Sanctions Watch Vol 99

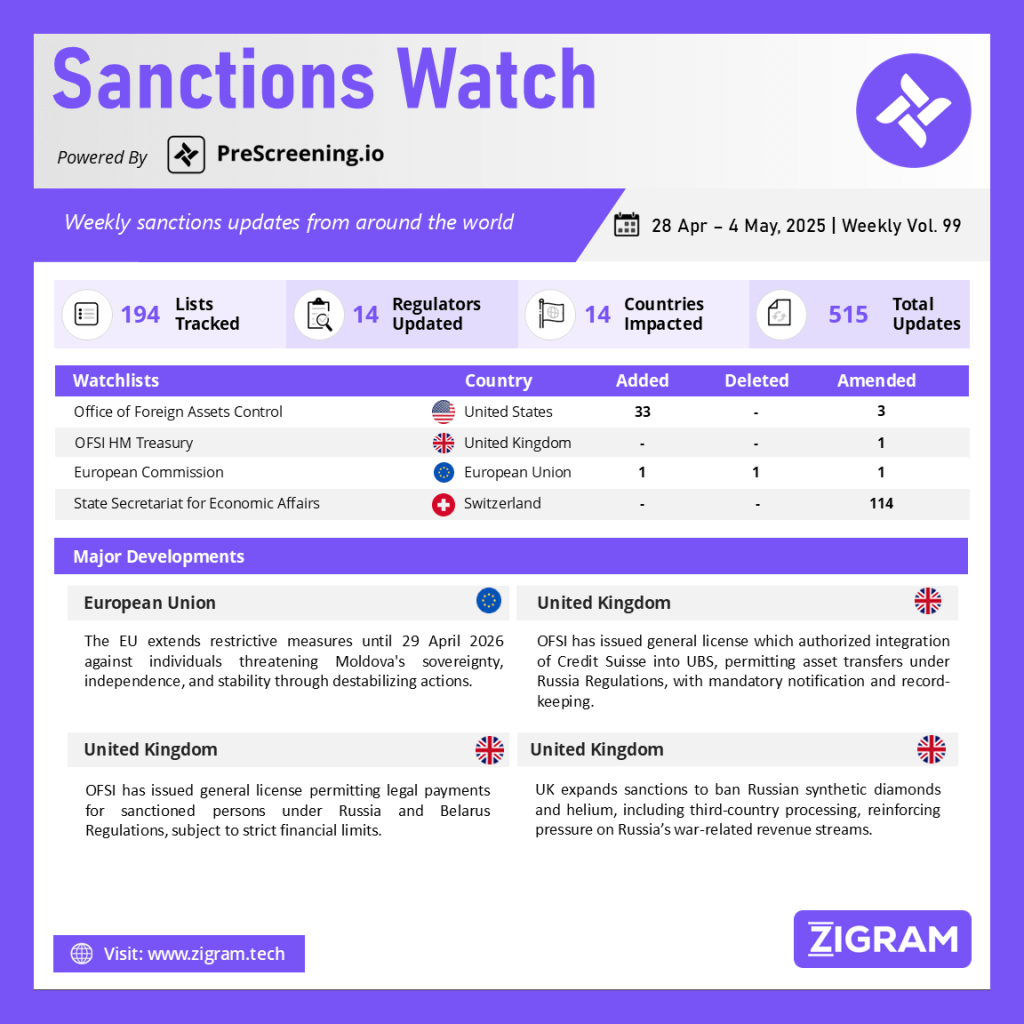

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

EU Renews Sanctions Against Destabilizing Actors in Moldova Until April 2026

The European Union announced the extension of its restrictive measures targeting individuals and entities responsible for actions that undermine the sovereignty, independence, and stability of the Republic of Moldova. These measures will now remain in force until 29 April 2026. The sanctions list currently includes 16 individuals and 2 entities, all of whom are subject to asset freezes, travel bans, and restrictions on access to financial and economic resources. The individuals are barred from entering or transiting through any EU Member State, and EU persons and entities are prohibited from making funds or resources available to them.

The decision reflects the EU’s continued support for Moldova amidst ongoing destabilising efforts linked to Russia’s aggression against Ukraine. The European Council reaffirmed in its March 2024 conclusions its strong commitment to bolstering Moldova’s resilience, democratic institutions, and regional stability. Initially imposed in April 2023 at Moldova’s request, the sanctions aim to deter interference that threatens its democratic order and national security.

