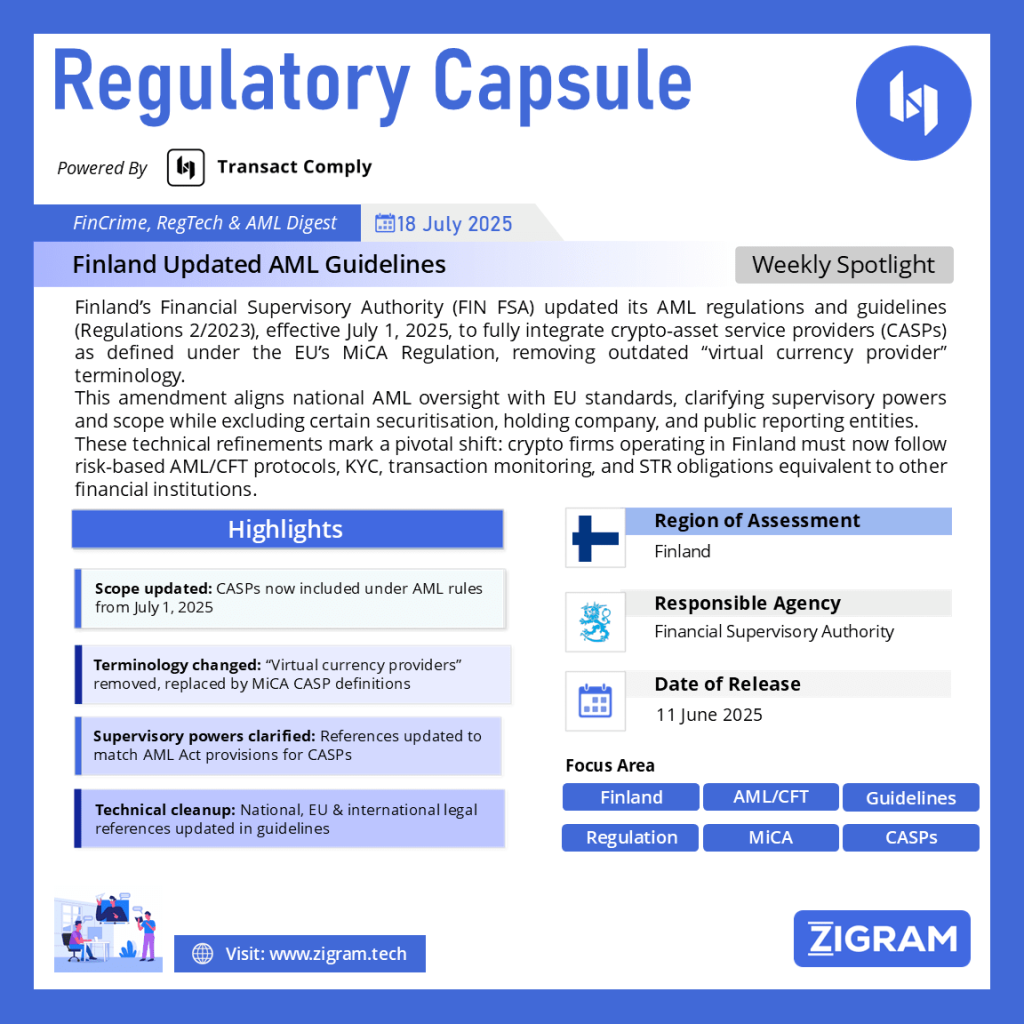

Regulation Name: Amendments to regulations and guidelines 2/2023 on the prevention of money laundering and terrorist financing

Date Of Release: 11 June 2025

Region: Finland

Agency: Financial Supervisory Authority

Finland’s 2025 AML Guidelines: Aligning Crypto Regulation with EU MiCA Standards

Finland has taken a significant leap forward in strengthening its Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) regime, particularly concerning crypto-asset oversight. On 1 July 2025, revised AML guidelines issued by the Finnish Financial Supervisory Authority (FIN-FSA) took effect. These changes align Finland’s national laws with the European Union’s Markets in Crypto-Assets Regulation (MiCA) and reinforce the country’s commitment to a harmonized regulatory environment across the bloc.

This article examines the key components, implications, and legal underpinnings of Finland’s updated AML guidelines, particularly in relation to the cryptocurrency sector.

