Regulation Name: STREAMLINE Act

Date Of Release: 21 Oct 2025

Region: United States

Agency: US Senate

STREAMLINE Act: Modernizing U.S. Anti-Money Laundering Reporting Thresholds

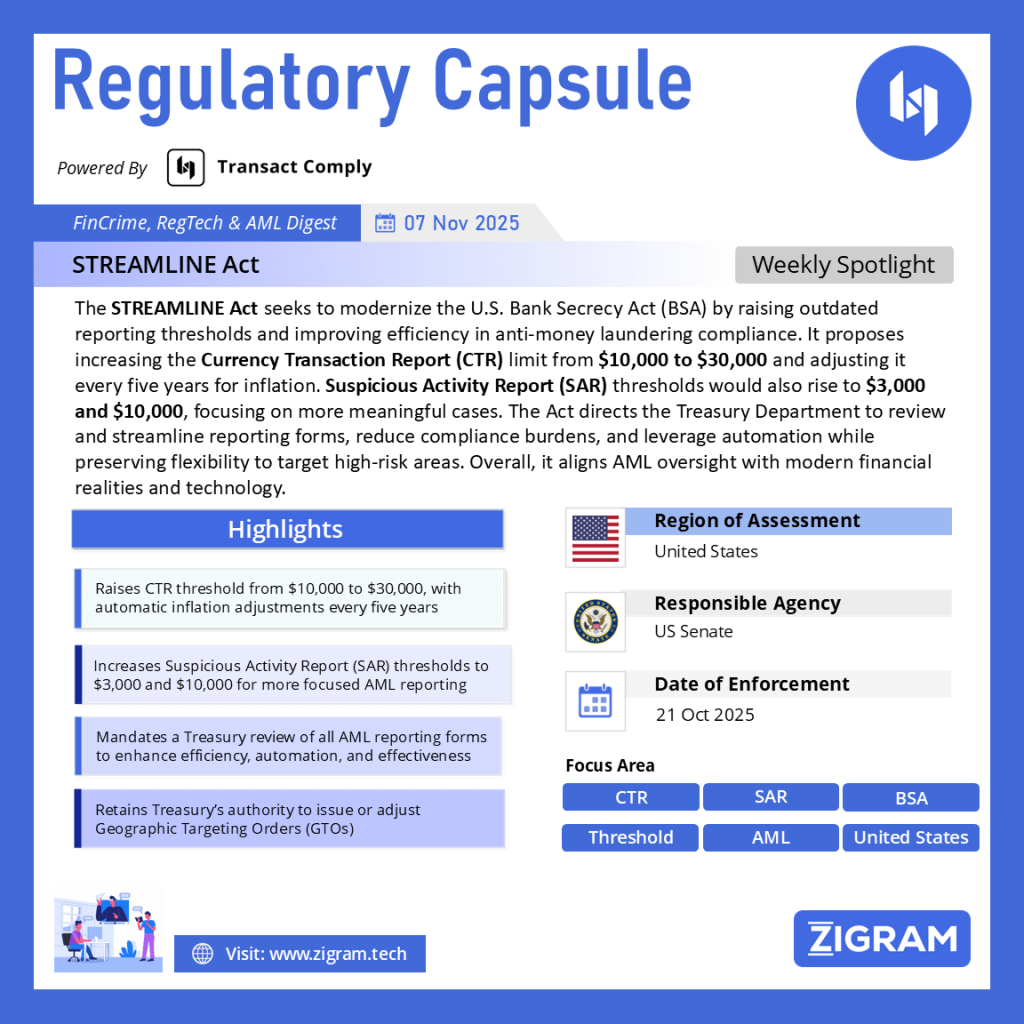

The U.S. Senate has introduced a significant new bill titled the Streamlining Transaction Reporting and Ensuring Anti-Money Laundering Improvements for a New Era Act, or the STREAMLINE Act. Sponsored by Senator John Kennedy, along with several co-sponsors, including Senators Tim Scott, Mike Rounds, Katie Britt, and Cynthia Lummis, among others, the bill seeks to reform how the U.S. Treasury manages financial reporting under the Bank Secrecy Act (BSA). Its primary goal is to reduce unnecessary compliance burdens while maintaining strong anti-money laundering (AML) safeguards.

Why the STREAMLINE Act Matters

For over 50 years, the $10,000 threshold for Currency Transaction Reports (CTRs) has remained unchanged, despite inflation and the evolving financial landscape. As a result, financial institutions have been filing millions of low-value reports, overwhelming both regulators and banks with compliance paperwork while offering limited value for detecting illicit finance.

