IPA AML Annual Report 2024–25: Stronger Supervision, Smarter Compliance

The Insolvency Practitioners Association (IPA) has released its Anti-Money Laundering (AML) Annual Report 2024–25, marking another year of intensified regulatory oversight, enhanced information sharing, and a sharper focus on emerging financial crime risks across the UK insolvency sector.

Strengthening Risk-Based Supervision

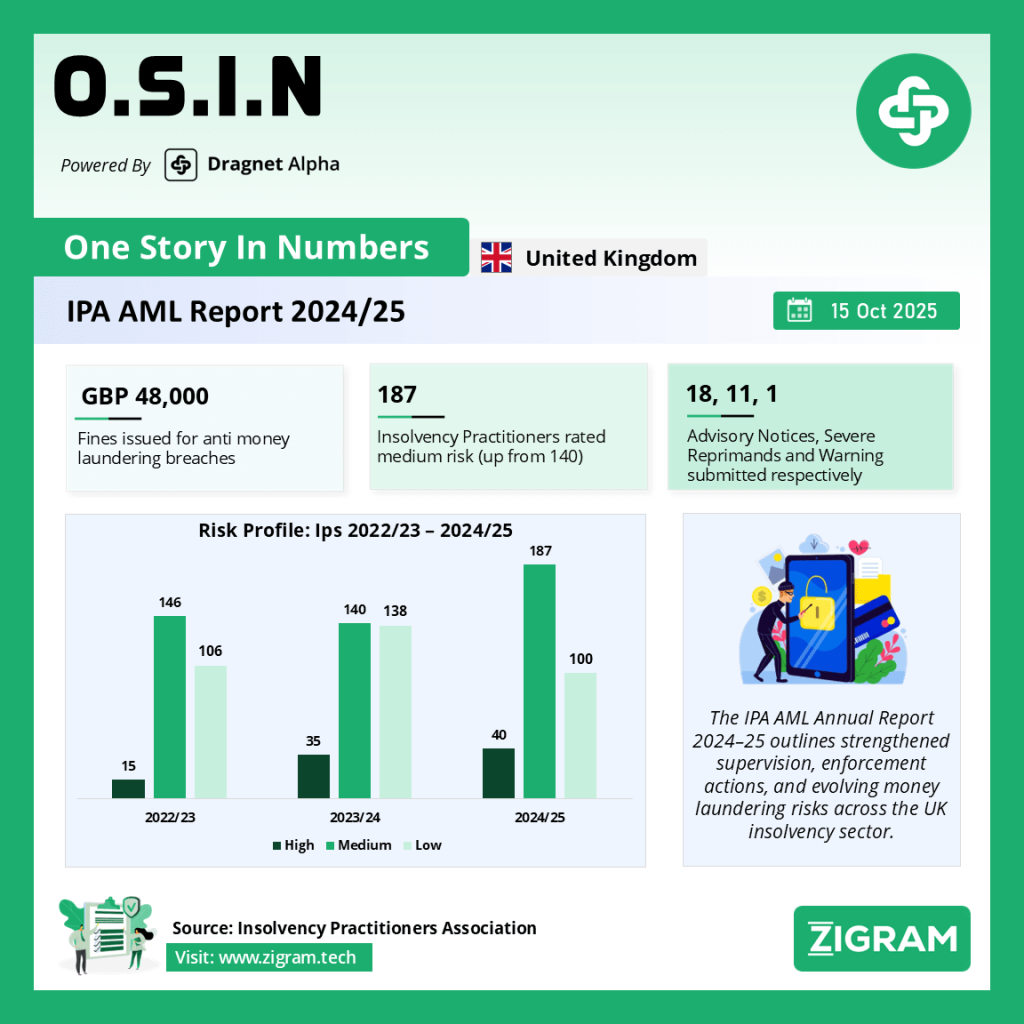

The IPA, which supervises 327 Insolvency Practitioners (IPs) across 202 firms, recorded a year of proactive supervision, undertaking 10 AML visits and 12 compliance reviews during 2024–25. Its supervisory approach—driven by continuous risk profiling, compliance reviews, and enforcement—has led to measurable improvement in AML practices among member firms.

