulatory requirements.

Can transaction monitoring be customised by institution type?

Yes, ZIGRAM’s Transact Comply allows full customization of rules, thresholds, scenarios, and risk models based on institution size, geography, customer profile, and regulatory needs.

Does ZIGRAM’s transaction monitoring integrate with existing systems?

Yes, Transact Comply, ZIGRAM’s transaction monitoring platform, offers APIs for seamless integration with core banking systems, payment gateways, data warehouses, and compliance tools.

Is ZIGRAM’s transaction monitoring suitable for cross-border transactions?

Yes, Transact Comply includes geolocation analysis and cross-border risk monitoring to identify high-risk jurisdictions and international exposure.

FAQs for Transaction Monitoring

Is Transaction Monitoring mandatory for regulated institutions?

Yes, regulators across jurisdictions require banks, fintechs, casinos, MSBs, and other regulated entities to implement transaction monitoring as part of their AML and CFT compliance obligations.

What types of transactions can be monitored?

Transaction monitoring can cover payments, transfers, cards, wallets, cash deposits, withdrawals, forex, trade transactions, crypto transactions and cross-border activity across multiple channels.

How does transaction monitoring reduce false positives?

Modern transaction monitoring uses risk-based thresholds, behavioral profiling, alert prioritization, and scenario testing to reduce unnecessary alerts and focus on high-risk activity.

What is real-time vs batch transaction monitoring?

Real-time monitoring flags suspicious transactions instantly, while batch monitoring reviews transactions at scheduled intervals, such as daily or end-of-day processing.

How does ZIGRAM’s transaction monitoring support regulatory reporting?

ZIGRAM’s transaction monitoring platform, Transact Comply, automates alert investigations, maintains audit trails, and generates STR/SAR-ready reports aligned with regulatory requirements.

Can transaction monitoring be customised by institution type?

Yes, ZIGRAM’s Transact Comply allows full customization of rules, thresholds, scenarios, and risk models based on institution size, geography, customer profile, and regulatory needs.

Does ZIGRAM’s transaction monitoring integrate with existing systems?

Yes, Transact Comply, ZIGRAM’s transaction monitoring platform, offers APIs for seamless integration with core banking systems, payment gateways, data warehouses, and compliance tools.

Is ZIGRAM’s transaction monitoring suitable for cross-border transactions?

Yes, Transact Comply includes geolocation analysis and cross-border risk monitoring to identify high-risk jurisdictions and international exposure.

