Law Society of Northern Ireland Releases Its 2024–25 AML Supervision Report

The Law Society of Northern Ireland (LSNI) has published its fifth Annual Supervisors’ Report on Anti-Money Laundering (AML) under Regulation 46A of the UK Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017. The 2024–25 report provides an in-depth review of AML/CTF compliance among solicitor firms in Northern Ireland and outlines the Society’s supervisory activities, enforcement actions, and ongoing reforms in the UK’s AML supervision regime.

Supervision Landscape

The LSNI is the sole professional body supervisor (PBS) for solicitors in Northern Ireland, overseeing 434 solicitor firms, of which 423 are in scope under the Money Laundering Regulations (MLRs). These include 362 relevant firms (RFs) and 61 relevant sole practitioners (RSPs).

Approximately 70% of all relevant firms are also registered as Trust or Company Service Providers (TCSPs) with HMRC, reflecting the high overlap between legal and company service functions.

The Society’s risk-based supervisory approach continues to evolve. Each relevant firm is assigned a risk profile—low, medium, or high—based on data gathered from annual AML returns, inspections, disciplinary records, and intelligence sharing. In 2024–25, 18% of firms were assessed as high-risk, an increase from 15% the previous year.

Monitoring, Inspections, and Risk Management

During the reporting period, the LSNI conducted 214 inspections and reviews, marking a 31% increase from 2023–24. This included 47 desk-based reviews (DBRs) and 167 onsite inspections. Of these,

76% were found compliant or generally compliant, and

24% were non-compliant, prompting formal or informal enforcement actions.

The rise in non-compliance cases—up 6% from the prior year—was attributed mainly to a larger number of assessments and enhanced supervisory scrutiny. Despite this, LSNI emphasized that overall compliance levels remain strong.

Frequent issues noted:

Inadequate or missing client due diligence (CDD) documentation

Delayed or absent source of funds (SoF) and source of wealth (SoW) verification

Incomplete firm-wide risk assessments

Weak recordkeeping and poor documentation of AML decisions

The most common area of non-compliance continues to be conveyancing, which carries the highest inherent money laundering risk.