The risk distribution data show a clear shift: more IPs and firms are now classified as medium risk rather than low. In 2024–25, 187 IPs were rated medium risk, compared with 140 the previous year, while high-risk firms increased from 24 to 46 due to new calibration that ties firm risk to their highest-risk practitioner.

The IPA attributes this to changing case profiles—especially Members’ Voluntary Liquidations (MVLs) and Creditors’ Voluntary Liquidations (CVLs)—and to non-reporting of Suspicious Activity Reports (SARs) by some Nominated Officers.

AML Activity and Enforcement Actions

Supervisory outcomes were backed by decisive enforcement measures. The IPA imposed £48,000 in fines for AML breaches, issued 18 Advisory Notices, 11 Severe Reprimands, one Reprimand, and one Warning. The two most frequent issues leading to disciplinary action were:

- Failure to complete Customer Due Diligence (CDD) before client engagement; and

- Inadequate or unclear SAR policies, particularly around tipping-off and Defence Against Money Laundering (DAML) requests.

Greater Engagement and Intelligence Sharing

The IPA reported higher engagement from practitioners, including 49 AML helpline queries and 8 whistleblowing disclosures during the year. Queries mainly related to CDD/EDD (25%), supervisory requests (18%), and SARs (8%).

Information-sharing efforts were strengthened through participation in the Accountancy AML Supervisors Group (AASG), the AML Supervisors Forum (AMLSF), and the Intelligence Sharing Expert Working Group (ISEWG). The IPA itself submitted 20 SARs to the National Crime Agency, reflecting its dual role as regulator and intelligence contributor.

Focus on Evolving Risks

The report highlights a growing concern around proliferation financing, which the UK’s 2025 National Risk Assessment (NRA) reaffirmed as an under-assessed area. The IPA noted that some distressed entities had tried to use insolvency procedures to shield assets from sanctions—a clear warning for IPs to assess these risks explicitly within their firm-wide risk assessments (FWRAs).

Insolvency case types such as administrations and MVLs remain high-risk categories due to challenges in verifying sources of wealth and funds. Personal insolvency, though generally lower risk, still poses threats through potential money-muling and the exploitation of vulnerable debtors.

Education, Training, and Member Support

The IPA maintained its focus on education and awareness throughout the year. It hosted its second “Spotlight on AML & Fraud” conference, two free AML webinars, and released three AML newsletters and 26 regulatory alerts. These initiatives aimed to translate complex regulatory expectations into actionable guidance for practitioners.

A key development was the IPA’s collaboration with Leeds University on a two-year research project—Behind Closed Books: Money Laundering in UK Insolvency Proceedings—to study patterns of illicit behaviour and identify potential vulnerabilities within insolvency frameworks.

The Road Ahead: 2025–26 Priorities

For the coming year, the IPA will double down on two areas: Suspicious Activity Reporting and AML Training.

- Supervisors plan to review firms that have not submitted SARs, checking for gaps in policies, staff awareness, and timeliness of reporting.

- AML training programmes will be assessed for quality, testing effectiveness, and ensuring Nominated Officers receive adequate knowledge and support.

The IPA also intends to re-issue its AML quality assurance questionnaire to capture current risk trends and feedback on its supervisory tools and guidance.

A Collaborative Future

The report concludes with a call for greater collaboration across regulators, academia, and practitioners. “Money laundering is a shared problem,” the IPA notes. “Timely intelligence is not a compliance luxury; it is an essential defence.”

The message is clear: AML supervision in the insolvency sector has evolved from checklist compliance to an intelligence-driven, risk-based framework. With rising sanctions risks, expanding case complexities, and the profession’s increasing accountability, the IPA’s focus on proactive education and enforcement sets a higher standard for AML compliance in the UK’s financial ecosystem.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #IPA

- #AML

- #FinancialCrime

- #Compliance

- #UKRegulation

- #AntiMoneyLaundering

- #RiskManagement

- #Enforcement