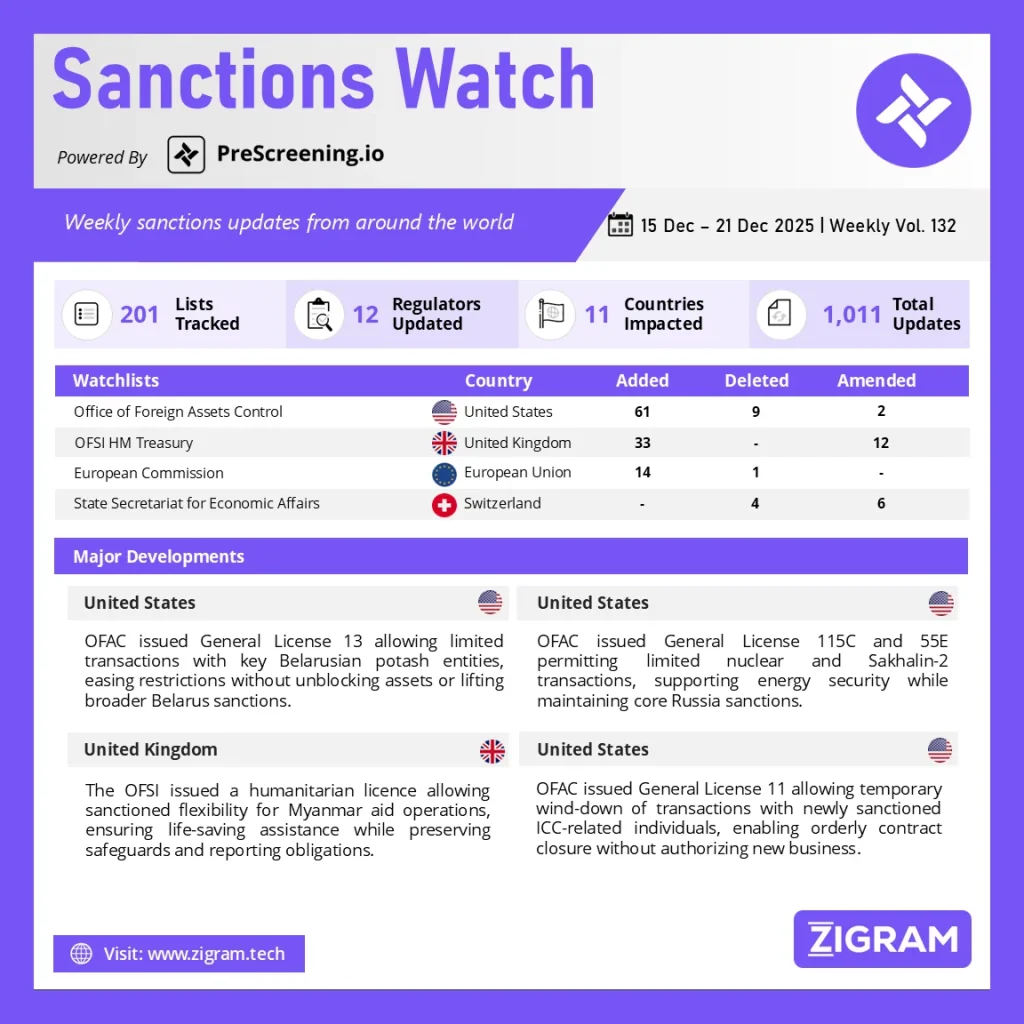

Sanctions Watch Vol 132

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

U.S. Issues General License Allowing Limited Transactions with Key Belarusian Potash Entities

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has issued General License No. 13, authorizing specific transactions involving three major Belarusian entities: Belarusian Potash Company, Agrorozkvit LLC, and Belaruskali OAO, along with any subsidiaries they own by 50 percent or more. The authorization applies only to activities that were previously prohibited under the Belarus Sanctions Regulations (31 CFR part 548) and is aimed at enabling certain economic engagements without fully lifting sanctions against the Belarusian regime.

While the license offers targeted relief, OFAC emphasized strict limitations. It does not permit the unblocking of any property frozen under existing U.S. sanctions, nor does it authorize dealings with any Belarus-related individuals or entities that remain designated. All other prohibitions under the Belarus Sanctions Regulations continue to apply unless separately licensed. The move reflects a calibrated approach by the U.S. government, balancing economic and geopolitical considerations while maintaining pressure on Belarusian state-linked enterprises.

This development is particularly notable given the global significance of Belarus’s potash sector, a key component of global fertilizer supply chains. Market observers anticipate short-term adjustments in trade flows as stakeholders assess the scope and boundaries of the newly authorized transactions. The license, signed by Bradley T. Smith, Director of OFAC, was issued on December 15, 2025, signaling ongoing U.S. scrutiny of Belarusian commercial activity amid broader sanctions policy.

