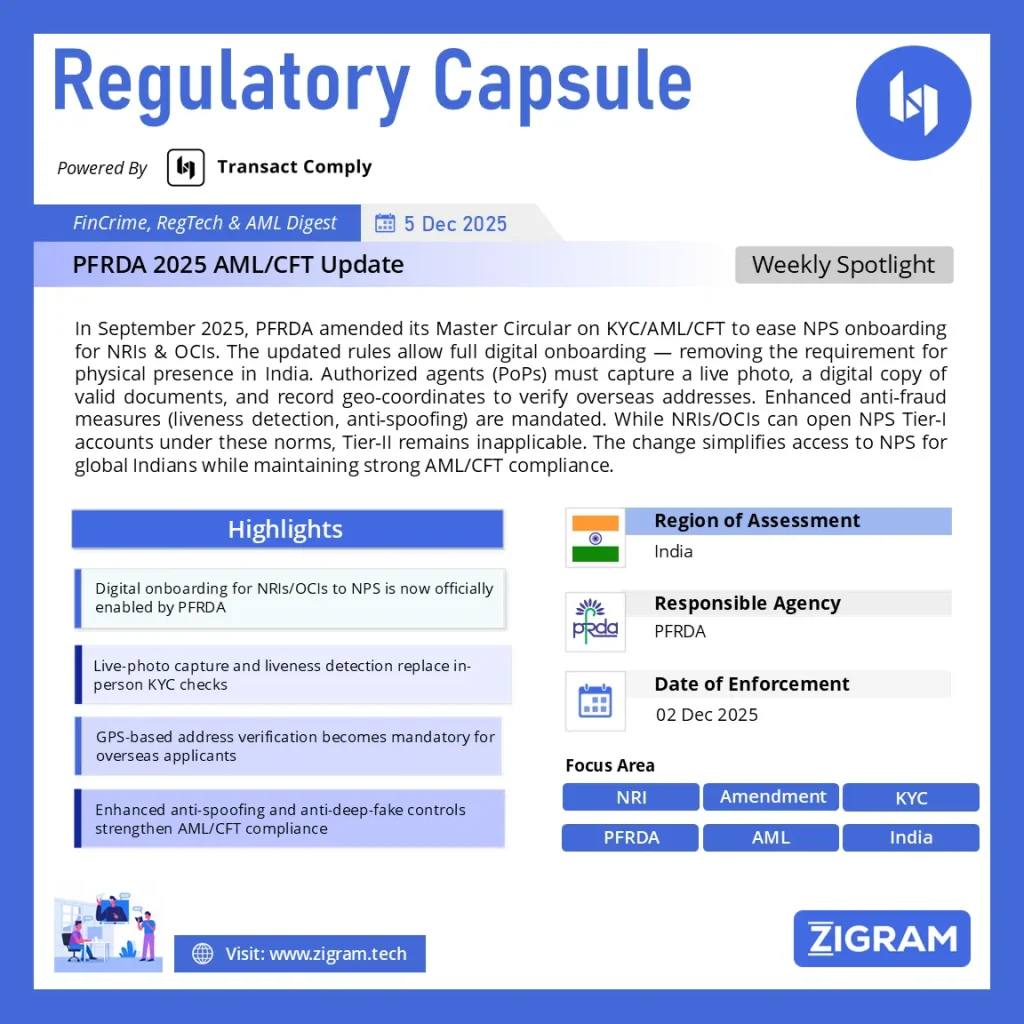

Regulation Name: PFRDA AML/CFT Update

Date Of Issue: 02 Dec 2025

Region: India

Agency: PFRDA

What the 2025 PFRDA AML/CFT Amendment Means for NRI & OCI Subscribers to NPS?

The PFRDA’s September 2025 amendment to its KYC/AML/CFT Master Circular marks a significant step in modernizing compliance norms — especially for Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs) seeking to enrol in the National Pension System (NPS). The updated guidelines streamline onboarding, enable complete digital KYC, and strengthen anti-money-laundering and anti–terrorist-financing safeguards.

Key changes & what they imply

- Digital onboarding allowed for NRIs/OCIs — The prior requirement that subscribers must be physically present in India for KYC has been removed. Now, NRI/OCI applicants can complete the process from abroad via authorized Point-of-Presence (PoP).

- Robust KYC/CDD procedures for non-resident subscribers — For remote/digital onboarding, the PoP must: capture a live photograph of the subscriber, collect a digital copy of an Officially Valid Document (OVD), and record geo-coordinates (GPS location) of the captured address. This ensures the address matches the overseas residence and prevents spoofed or falsified entries.

- Enhanced anti-fraud features — The digital onboarding process must implement “liveness detection,” randomness checks, and anti-spoofing / anti-deep-fake measures. This aims to make sure that the verification is genuine, not from a prerecorded or manipulated video / image.

- Clearer documentation for NRIs / OCIs — For NRIs: passport accepted as Proof of Identity (PoI) and Proof of Address (PoA); PoA may also include residence permit, overseas work permit, or government-issued foreign license/permit. For OCIs: OCI card plus foreign passport (for PoI), and overseas address proof for PoA.

- Applicability only to NPS Tier-I (not Tier-II for NRIs/OCIs) — The updated circular clarifies that NRI/OCI users can only open NPS Tier-I accounts under the revised KYC/AML framework; they are not eligible for Tier-II as per this circular.

Why does this change matter?

- Greater financial inclusion and ease for diaspora — NRIs and OCIs can now enroll in NPS from overseas, without needing to travel to India—a major convenience, especially for those living abroad.

- Reduced onboarding friction and faster processing — Digital KYC means faster verification, fewer physical hurdles, and possibly fewer delays — encouraging more global Indians to participate.

- Stronger AML/CFT compliance while enabling convenience — By embedding geo-location, liveness checks, and document verification, PFRDA balances ease of access with robust anti-fraud / anti–money-laundering safeguards.

- Standardization and clarity across PoPs & CRAs — With a unified Master Circular (updated 25 Sep 2025) and this amendment, PoPs and CRAs (Central Recordkeeping Agencies) now have clear instructions consistent with global AML/CFT standards.

What regulated entities / prospective NRI/OCI subscribers should note

- NRIs/OCIs must ensure they have valid overseas address proof (passport + residence permit / overseas ID / foreign license, etc.) if they wish to register for NPS.

- The digital KYC process must be done via an authorized PoP, capturing live photo + GPS + document scan + liveness detection.

- NPS Tier-II accounts remain unavailable to NRIs/OCIs under these rules — only Tier-I is permitted.

- PoPs/CRAs need to implement anti-spoofing & anti–deep-fake verification processes to comply with AML/CFT rules.

Read about the law here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #PFRDA

- #NPS

- #KYC

- #AML

- #CFT

- #DigitalOnboarding

- #NRI

- #OCI

- #RegTech

- #FinancialCompliance