Activity Data as a Financial Intelligence Unit – 2024

The 2024 activity data highlights the scale and evolution of financial intelligence efforts, reflecting both the effectiveness of reporting entities and the growing complexities of financial crime. The report provides a comprehensive picture of how financial and non-financial obliged entities, international cooperation, and oversight bodies contributed to the fight against money laundering and terrorist financing in 2024.

Surge in Reporting from Obliged Entities

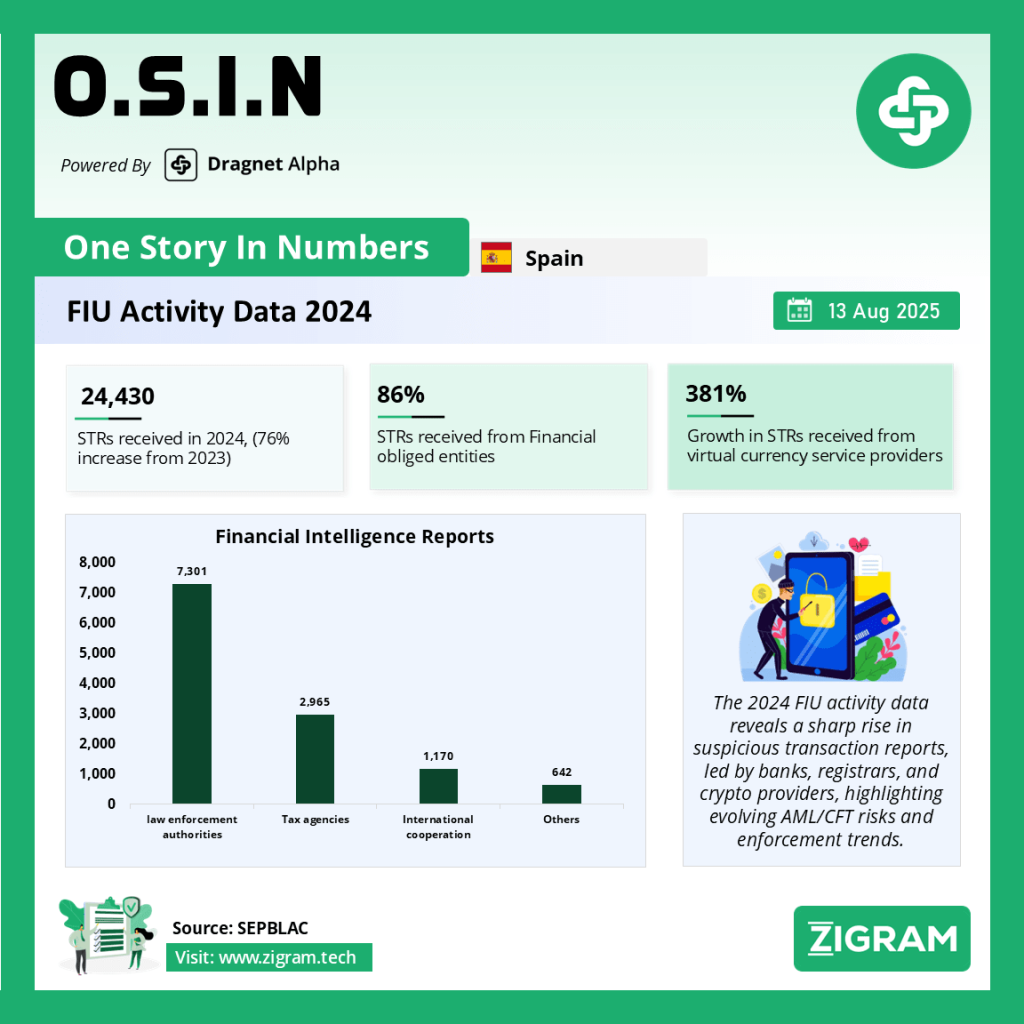

In 2024, the Financial Intelligence Unit (FIU) received a total of 24,320 suspicious transaction reports (STRs), marking a 76% increase compared to 2023.