The STREAMLINE Act directly addresses this issue by updating outdated reporting thresholds, introducing inflation adjustments, and requiring a comprehensive review of the Treasury’s AML reporting system.

Key Provisions of the STREAMLINE Act

Increasing the Currency Transaction Report (CTR) Threshold

Under 31 U.S.C. §§ 5313 and 5315, the Treasury currently mandates financial institutions to file a CTR for any transaction exceeding $10,000 in cash.

The STREAMLINE Act proposes to raise this threshold to $30,000, recognizing that $10,000 in the 1970s no longer represents a high-value transaction today.

Additionally, the Act mandates:

– Automatic inflation adjustments every five years, based on the Consumer Price Index (CPI) published by the Bureau of Labor Statistics.

– Each new adjustment will take effect on the first January 1 following publication.

This change aims to ensure that reporting requirements remain relevant and proportionate over time.

Updating Nonfinancial Business Reporting

Section 5331 of Title 31, which governs reports by nonfinancial trades or businesses that receive large amounts of coins or currency, will also see its threshold raised from $10,000 to $30,000.

Like CTRs, these figures will be automatically indexed to inflation every five years, maintaining consistency across the AML framework.

Raising Suspicious Activity Report (SAR) Thresholds

Suspicious Activity Reports (SARs) are critical tools in the detection of potential money laundering or terrorist financing. Currently, SAR filing thresholds vary:

– $2,000 for transactions involving possible criminal violations.

– $5,000 for transactions with potential insider involvement or where the suspect is identifiable.

The STREAMLINE Act updates these to:

– $3,000 (from $2,000) and

– $10,000 (from $5,000), respectively.

These new limits reflect modern transaction volumes and aim to focus attention on genuinely suspicious, higher-value activities rather than routine low-level anomalies.

Comprehensive Review and Modernization of AML Forms

Within 360 days of enactment, the Secretary of the Treasury must:

– Conduct a review of all forms and reporting/recordkeeping requirements under 31 U.S.C. §§ 5313, 5315, and 5318.

– Assess whether current systems can be improved through aggregation, prioritization, and automation.

– Update reporting systems where necessary to make them more efficient and effective in detecting illicit finance.

– Submit a detailed report to Congress summarizing findings and recommendations.

This review will build on the Anti-Money Laundering Act of 2020, reinforcing the ongoing modernization of the U.S. AML infrastructure.

Preserving the Treasury’s Flexibility

The bill includes a rule of construction ensuring that:

– The Secretary of the Treasury retains the authority to issue Geographic Targeting Orders (GTOs) under §5326 of Title 31.

– Any existing or future GTOs remain legally valid.

– The Secretary can still lower reporting thresholds if necessary to counter emerging financial crime risks.

This ensures that while thresholds rise overall, the Treasury can still act decisively when faced with regional or sector-specific AML threats.

Impact on Financial Institutions and the AML Ecosystem

If enacted, the STREAMLINE Act could significantly ease compliance burdens for banks, credit unions, and money service businesses. By focusing on higher-value and more relevant transactions, regulators will receive fewer but more actionable reports, enhancing the effectiveness of AML enforcement.

From a financial institution’s perspective, this means:

– Reduced operational costs tied to report generation.

– Fewer false positives and less time spent on routine filings.

– Greater focus on true risk indicators in transaction monitoring systems.

At the same time, the periodic inflation indexing ensures the framework remains adaptive and sustainable without requiring constant legislative intervention.

Potential Effects on the Bank Secrecy Act (BSA)

The STREAMLINE Act effectively modernizes key operational thresholds of the Bank Secrecy Act for the first time in decades. While it does not replace or weaken the BSA, it aligns it more closely with today’s financial realities and technological capabilities.

This modernization:

– Enhances the efficiency of the BSA framework.

– Reduces unnecessary data overload for FinCEN and law enforcement.

– Ensures continued flexibility to address high-risk areas.

Ultimately, it brings balance between regulatory vigilance and operational practicality, positioning the U.S. AML regime for a new era of smarter compliance.

The STREAMLINE Act represents a thoughtful recalibration of the United States’ AML reporting system. By raising outdated thresholds, mandating inflation-based adjustments, and emphasizing modernization, it promises to make AML compliance both more efficient and more effective. If enacted, it would mark one of the most practical updates to the Bank Secrecy Act in decades—streamlining compliance for institutions while strengthening the nation’s fight against financial crime.

Read about the law here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #STREAMLINEAct

- #BankSecrecyAct

- #AMLCompliance

- #FinCEN

- #USRegulation

- #FinancialCrime

- #MoneyLaundering

- #CTRs

- #SARs

- #TreasuryUpdate

- #RegTech

- #ComplianceModernization