UK AML/CFT Supervision Report 2024–25: What It Means for Financial Institutions, Professional Services, and Compliance Leaders

Why the UK AML/CFT Supervision Report 2024–25 Matters

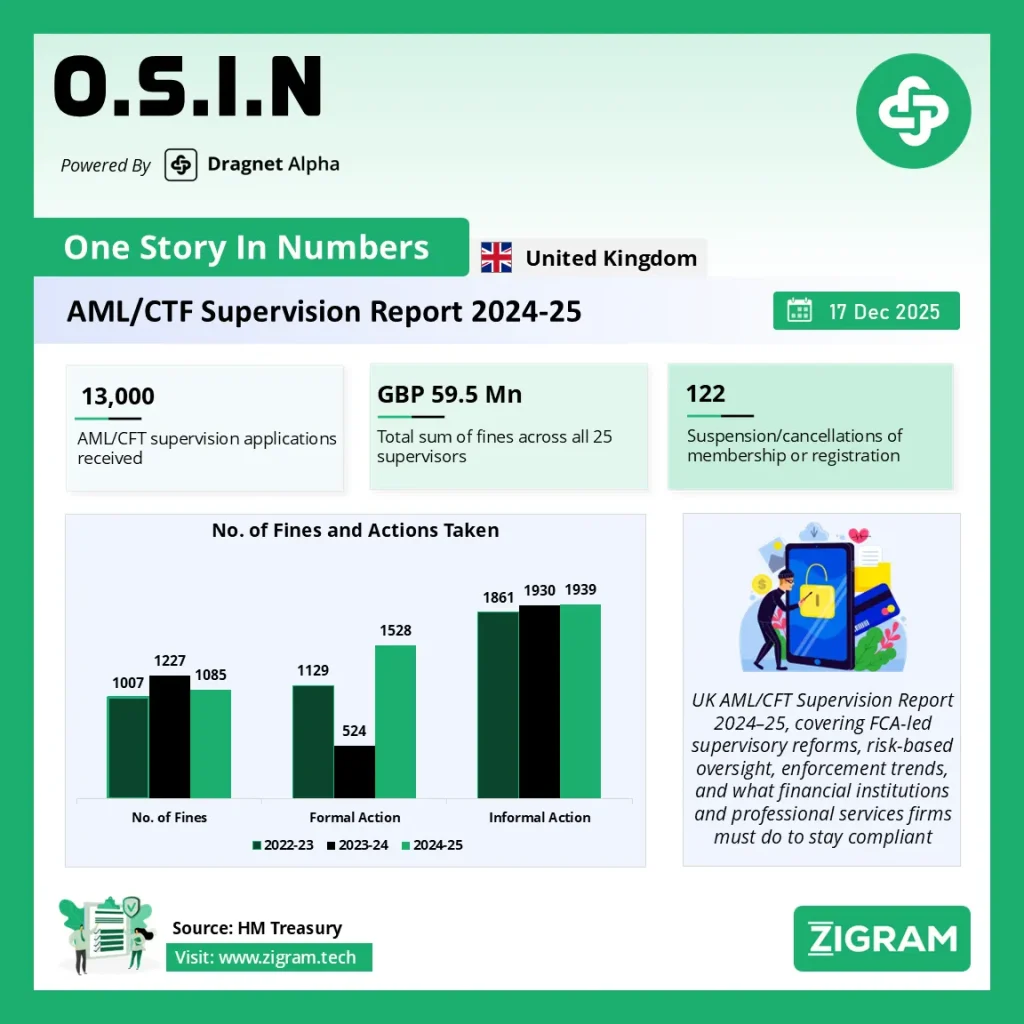

The Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) Supervision Report 2024–25, published by HM Treasury, offers the most comprehensive assessment to date of how the UK supervises financial institutions, professional services firms, and other regulated sectors against illicit finance risks. As the UK prepares for major supervisory reform and an upcoming FATF mutual evaluation, the report provides critical insights into supervisory effectiveness, enforcement trends, risk prioritisation, and future regulatory direction .

For banks, crypto firms, casinos, accountants, lawyers, and compliance teams operating in or with the UK, this report signals tighter expectations, more data-driven supervision, and higher accountability.

Overview of the UK AML/CFT Supervisory Framework

The UK operates one of the most extensive AML/CFT supervisory regimes globally, covering 25 supervisors, including:

- The Financial Conduct Authority (FCA)

- HM Revenue & Customs (HMRC)

- The Gambling Commission (GC)

- 22 Professional Body Supervisors (PBSs) for legal and accountancy sectors

Supervisors are responsible for gatekeeping, risk assessment, monitoring compliance with the Money Laundering Regulations (MLRs), enforcement actions, and coordination with law enforcement agencies.

