Digital Payment Fraud Statistics 2025: The Alarming Rise and How to Combat It

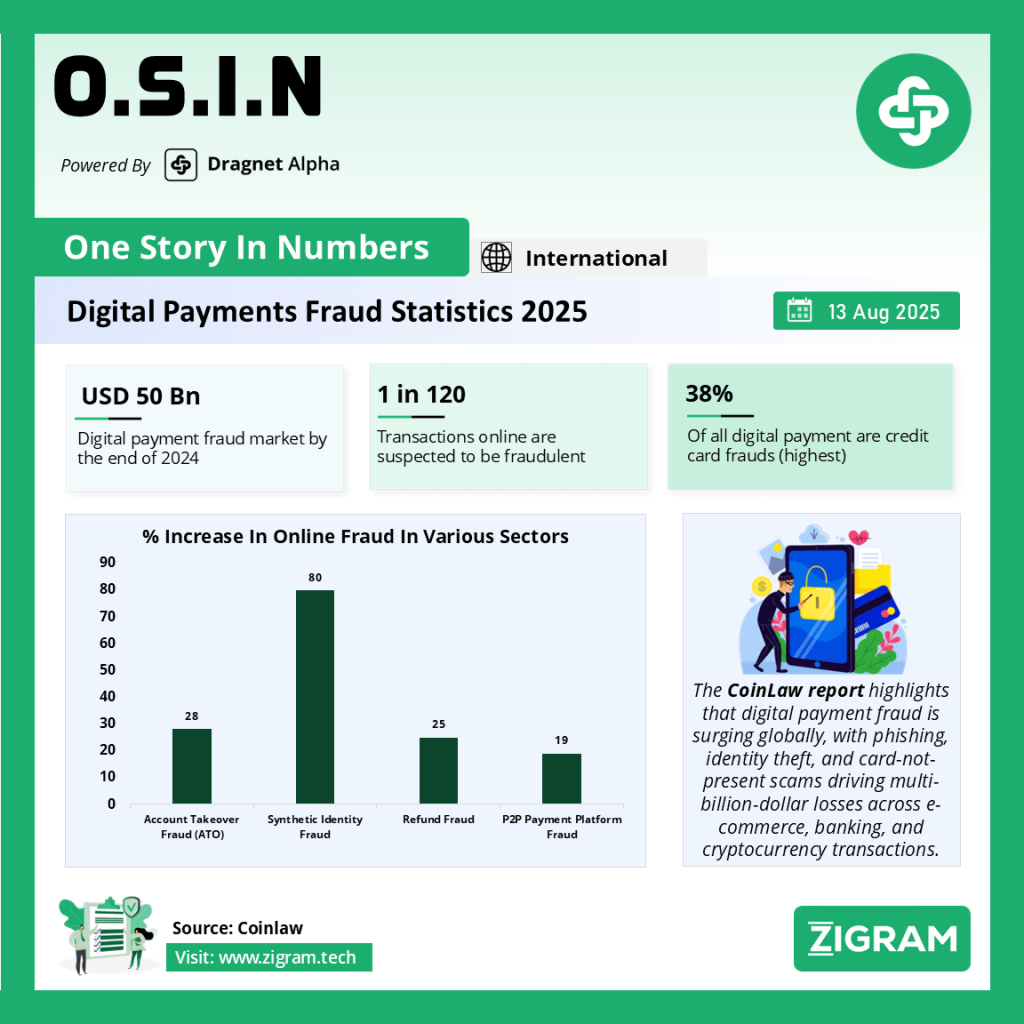

In recent years, the world has witnessed an unprecedented surge in digital payments, driven by e-commerce growth, fintech innovation, and widespread mobile adoption. While these advancements have revolutionized the way consumers transact, they have also opened new doors for cybercriminals. The latest CoinLaw Digital Payment Fraud Statistics 2025 report paints a stark picture: fraud is not only rising, but evolving at a pace that threatens the trust and stability of digital commerce.

The Current Fraud Landscape

One of the most striking findings from the report is the dominance of phishing, which contributes to 40% of all online fraud losses. This method, which tricks victims into revealing sensitive information, remains the most common and successful attack vector. Identity theft also remains a pressing issue, with one in every fifteen digital consumers affected annually, leading to significant personal and financial damage.

Businesses are shouldering heavy losses as well. Chargeback fraud—where fraudulent claims are made to reverse legitimate transactions—cost companies a staggering $20 billion in 2023. Adding to this burden is friendly fraud, where customers dispute genuine transactions, accounting for 15% of all e-commerce fraud losses. Both types of fraud not only lead to direct financial loss but also strain merchant–bank relationships and increase operational costs.