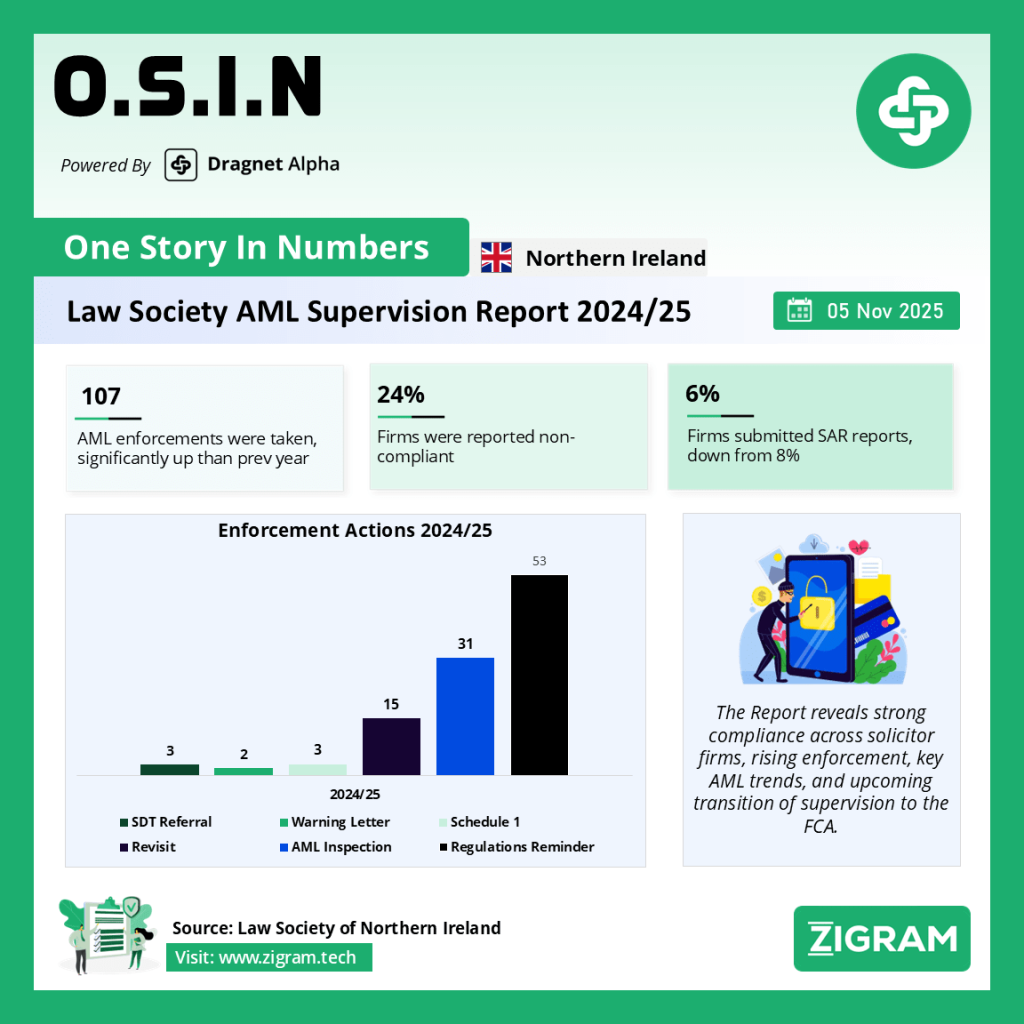

Key Enforcement Actions

LSNI exercised a range of enforcement measures in 2024–25, from warning letters and revisits to referrals to the Solicitors Disciplinary Tribunal (SDT).

- 107 enforcement actions were recorded, including 3 SDT referrals and 3 fines totaling £4,000.

- The most frequent breaches involved insufficient SoF/SoW checks (43%), poor CDD procedures (21%), and weak risk assessments (17%).

In several cases, LSNI’s follow-up inspections confirmed meaningful improvement. For example, one high-risk firm remediated its AML deficiencies by hiring a specialist consultant and implementing a firm-wide AML framework, earning praise from the Professional Conduct Committee.

Suspicious Activity Reporting (SARs)

Analysis of SAR data revealed a decrease in external reporting:

- Only 6% of firms submitted SARs to the National Crime Agency (NCA), compared to 8% last year.

- However, 90% of those reports were Defence Against Money Laundering (DAML) SARs, showing improved understanding of reporting requirements.

To enhance reporting quality, LSNI hosted a SARs training webinar with the UK Financial Intelligence Unit (UKFIU) in June 2024, attended by over four times more participants than the prior year. It also introduced a dedicated SARs resource hub on its member dashboard.

Training, Outreach, and Staff Development

The Society delivered a comprehensive education and communication programme to strengthen AML awareness across the legal sector:

Multiple AML-focused CPD sessions throughout 2024–25

A Risk Management webinar series covering effective controls and due diligence

In-person training at the October 2024 Conveyancing Conference, attended by over 400 solicitors

Updated AML and Suspicious Activity Reporting sections on the new LSNI website

Internally, LSNI’s Professional Conduct Team underwent continuous AML/CTF training and participated in regulatory forums including the Legal Sector Affinity Group (LSAG), AML Supervisors’ Forum, and FIN-NET. Staff also attended the SRA Compliance Officers Conference, fostering cross-jurisdictional exchange on AML supervision.

Sanctions and Cross-Sector Cooperation

Given the dynamic UK sanctions regime, LSNI reinforced guidance to firms through:

Regular updates on OFSI sanctions lists and general licences

Inclusion of sanctions compliance in AML CPD training

Participation in the OFSI threat and vulnerability survey

Signposting members to OFSI’s consolidated list and email alert system

These initiatives aim to ensure that solicitors remain vigilant against sanction breaches, especially in cross-border transactions.

Transition to FCA Supervision

A pivotal development in 2025 was the UK Government’s decision to transfer AML/CTF supervisory responsibility for solicitors from the Law Society to the Financial Conduct Authority (FCA). The reform follows the 2023 consultation on modernizing the UK’s AML supervision framework. LSNI has pledged to work closely with the FCA during the transition to safeguard member interests and maintain compliance continuity.

Conclusion

The 2024–25 AML Supervisors’ Annual Report underscores the Law Society of Northern Ireland’s sustained efforts to strengthen AML compliance and risk management within the legal profession. Despite rising complexity and regulatory change, compliance levels remain high, supervision more data-driven, and industry awareness significantly improved.

As the legal sector prepares for FCA-led supervision, LSNI’s proactive engagement, educational outreach, and enforcement framework continue to uphold the integrity of Northern Ireland’s legal and financial systems.

Click here to read the full report.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #AntiMoneyLaundering

- #AMLCompliance

- #LawSocietyNI

- #FCA

- #FinancialCrime

- #LegalCompliance

- #RiskManagement

- #OPBAS