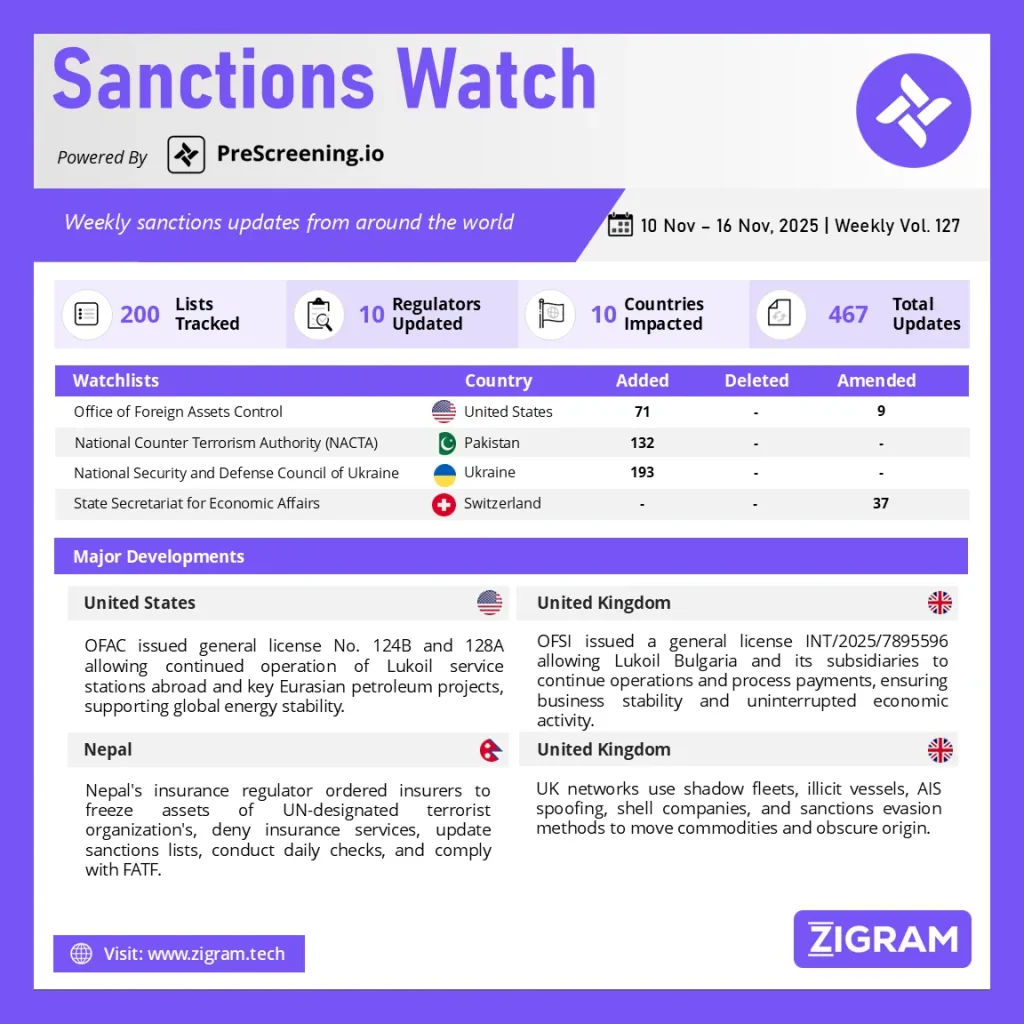

Sanctions Watch Vol 127

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

U.S. Issued New Licenses to Keep Global Fuel Operations Stable and Energy Projects Running Smoothly

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has taken significant steps to support global energy stability by issuing two key authorizations—General License 128A and General License 124B. These updated licenses ensure that essential fuel and petroleum operations across multiple countries can continue without disruption despite ongoing sanctions related to Russian harmful foreign activities.

General License 128A authorizes all necessary transactions involving Lukoil retail service stations operating outside Russia through December 13, 2025. This includes the purchase of goods and services, routine maintenance, and operational continuity. By allowing payments into blocked accounts, the authorization maintains strict compliance while ensuring that fuel supply chains remain uninterrupted for consumers and local economies.

Simultaneously, General License 124B enables continued petroleum-related activities linked to the Caspian Pipeline Consortium, Tengizchevroil, and Karachaganak projects. These major international energy ventures play a crucial role in global oil transportation and production. The license authorizes certain transactions involving Rosneft, Lukoil, and their majority-owned entities, ensuring that vital operations remain functional while maintaining strong oversight.