Key Regulatory Shift: FCA to Become Supervisor for Professional Services

One of the most significant developments highlighted in the report is the UK Government’s decision to appoint the FCA as the AML/CFT supervisor for professional services firms, including:

- Legal Service Providers (LSPs)

- Accountancy Service Providers (ASPs)

- Trust and Company Service Providers (TCSPs)

Once implemented through legislation, this reform will transfer AML supervision away from PBSs to the FCA, aiming to deliver greater consistency, clearer accountability, and stronger enforcement capability .

Gatekeeping and Risk Assessment: Stronger Front-Line Controls

Registration and Fit-and-Proper Checks

In 2024–25, supervisors received nearly 13,000 applications for AML supervision, rejecting approximately 9%, often due to inadequate controls or integrity concerns. This reinforces the UK’s emphasis on preventing high-risk or unfit firms from entering regulated sectors .

Risk Distribution Across the Regulated Population

Across all supervisors:

- 9% of firms were rated high-risk

- 35% medium-risk

- 56% low-risk

High-risk exposure remains concentrated in cryptoassets, money services, casinos, TCSPs, and parts of professional services, reflecting global typologies and FATF risk priorities .

Monitoring and Supervision: Data-Driven, Risk-Based, and More Intensive

Increased Supervisory Activity

During 2024–25:

- 7,991 desk-based reviews and onsite inspections were conducted

- 693 full-time equivalent staff supported AML supervision

- £57 million was spent on AML/CFT supervision, a 24% increase year-on-year

Supervisors are clearly shifting toward intensive, targeted oversight, particularly for high-risk firms .

New Effectiveness Metrics Introduced

For the first time, supervisors tracked:

- Persistent non-compliance (firms failing repeatedly)

- Risk re-categorisation after inspections

These metrics align closely with FATF’s effectiveness-focused methodology and will directly influence the UK’s future international assessment.

Sector-Specific Insights

Financial Conduct Authority (FCA)

- Supervised approximately 16,000 firms

- Identified retail banking, e-money, wholesale banking, wealth management, and cryptoassets as highest risk

- Increased use of advanced analytics, AI-driven outlier detection, and multi-firm thematic reviews

- Common weaknesses: poor AML knowledge, weak CDD, inadequate documentation

Gambling Commission

- Supervised 257 casino operators

- 42% rated high-risk

- Key risks: cash-intensive activity, remote gambling, AI-enabled onboarding abuse, prepaid instruments

- 40% of assessed firms found non-compliant, highlighting persistent vulnerabilities in the sector

HMRC-Supervised Sectors

- Covered 36,782 businesses, including estate agents, MSBs, TCSPs, and art market participants

- TCSPs, MSBs, and art dealers remain highest risk

- Annual bulk screening of beneficial owners and managers reinforces focus on ownership transparency

Professional Body Supervisors (PBSs)

- Supervised over 41,000 legal and accountancy firms

- 9% classified as high-risk

- Significant variation in supervisory maturity, reinforcing the rationale for FCA consolidation

Enforcement and Compliance Outcomes

Supervisors increasingly rely on:

- Formal and informal enforcement actions

- Risk-segmented penalties

- Public disclosure of enforcement outcomes

Across sectors, 15% of firms found non-compliant had also failed previous assessments, underlining the regulator’s growing intolerance for repeat breaches.

Strategic Context: FATF, National Risk Assessment, and Economic Crime Policy

The report aligns AML supervision with:

- The UK Anti-Corruption Strategy

- The Economic Crime Plan 2023–26

- The National Risk Assessment 2025

- Preparations for the FATF Mutual Evaluation Report (expected 2028)

Supervision effectiveness, not just technical compliance, will be central to how the UK is judged internationally.

What This Means for Regulated Firms

For regulated entities, the message is clear:

- AML systems must be risk-based, evidence-driven, and continuously updated

- Poor documentation and weak CDD remain top enforcement triggers

- Supervisory scrutiny will intensify, not ease, during the transition period

- Data quality, SAR effectiveness, and governance oversight are now board-level issues

Firms that treat AML as a checkbox exercise face increasing regulatory, financial, and reputational risk.

Conclusion: A More Assertive, Centralised, and Outcome-Focused AML Regime

The UK AML/CFT Supervision Report 2024–25 confirms a decisive shift toward centralised oversight, smarter supervision, and measurable effectiveness. As supervisory reform progresses and FATF scrutiny intensifies, compliance leaders must invest in robust AML frameworks, advanced monitoring capabilities, and proactive regulatory engagement.

For institutions operating in high-risk sectors, the cost of non-compliance has never been clearer.

Click here to read the full report.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #AML

- #AntiMoneyLaundering

- #FinancialCrime

- #UKRegulation

- #AMLCompliance

- #SupervisionReport

- #FinancialIntelligence

- #SuspiciousTransactions

- #RiskBasedApproach

- #Enforcement

- #TerroristFinancing

- #RegTech