Fraud Techniques on the Rise

The report underscores how fraudsters are diversifying their tactics. Social engineering scams—where criminals manipulate victims into giving away confidential information—make up 30% of all fraud incidents globally. This highlights the fact that while technology enables fraud, human psychology is still one of the most exploited vulnerabilities.

Another growing concern is fake merchant websites, which have seen a 22% increase in fraud cases. These sites, often created around shopping seasons or discount events, lure customers with enticing offers before stealing their payment credentials. In the cryptocurrency space, payment fraud has increased by 15%, with schemes often rooted in phishing emails or fraudulent investment opportunities.

Credit Card and E-Commerce Fraud

Credit card fraud continues to lead the pack in terms of financial damage. Projected losses for 2024 stand at $37 billion, a 19% increase from the previous year. Much of this is driven by card-not-present (CNP) transactions, which occur when the physical card is not used—such as during online purchases. Alarmingly, CNP fraud accounts for nearly 80% of all e-commerce credit card fraud losses, reflecting the challenges of verifying transactions in remote payment environments.

E-commerce fraud overall is expected to surpass $50 billion globally in 2024, fueled by the growth of online shopping. Major sales events like Black Friday, Cyber Monday, and holiday seasons create perfect conditions for fraudsters to blend in with legitimate transaction surges, making detection even more difficult.

Why the Numbers Are Rising

Several factors contribute to the steep increase in fraud cases. The shift towards mobile payments has expanded the attack surface, with mobile transactions often lacking the same multi-layer authentication used in desktop environments. The global adoption of faster payment systems, while convenient, also leaves less time to detect and stop fraudulent activity before funds are transferred.

Moreover, the democratization of cybercrime tools has lowered the barrier to entry for would-be criminals. Dark web marketplaces sell phishing kits, stolen card data, and step-by-step fraud tutorials at low prices, making sophisticated fraud accessible to even low-skilled attackers.

The Human Factor in Fraud

While technology plays a key role in fraud prevention, the CoinLaw report makes it clear that human behavior remains a weak link. Phishing, social engineering, and friendly fraud thrive because they exploit trust, urgency, and lack of awareness. This means consumer education is as important as any technological safeguard.

For example, many phishing campaigns now use AI-generated content to mimic legitimate communications, making them harder to spot. Similarly, social media platforms have become fertile ground for scams, where fraudsters pose as legitimate merchants or service providers.

Prevention and Response Strategies

The growing scale and sophistication of digital payment fraud calls for a multi-pronged defense strategy:

Advanced Fraud Detection Systems

Businesses should invest in AI-powered fraud detection tools, which, according to industry data, can achieve up to 92% accuracy in identifying suspicious activity. Machine learning algorithms can adapt to evolving fraud patterns, reducing false positives while catching high-risk transactions.Multi-Factor Authentication (MFA)

Requiring users to authenticate with multiple credentials significantly reduces the risk of unauthorized access. Biometrics, one-time passwords, and device recognition add layers of protection that fraudsters find difficult to bypass.Consumer Awareness Campaigns

Since human error is often the entry point for fraud, education on identifying phishing attempts, verifying merchants, and securing personal devices is crucial. Clear communication from banks and merchants can help customers recognize and report fraud faster.Stronger Merchant Vetting

Payment processors and marketplaces should tighten onboarding procedures for merchants, using verification tools to weed out fake or high-risk vendors before they start accepting payments.Cross-Border Collaboration

With cross-border fraud on the rise, international cooperation among law enforcement, payment networks, and regulatory bodies is essential to track and dismantle fraud rings operating across jurisdictions.

Looking Ahead

The battle against digital payment fraud is a constant arms race. As technology advances, so too will the tactics of cybercriminals. The CoinLaw statistics make it clear that the threat landscape is expanding, with fraud affecting everything from traditional credit card transactions to cryptocurrency payments.

However, the situation is far from hopeless. By combining advanced detection technologies, strict merchant verification, cross-border intelligence sharing, and continuous consumer education, stakeholders can significantly reduce the incidence and impact of fraud. The key is to act quickly and decisively—fraud prevention must be proactive, not reactive.

Conclusion

The numbers from the Digital Payment Fraud Statistics 2025 report should serve as a wake-up call to consumers, businesses, and regulators alike. From phishing and identity theft to fake merchant websites and CNP fraud, the threats are varied and growing. As global e-commerce volumes soar past previous records, the cost of complacency will only rise. The path forward requires not only stronger technology but also greater awareness, collaboration, and vigilance at every level of the payment ecosystem.

Read the full report here.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #DigitalPayments

- #PaymentFraud

- #Cybersecurity

- #FraudPrevention

- #EcommerceSecurity

- #Fintech

- #OnlineFraud

- #CreditCardFraud

- #IdentityTheft

- #PhishingScams

- #CardNotPresent

- #ChargebackFraud

- #CryptoFraud

- #FraudDetection

- #CyberCrime