Together, these measures provide reassurance to global markets, protect regional energy security, and support economic stability at a time of elevated geopolitical tension.

OFSI Grants Temporary Licence Ensuring Smooth Continuation of Lukoil Bulgaria’s Business Operations

The UK has issued a positive and business-stabilizing general licence allowing Lukoil Bulgaria EOOD, Lukoil Neftochim Burgas AD, and their subsidiaries to continue operating seamlessly despite existing Russia-related sanctions. Effective from 14 November 2025 to 14 February 2026, this authorization provides essential certainty for businesses, employees, suppliers, and customers who depend on the company’s operations across Bulgaria. The licence, issued under Regulation 64 of the Russia (Sanctions) (EU Exit) Regulations 2019, exempts activities that would normally breach sanctions, ensuring that commercial operations can proceed without disruption.

The authorization permits all necessary payments to and from Lukoil Bulgaria entities, including those related to existing or new contracts. It also allows economic resources to flow between the entities and other business partners, ensuring continuity in fuel refining, distribution, and associated economic activities. Relevant UK financial institutions are also permitted to process these transactions, providing further clarity and operational confidence.

While the licence strictly applies only to Russia Regulations and does not override other UK sanctions, it reflects a pragmatic approach from HM Treasury aimed at maintaining economic stability and avoiding unintended commercial harm. By keeping essential energy operations active, the UK supports business continuity, market confidence, and regional energy security during a period of heightened geopolitical pressure.

Nepal Orders Insurance Firms to Freeze Assets of Terror Groups to Meet FATF Standards

The Nepal’s Insurance Authority has directed all insurers to immediately freeze assets and deny services to individuals and organizations designated as terrorists by the United Nations Security Council (UNSC), as part of the country’s efforts to exit the Financial Action Task Force (FATF) grey list. Nepal was placed on the grey list in February 2025 due to weaknesses in implementing targeted financial sanctions (TFS), particularly in preventing terrorist organizations and their associates from accessing financial systems.

The regulator’s new Guidelines on Targeted Financial Sanctions for Insurers, 2025 mandate insurers to block any funds, policies, settlements, or financial services linked to entities such as Lashkar-e-Toiba (LeT), Jaish-e-Mohammed (JeM), and Harakat-ul-Jihad Islami (HuJI), all of which are accused of supporting terrorist activities in the region.

The guidelines require insurers to conduct daily automated checks against updated sanction lists issued by the UN and Nepal’s Ministry of Home Affairs. In cases where a match is confirmed, insurers must freeze assets without delay and suspend all related transactions. Failure to comply could lead to fines ranging from NPR 1 million to NPR 50 million, warnings, or license revocation. This move aligns Nepal with global anti-money laundering and counter-terrorism financing standards as it works toward FATF compliance.

UK Agencies Strengthen Global Push Against Shadow Fleets and Sanctions-Evasion Networks

The latest Amber Alert issued by the UK’s National Crime Agency (NCA), in partnership with the Office of Financial Sanctions Implementation (OFSI) and the Foreign, Commonwealth & Development Office (FCDO), highlights significant progress in identifying and countering global sanctions-evasion networks. These illicit systems enable sanctioned regimes—including Russia, Iran and the DPRK—to generate billions in revenue by covertly transporting energy commodities through sophisticated maritime practices.

According to the alert, these networks use opaque corporate structures, shell companies, falsified documentation, and large “shadow fleets” of ageing vessels that routinely disable AIS tracking to conceal movement. The report notes that over 180 vessels linked to such operations were designated by sanctioning authorities in 2025, marking a major step in disrupting these supply chains.

The alert outlines how networks exploit permissive jurisdictions, offshore intermediaries, and deceptive ship-to-ship transfers to mask the true origin of sanctioned cargo. It also provides detailed typologies and red flags to help financial and maritime institutions detect suspicious activity. By strengthening public-private collaboration, enhancing awareness, and sharing actionable intelligence, the UK and its partners aim to curtail the financial lifelines of sanctioned regimes and reduce the risks posed by unsafe, covert maritime operations.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #SanctionsUpdate

- #GlobalEnergySecurity

- #OFAC

- #OFSI

- #ShadowFleets

- #FATF

- #CounterTerrorism

- #RussiaSanctions

- #MaritimeSecurity

- #FinancialCompliance