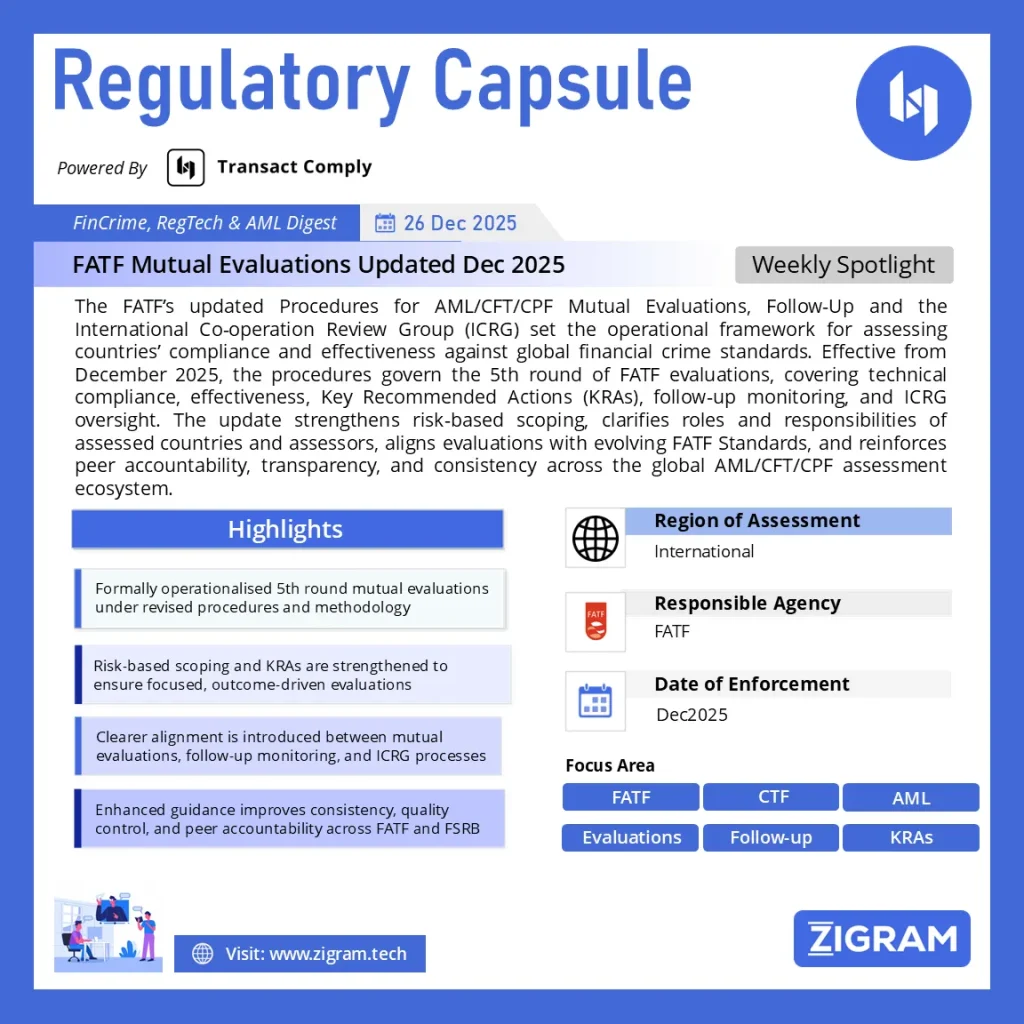

Regulation Name: Procedures For the FATF AML/CFT/CPF Mutual Evaluations, Follow-Up And ICRG

Date Of Issue: Dec 2025

Region: International

Agency: FATF

FATF Mutual Evaluation Procedures 2025 Explained: AML/CFT/CPF Assessments, Follow-Up and ICRG

Updated FATF Procedures for AML/CFT/CPF Mutual Evaluations – December 2025

The Financial Action Task Force (FATF) updated its Procedures for AML/CFT/CPF Mutual Evaluations, Follow-Up and International Co-operation Review Group (ICRG) in December 2025, setting the operational framework for the 5th round of FATF mutual evaluations, which began in 2024.

These procedures define how countries are assessed, how deficiencies are monitored, and how jurisdictions are escalated to enhanced monitoring or the grey list. For regulators, financial institutions, fintechs, and compliance professionals, the updated procedures clarify what FATF expects in practice—not just on paper.

What Are FATF Mutual Evaluation Procedures?

FATF Mutual Evaluation Procedures are the official rules that govern how FATF and its Global Network assess a country’s:

- Anti-Money Laundering (AML) framework

- Counter-Terrorist Financing (CFT) controls

- Counter-Proliferation Financing (CPF) measures

The procedures apply to:

- Mutual Evaluations (MEs)

- Regular and Enhanced Follow-Up

- ICRG reviews for high-risk jurisdictions

They are applied uniformly across FATF members and FATF-Style Regional Bodies (FSRBs) to ensure consistency and fairness.

FATF 5th Round of Mutual Evaluations: What Changed?

The 5th round of FATF evaluations, launched in 2024, reflects a stronger emphasis on:

- Effectiveness over formal compliance

- Risk-based assessment and scoping

- Outcome-driven remediation

- Accountability through timelines and peer pressure

Countries are assessed against the FATF Standards and Methodology in force at the date of their technical compliance submission, while later changes are addressed during follow-up rather than re-opening the evaluation.