U.S. Authorizes Limited Transactions for Russian Civil Nuclear Projects and Japan-Bound Sakhalin-2 Energy Shipments

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has issued two significant Russia-related General Licenses—GL 115C and GL 55E—providing targeted authorizations designed to support energy security and maintain stability in critical global supply chains while preserving broader sanctions pressure on Russia.

Under General License No. 115C, OFAC authorizes specific transactions related to civil nuclear energy projects that were initiated before November 21, 2024. Covered activities include dealings with major Russian financial institutions such as Gazprombank, Sberbank, VTB, Alfa-Bank, and the Central Bank of Russia, as well as their majority-owned subsidiaries, through June 18, 2026. The authorization is strictly limited to transactions supporting or maintaining qualifying civil nuclear projects. It explicitly prohibits opening or maintaining correspondent or payable-through accounts, debits to the accounts of the Central Bank or National Wealth Fund, and any dealings outside the scope of the nuclear-energy carve-out.

OFAC also issued General License No. 55E, which permits certain services and transactions related to the Sakhalin-2 project—specifically the maritime transport of crude oil originating from Sakhalin-2, provided the oil is destined solely for importation into Japan. The license additionally authorizes transactions involving Gazprombank and Sakhalin Energy LLC connected to the project. These permissions also extend through June 18, 2026. Prohibitions under Directives 2 and 4 remain in effect, and the license does not authorize dealings with other blocked parties under the Russian Harmful Foreign Activities Sanctions Regulations.

These updates reinforce OFAC’s strategy of allowing narrowly tailored energy-related activities that support key allies while maintaining rigorous restrictions against Russia’s broader financial and industrial sectors.

UK Issues New Humanitarian General Licence Allowing Limited Sanctions Flexibility for Myanmar Relief Efforts

The United Kingdom has issued a new General Licence (INT/2025/8257372) permitting carefully controlled humanitarian activity in Myanmar, easing certain sanctions restrictions to ensure uninterrupted delivery of life-saving assistance. Effective 19 December 2025, the licence is granted under both the Myanmar (Sanctions) Regulations 2021 and the Global Human Rights (Sanctions) Regulations 2020. It allows designated humanitarian organizations, UN bodies, UK-funded agencies, NGOs participating in UN-coordinated humanitarian plans, and their implementing partners to carry out essential humanitarian and basic-needs activities in Myanmar that would otherwise be restricted under sanctions rules.

The licence authorizes activities such as the provision, processing and payment of funds, supply of goods and services, and use of digital technologies—provided these are solely for humanitarian purposes and relate specifically to Myanmar. Financial institutions and regulated payment providers are likewise permitted to undertake actions necessary to facilitate these activities.

However, strict safeguards remain in place. Humanitarian actors must ensure that no funds or economic resources used originate from assets owned, held or controlled by sanctioned individuals or entities. Economic resources of a designated person may only be used in very narrow circumstances where they receive goods, funds or services in exchange directly related to authorized humanitarian work.

Organizations relying on this licence must notify HM Treasury’s Office of Financial Sanctions Implementation (OFSI) within 30 days of commencing activities. While the licence grants permissions, OFSI emphasizes that notifications do not constitute approval and do not override other applicable legal obligations. The licence may be varied, suspended or revoked at any time.

This measure aims to ensure sanctions do not impede urgent humanitarian needs amid Myanmar’s worsening crisis.

U.S. Issues General License Allowing Limited Wind-Down of Transactions with Newly Sanctioned ICC-Related Individuals

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has issued General License No. 11, authorizing a temporary wind-down period for transactions involving individuals newly designated under the International Criminal Court-Related Sanctions Regulations (ICCSR), 31 CFR part 528. Issued on December 18, 2025, the licence permits U.S. persons to conduct transactions that are ordinarily incident and necessary to the wind-down of dealings involving three blocked parties: Gocha Lordkipanidze, Erdenebalsuren Damdin, and any entities in which they hold a 50% or greater ownership interest, individually or collectively. The authorization extends through January 17, 2026, providing a defined period for businesses and financial institutions to settle outstanding obligations, unwind existing contracts, and redirect payment flows. OFAC mandates that any payment owed to a blocked person during this wind-down must be deposited into a blocked, interest-bearing account in the United States, consistent with regulatory requirements.

The General License does not authorize any transactions involving other ICCSR-designated individuals or entities, nor does it allow new business or financial engagements with the listed people beyond what is necessary for lawful wind-down activities. All other prohibitions under the ICCSR remain fully in effect.

The issuance of General License No. 11 reflects OFAC’s standard practice of providing a structured compliance pathway when new sanctions are imposed, ensuring an orderly cessation of transactions while maintaining pressure on targeted individuals associated with International Criminal Court–related concerns.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #OFAC

- #Sanctions

- #GeneralLicense

- #EnergySecurity

- #SanctionsRelief

- #Myanmar

- #HumanitarianAid

- #CivilNuclear

- #SanctionsCompliance

- #ICC