Financial obliged entities were by far the dominant contributors, filing 20,924 reports (86% of the total). This represents an 88% jump from the previous year.

Non-financial obliged entities filed 2,770 reports (11%), up 34% from 2023.

Other sources such as Sepblac alerts and miscellaneous reporting parties accounted for a very small fraction, and in fact, showed a sharp decline compared to previous years.

This surge underscores the strengthening compliance culture among financial institutions and the widening perimeter of monitoring obligations.

Banking and Payments Sector in Focus

Banks and savings banks remained the backbone of suspicious reporting, filing 8,442 reports in 2024, a 39% increase from 2023. Credit institutions and payment institutions also contributed heavily. However, the most striking growth came from virtual currency service providers, which filed 972 reports, a staggering 381% rise compared to 2023. This reflects heightened scrutiny and risk in the digital assets sector.

Traditional financial actors such as insurance companies, investment service firms, and collective investment managers showed much smaller volumes, indicating either lower exposure or relatively weaker detection capacity.

Trends in Non-Financial Reporting

Among non-financial obliged entities, notaries and registrars were the most active.

Registrars filed 896 reports, a dramatic 100% increase from 2023.

Notaries submitted 665 reports, up 6%.

Conversely, traditionally sensitive sectors such as jewelry and precious metals trade saw reporting collapse to just 13 reports, down 84%. Similarly, gambling, casinos, and property developers recorded declines.

This suggests uneven awareness and enforcement across non-financial professions, even as certain regulated professions like registrars have stepped up.

Intelligence Flow and Cooperation

The FIU’s role extends beyond domestic monitoring to international cooperation and intelligence sharing. In 2024, it handled:

879 incoming requests for information, up 19% from 2023.

504 outgoing requests, steady compared to 2023.

509 incoming suspicious transaction reports from abroad, up 6%.

This increasing exchange underscores the global dimension of financial intelligence and the interdependence of FIUs worldwide.

Utilisation of Reports

In terms of dissemination of financial intelligence:

Law enforcement authorities were the primary recipients, obtaining 7,301 reports (60% of total), reflecting a 20% increase from 2023.

The tax agency received 2,965 reports (25%), a sharp 28% increase, showing greater use of financial intelligence in tax enforcement.

International cooperation remained a significant destination, with 1,170 reports shared abroad, up 35%.

Judicial authorities and prosecutors received comparatively fewer reports, highlighting that most intelligence remains at the preventive and investigative stage rather than immediate judicial escalation.

Shifting Risk Landscape

The statistics illustrate key trends shaping the FIU’s activity in 2024:

Digital finance risk – The explosion in reports from virtual currency providers highlights the systemic risks tied to crypto-related activities.

Professional gatekeepers – Registrars and notaries are increasingly central to identifying suspicious activity, especially around real estate and company structures.

Declining vigilance in traditional high-risk trades – Jewelry, gambling, and casinos showed a drop in reports, raising questions about enforcement and compliance.

Tax integration – The tax authority’s growing use of FIU intelligence signals a stronger link between AML/CFT monitoring and fiscal crime enforcement.

The 2024 FIU activity data presents a picture of a financial system under intense scrutiny, with banks, registrars, and digital asset providers at the forefront of suspicious activity reporting. While international cooperation is deepening, the unevenness across sectors shows that more work is required to close loopholes in traditional high-risk industries. The sharp increase in reporting volumes signals both improved detection and the rising sophistication of financial crime.

Read the full report here.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- \#FinancialCrime

- #MoneyLaundering

- #AML

- #CFT

- #RegTech

- #FinancialIntelligence

- #Compliance

- #CryptoRisks

- #SuspiciousTransactions

- #TaxEnforcement

- #InternationalCooperation

- #BankingCompliance

- #FIU