Scope of FATF Assessments: Technical Compliance vs Effectiveness

- Technical Compliance (TC)

Technical compliance assesses whether a country has:

- Appropriate AML/CFT/CPF laws and regulations

- Designated competent authorities

- Supervisory, enforcement, and reporting mechanisms

This is primarily a desk-based review, building on prior evaluations and follow-up reports.

- Effectiveness Assessment

Effectiveness evaluates whether the AML/CFT/CPF system actually works in practice, measured across 11 Immediate Outcomes (IOs), including:

- Risk understanding

- Supervision effectiveness

- Investigation and prosecution

- Confiscation of criminal assets

- International cooperation

FATF now places greater weight on real-world outcomes, not theoretical compliance.

Risk-Based Scheduling of FATF Mutual Evaluations

FATF schedules mutual evaluations based on:

- Time since the last evaluation (typically 5–11 years)

- National ML/TF/PF risk exposure

- Size and complexity of the financial system

- Follow-up or ICRG status

Countries with higher residual risk or prior deficiencies may be evaluated earlier or monitored more closely.

Coordination with IMF and World Bank FSAPs

FATF procedures formally align AML/CFT/CPF evaluations with:

- IMF and World Bank Financial Sector Assessment Programs (FSAP)

- Reports on the Observance of Standards and Codes (ROSCs)

Where timelines align, FATF’s Key Recommended Actions (KRA) Roadmap and Executive Summary feed directly into FSAP findings, strengthening global financial surveillance.

Roles and Responsibilities in the FATF Evaluation Process

Assessed Countries

Countries must:

- Demonstrate compliance and effectiveness

- Provide accurate, up-to-date data

- Ensure access to regulators, FIUs, law enforcement, judiciary, and private sector

Assessment Teams

Assessment teams:

- Produce independent Mutual Evaluation Reports (MERs)

- Evaluate both technical compliance and effectiveness

- Apply FATF precedent and methodology consistently

Reviewers and Follow-Up Experts

They ensure:

- Quality and consistency of reports

- Objective reassessment during follow-up

- Accurate technical compliance re-ratings

ICRG Joint Groups

ICRG Joint Groups:

- Monitor jurisdictions with strategic deficiencies

- Assess progress against action plans

- Recommend escalation, continuation, or exit from monitoring

Risk and Scoping: A Core Feature of FATF 2025 Procedures

Before the on-site visit, FATF conducts a risk and scoping exercise to:

- Identify high-risk areas requiring deeper scrutiny

- Reduce focus on lower-risk sectors where justified

- Align assessment depth with national ML/TF/PF risk

This allows FATF to focus on:

- Virtual assets and VASPs

- Beneficial ownership transparency

- Cross-border financial flows

- Sanctions and proliferation financing risks

FATF On-Site Visits: What Happens During an Evaluation?

FATF on-site visits typically last 13–16 working days and include meetings with:

- Regulators and supervisors

- Financial Intelligence Units (FIUs)

- Law enforcement agencies

- Prosecutors and judiciary

- Banks, fintechs, DNFBPs, and VASPs

The goal is to validate effectiveness claims, test supervisory practices, and assess real enforcement outcomes.

Follow-Up and ICRG: How FATF Enforces Compliance

After the Mutual Evaluation:

- Countries enter Regular Follow-Up or Enhanced Follow-Up

- Jurisdictions with serious deficiencies may be referred to ICRG

- Time-bound Key Recommended Actions (KRAs) are monitored

- Lack of progress can lead to public statements or grey-listing

This structured follow-up mechanism is FATF’s primary enforcement lever.

Why FATF Procedures 2025 Matter for Financial Institutions

For banks, fintechs, crypto firms, and compliance teams, FATF’s updated procedures mean:

- Higher expectations for risk-based controls

- Stronger regulatory scrutiny aligned with FATF findings

- Increased supervisory pressure following poor national ratings

- Greater focus on data, outcomes, and auditability

National FATF performance increasingly shapes regulatory enforcement intensity at the institution level.

Key Takeaway: FATF Is Moving from Compliance to Outcomes

The December 2025 FATF Procedures confirm a clear shift:

AML/CFT/CPF compliance is no longer about ticking boxes—it is about demonstrable results, measurable effectiveness, and timely remediation.

Countries, regulators, and financial institutions that fail to align with this outcome-driven approach face longer monitoring cycles, reputational risk, and increased regulatory pressure.

FAQs:

What are FATF Mutual Evaluation Procedures?

They are the official rules governing how countries are assessed for AML/CFT/CPF compliance and effectiveness.

What is new in FATF procedures 2025?

Greater focus on effectiveness, risk-based scoping, structured follow-up, and accountability.

What is the role of ICRG?

ICRG monitors jurisdictions with strategic AML/CFT deficiencies and manages enhanced monitoring and grey-listing decisions.

When did the FATF 5th round start?

The 5th round of FATF mutual evaluations began in 2024.

Read about the full notice here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #FATF

- #AML

- #CFT

- #CPF

- #FinancialCrimeCompliance

- #MutualEvaluations

- #ICRG

- #AMLRegulation

- #GlobalCompliance

- #AntiMoneyLaundering