Background: Finland’s AML Framework

Finland’s AML/CFT regime is primarily governed by the Act on Preventing Money Laundering and Terrorist Financing (444/2017). Until recently, virtual asset service providers (VASPs) were regulated under the Act on Virtual Currency Providers (572/2019), which was one of the earliest crypto-specific AML laws in the EU.

However, with the advent of MiCA Regulation (EU 2023/1114) and broader EU AML reforms, the Finnish framework required an update to ensure consistent application across the European Economic Area. The FIN-FSA’s new guidelines—rolled out in June 2025 and enforced from 1 July 2025—represent this harmonization effort.

Key Features of the Revised FIN-FSA Guidelines

1. Crypto-Asset Service Providers Now Within Full AML Scope

One of the most notable changes is the formal inclusion of crypto-asset service providers (CASPs)—including exchanges, custodians, wallet providers, and token issuers—under the AML regulatory perimeter. While previous regulations referenced “virtual currency providers,” this outdated terminology has been replaced to reflect MiCA’s broader asset definitions.

Key obligations for CASPs now include:

• Full Know-Your-Customer (KYC) procedures

• Customer Due Diligence (CDD) aligned with risk-based frameworks

• Suspicious Transaction Reporting (STR) to the Financial Intelligence Unit (FIU)

• Ongoing monitoring of business relationships

• Enhanced due diligence for high-risk customers or jurisdictions

2. Alignment with MiCA’s Terminology and Supervision

The revised guidance ensures terminological consistency with MiCA, including:

• Definitions for asset-referenced tokens, e-money tokens, and utility tokens

• Clear expectations for liquidity management, reserve backing, and redemption rights

• Governance and capital adequacy requirements for regulated crypto firms

These updates eliminate regulatory ambiguity and ensure that Finnish entities are not left behind as MiCA becomes the central regulatory framework across the EU.

3. Strengthened Risk-Based Approach

The FIN-FSA’s Guidelines 2/2023, which entered into force in June 2023, had already emphasized a risk-based approach to AML compliance. The 2025 update reinforces this approach with regard to:

• Transaction monitoring tools for detecting suspicious activities

• Sector-specific risk assessments, especially for new crypto entrants

• Focus on technology-driven compliance, including AI and blockchain analytics integration

Regulatory and Legal Context

A. Act 444/2017 & Act 572/2019

While Act 444/2017 remains the foundation of Finland’s AML framework, many of the crypto-specific provisions of Act 572/2019 are now subsumed under MiCA. The transition from national crypto rules to EU-level legislation marks a turning point in the country’s AML oversight.

B. MiCA Regulation (EU 2023/1114)

MiCA establishes the first EU-wide regime for crypto-assets, governing licensing, consumer protection, and market integrity. Finland’s guideline updates are a direct response to this regulation and represent early compliance efforts ahead of MiCA’s full enforcement deadlines in 2026.

Implications for Crypto Firms and Financial Institutions

1. Licensing and Registration: All CASPs operating in Finland must be duly registered and demonstrate compliance with AML obligations. Unlicensed firms face severe penalties.

2. Compliance Infrastructure: Firms must invest in robust AML systems—including onboarding workflows, transaction monitoring tools, and reporting infrastructure.

3. Cross-Border Consistency: Firms operating in multiple EU jurisdictions will benefit from a unified compliance framework under MiCA, reducing friction and enhancing interoperability.

4. Supervisory Scrutiny: The FIN-FSA is expected to increase audits and inspections, especially for crypto firms with high transaction volumes or connections to high-risk jurisdictions.

Conclusion

Finland’s updated AML guidelines, effective from July 2025, demonstrate the country’s proactive stance in adapting to EU-wide regulatory shifts—especially in the fast-evolving crypto ecosystem. By aligning with MiCA, Finland not only strengthens its national compliance environment but also positions itself as a forward-thinking jurisdiction in the fight against money laundering and financial crime.

As AML/CFT expectations continue to evolve across the EU and beyond, Finnish crypto firms and financial institutions must remain vigilant, invest in compliance technologies, and build risk-aware cultures. This transformation will be key to surviving and thriving in a regulated digital asset economy.

Read the full guidelines here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #Ley22837

- #VASPRegulaciónCR

- #ActivosVirtualesCR

- #SUGEFcrypto

- #AMLCostaRica

- #PlataformaVASP

- #CFTCostaRica

- #CriptoLeyCR