Since the onset of the Russian invasion of Ukraine, destabilising activities targeting Moldova have escalated, raising concerns about the security of the EU’s eastern borders. The EU’s unwavering stance highlights its dedication to protecting democratic values and regional peace in Eastern Europe.

OFSI Granted general licence for Integration of Credit Suisse into UBS Amid Russia-Related Restrictions

The UK’s Office of Financial Sanctions Implementation (OFSI), part of HM Treasury, issued General Licence INT/2025/6135848 under regulation 64 of The Russia (Sanctions) (EU Exit) Regulations 2019. This licence authorises certain activities related to the integration of Credit Suisse Group AG into UBS Group AG, allowing otherwise restricted operations under Regulations 11-16 and 18B. This follows the global acquisition and operational consolidation of Credit Suisse by UBS.

The licence specifically permits the transfer of assets and liabilities necessary for both the UK and global integration processes between the two financial institutions. Covered entities include various UK subsidiaries of both Credit Suisse and UBS, whose details are provided in the annexes of the licence. However, parties conducting such activities must notify HM Treasury within 14 days of undertaking them and maintain accurate records for a minimum of six years.

Importantly, the licence does not authorise any broader breach of Russia-related sanctions. It is valid from 28 April 2025 to 26 April 2030, unless varied, revoked, or suspended by HM Treasury. This move ensures that the restructuring of these major financial institutions can proceed in compliance with UK sanctions law while maintaining oversight and transparency.

OFSI Issued General Licence to Facilitate Legal Services for Sanctioned Russian and Belarusian Entities

The UK Treasury’s Office of Financial Sanctions Implementation (OFSI) issued General Licence INT/2025/6160920 under Regulation 64 of the Russia (Sanctions) (EU Exit) Regulations 2019 and Regulation 32 of the Belarus (Sanctions) (EU Exit) Regulations 2019. This licence permits certain financial and legal transactions involving Designated Persons (DPs) under Russian and Belarusian sanctions, specifically to facilitate access to legal services.

Under this licence, law firms, legal advisers, and Counsel may receive payments for professional legal services and associated expenses from DPs, provided that stringent financial and procedural conditions are met. These include a cap of £4 million in legal fees per law firm or counsel, and specific limitations on additional expenses. Legal services covered include advice, representation, and related services, with the exclusion of defamation or malicious falsehood claims.

Payments must be made either to UK accounts or approved non-UK accounts in jurisdictions such as the EU, US, Canada, or EFTA member states. All parties must maintain detailed records for at least six years and notify HM Treasury within 14 days of receiving payments.

The licence is valid from 29 April 2025 until 28 October 2025, and aims to ensure that sanctioned entities maintain access to legal representation while preventing the misuse of funds.

UK Expands Import Sanctions on Russia to Include Third-Country Synthetic Diamonds and Helium

The UK government updated Notice to Importers (NTI) 2953 to expand the scope of import sanctions targeting Russian-origin goods under The Russia (Sanctions) (EU Exit) Regulations 2019. The latest amendment introduces new prohibitions on the import of synthetic diamonds manufactured in Russia but processed in third countries, as well as adding helium to the list of sanctioned revenue-generating goods. These measures are designed to further restrict Russia’s access to foreign markets and funding in response to its continued aggression in Ukraine.

The sanctions cover a wide range of goods including arms, metals, oil, coal, gold, diamonds, and a comprehensive list of revenue-generating products. Prohibitions extend beyond direct imports from Russia to include goods processed elsewhere but originating in Russia, such as iron, steel, gold, and diamonds. Services supporting these imports—such as financial, technical, and brokering services—are also restricted. Certain exceptions exist, particularly for contracts made before specific cutoff dates, and licenses may be granted under strict criteria. Breaches of these regulations can result in severe penalties, including imprisonment for up to 10 years. The update reaffirms the UK’s commitment to aligning with international sanctions efforts and applying pressure on Russia to cease its destabilising activities in Ukraine.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #RussiaSanctions

- #UKSanctions

- #EUSanctions

- #MoldovaSecurity

- #UkraineWar

- #OFISanctions

- #LegalServicesLicence

- #UBSMerger

- #CreditSuisse

- #ImportBan

- #SyntheticDiamonds

- #HeliumSanctions

- #FinancialSanctions

- #AssetFreeze

- #TravelBan

- #SanctionsCompliance

- #GeopoliticalRisk

- #EUForeignPolicy

- #UKTreasury

- #RussiaUkraineCrisis