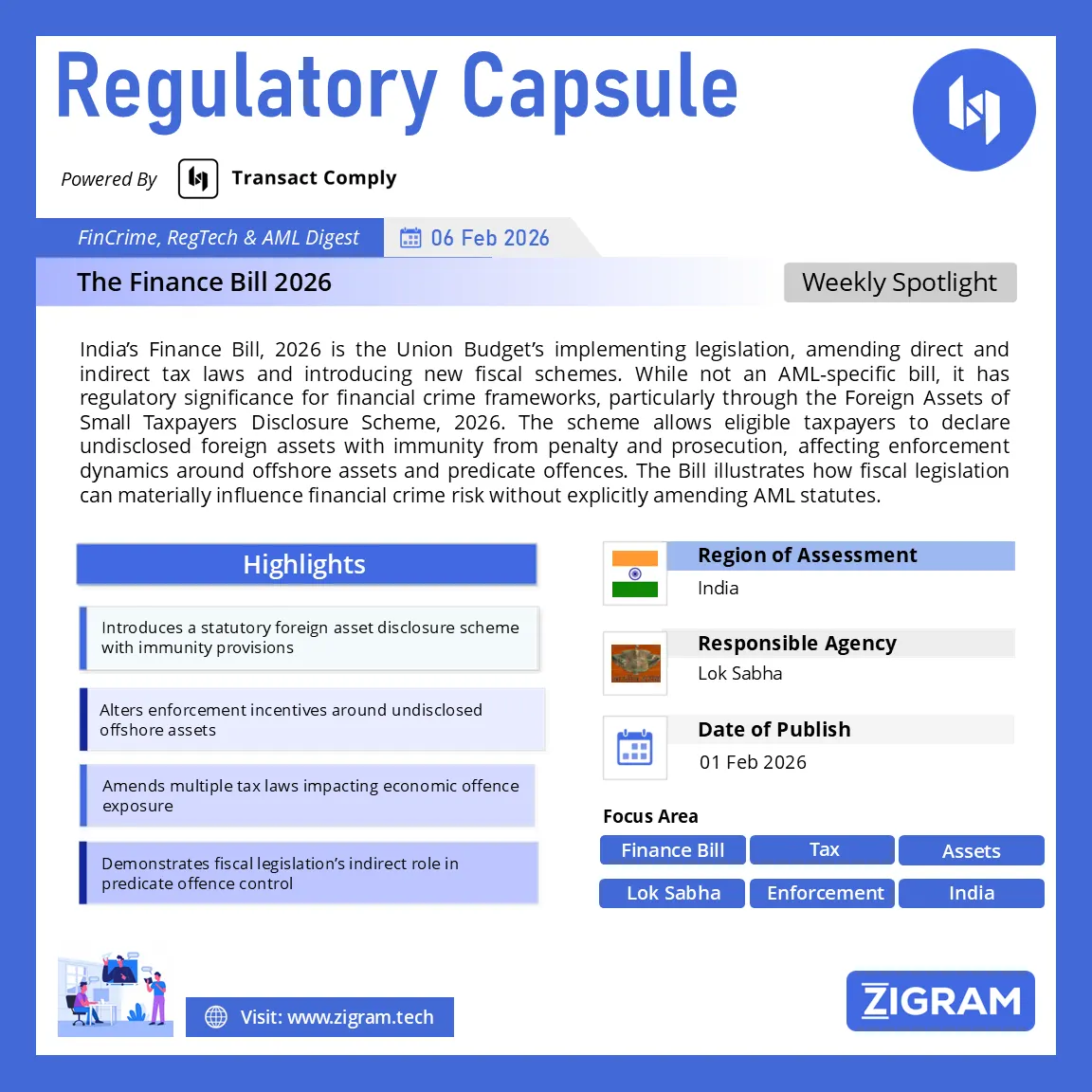

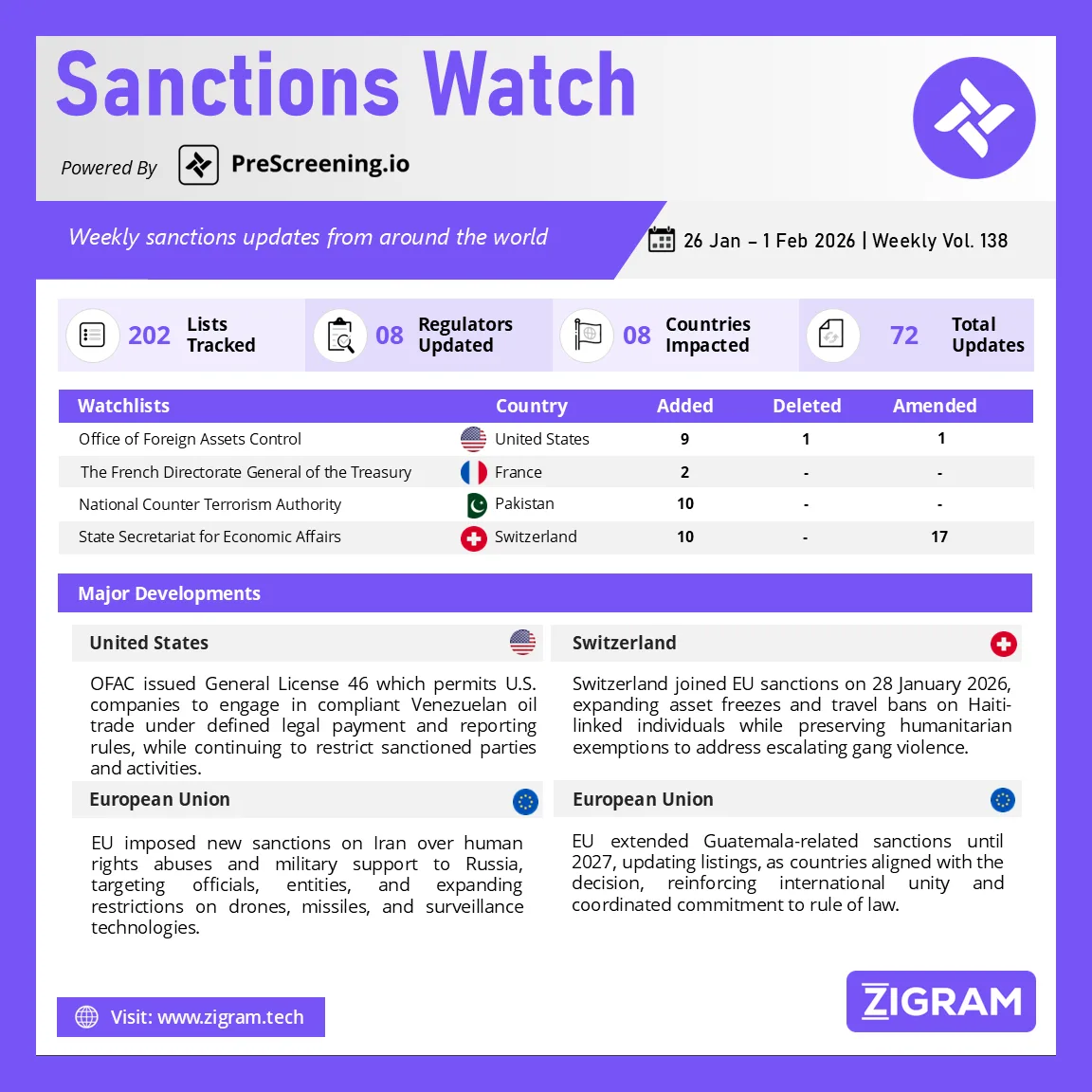

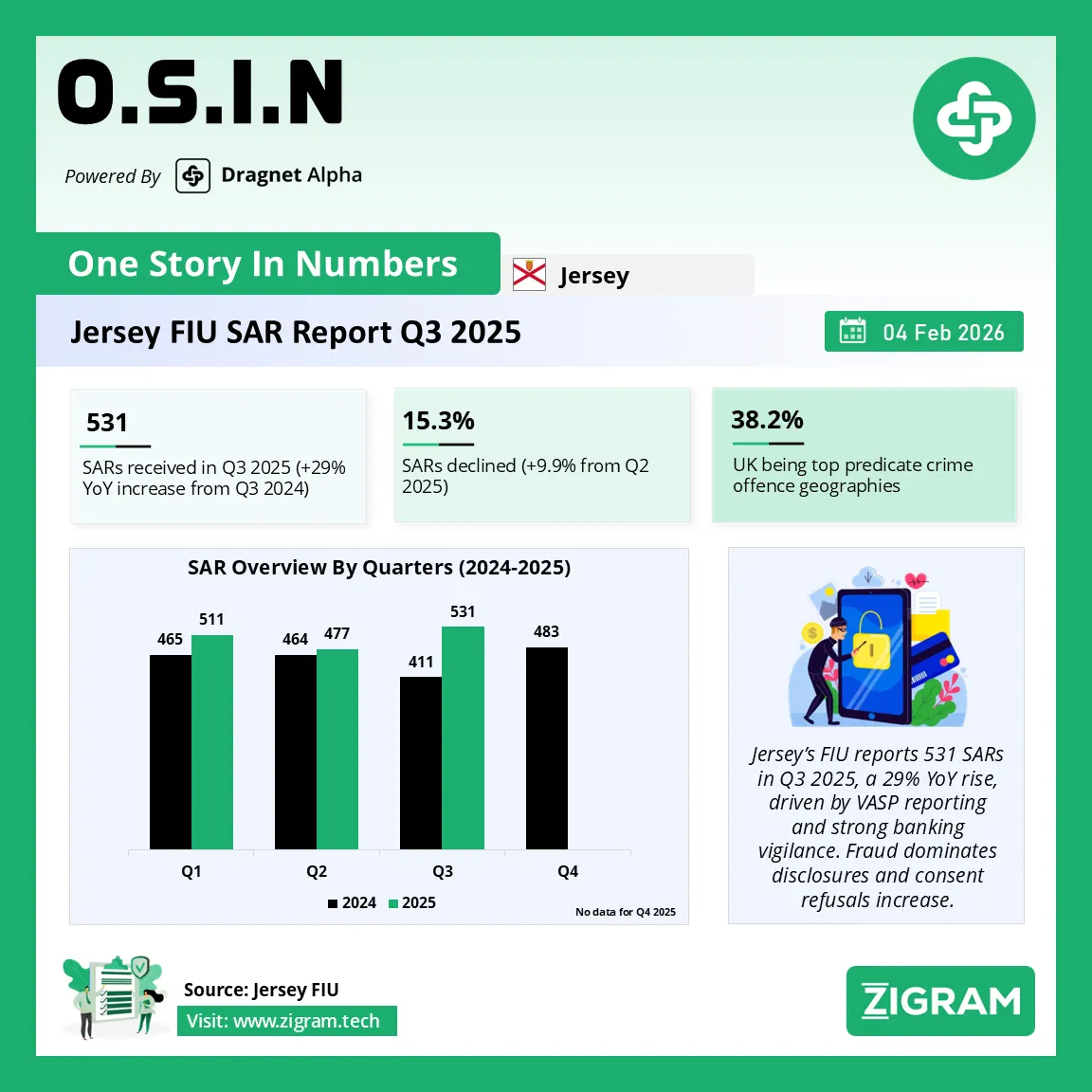

Articles

Explore insightful articles on cutting-edge topics like regulations, technological advancements, and critical insights into AML and financial crime risks

Resources

Our weekly dose of knowledge on the latest developments in anti-money laundering, financial crime, and other offenses, including news, regulations, and reports from around the world

LEARN MORE

Let's Find the Right Solution for You

Discover how our technology and data solutions can accelerate your compliance goals.

Explore Our Solutions

Explore Our Solutions Request Custom Pricing

Request Custom Pricing Schedule A Free Trial Or Demo

Schedule A Free Trial Or Demo